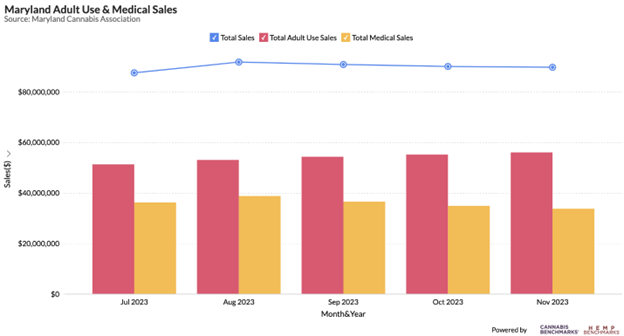

The Maryland Cannabis Administration (MCA) posted November 2023 sales made by licensed dispensaries last week. Total adult use and medical sales for November came in at $89,670,575, down 0.4% from $89,997,762 in October. However, November’s average daily sales were $2,989,019, up 3% from $2,903,153 the month prior. Adult use sales began in July 2023, so year-on-year comparisons are not yet possible.

Combined adult use and medical sales totals have been remarkably stable since the recreational market opened. With five months of data in the books, monthly sales totals have ranged between a low of $87.5 million and a high of $91.7 million in July and August, respectively. Similar data have been reported out of other recently-opened adult use markets, such as Missouri, New Mexico, and Montana. Sales in those markets also quickly rose to reach a baseline level, rather than seeing gradual growth over a number of years.

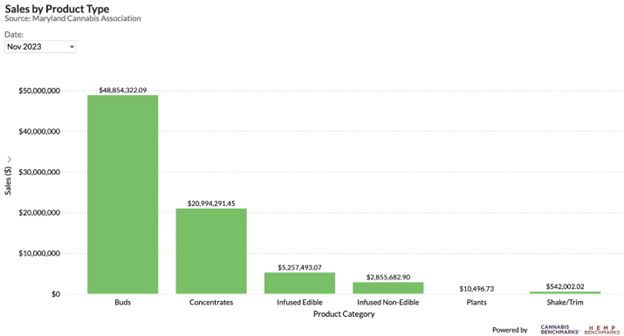

54.5% of total retail revenue in November was attributable to flower sales. Concentrates generated 23.4% of the combined sales total, while edibles accounted for 5.9% of all adult use and medical cannabis sales.

As Maryland’s market matures, new product manufacturing companies entering the market will lead to greater product variety and diversity, boosting sales of concentrates, edibles, and other infused products, as we’ve seen in other markets.

In the first two weeks that Cannabis Benchmarks has been reporting on Maryland’s spot wholesale flower price, it has averaged $2,852 per pound. At $2,882 per pound last week, it was the most expensive wholesale market that we track currently, surpassing Connecticut.

Maryland’s medical cannabis market is constituted by 101 dispensaries supplied by only 18 cultivation operations, the vast majority of which were licensed to participate in the adult use market when it opened in July. There is currently a licensing round open for social equity applicants. High wholesale prices are likely to persist in Maryland until more cultivators are licensed and producing.