Photo: Evan Brorby/Unsplash

Photo: Evan Brorby/Unsplash

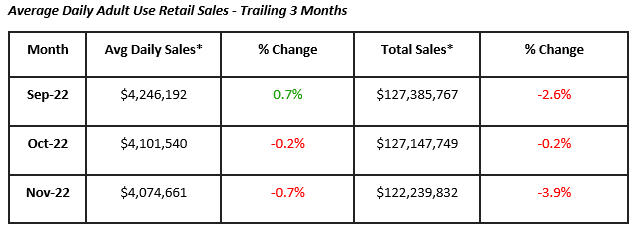

The Massachusetts Cannabis Control Commission (CCC) issued data for November 2022 adult use sales. November 2022 sales, at $122.2 million, were down 3.9% from October 2022 sales of $127.1 million and down 3.8% from November 2021 sales of $127.1 million. This is the fourth consecutive month of lower adult use retail sales and the third in the last four months of lower daily sales.

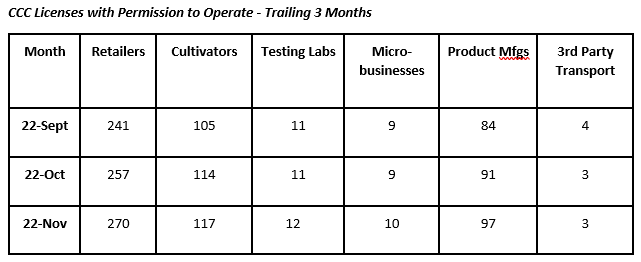

The CCC also provides information on the number of licensed cannabis businesses with permission to operate. The table below shows the monthly progress in license issuance for the past three months. The pace of licensing, which might be considered part of the CCC’s regulatory control given the extremely slow pace of issuance, shows a jump in Retailer and Product Manufacturer licensing, and to a lesser extent, a jump in cultivation licensing. While the CCC can keep the pace of issuance slow, the issues in the state’s cannabis industry appear driven more by market participants and are largely focused on oversupply, overbuilding, and over-borrowing.

Behind the licenses with permission to operate are the provisional licenses – hundreds of them – that are working their way through the regulatory process. CCC has issued 156 provisional retailer licenses, 192 provisional cultivator licenses, 143 provisional manufacturer licenses, 20 provisional micro-business licenses, six testing lab licenses, and two provisional transporter licenses. Should these licenses ultimately become active, they will provide significant supply, retail, and manufacturing capacity to what appears to be an already crowded market. Several months ago, the CCC had mentioned their support for craft cannabis licensing and there are currently four provisional licenses of that type issued.

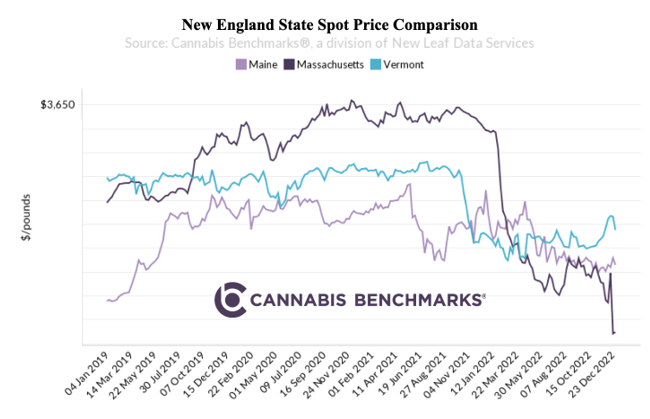

As the market becomes more sophisticated, with more participants vying to sell product – whether from cultivation or retail – price moves in the state have become more volatile. Sources in the Bay State have told Cannabis Benchmarks that some of the larger outfits, including multi-state operators, have been moved by debt considerations to offload inventory in the most expeditious manner. As well, the state’s regulations on cannabis “shelf-life” appear to have come into play, with sources saying the vast majority of flower in the market is now approaching the one-year mark where holders will have to pay to retest or dispose of the product. As much as 80% of the current flower on the market is estimated to be in this category.

A confluence of events has served to knock down Massachusetts’ spot cannabis price, not the least of which is debt-service, plateauing demand, competition from contiguous states, and regulations regarding cannabis shelf-life. As other states come on board in the Northeast, Massachusetts spot prices will remain under pressure, which in turn will weigh on large canopy build-outs.

The fact remains, some states were destined for a large portion of the state’s economy to be agricultural in nature: Massachusetts is not one of those states. Indeed, the state’s agricultural portion of overall GDP is 1.1%, not including cannabis. The Northeast cannabis markets will have a shorter span of high prices than did preceding states. Thus, those with business plans in newer, high population states should plan on significantly lower cannabis prices within months, rather than years, of opening.

The chart below illustrates price compression and convergence in several New England states where adult use sales are currently taking place. We expect similar price behavior to manifest across the Northeast and Mid-Atlantic as new adult use markets come online.