Image: Benjamin Suter

Image: Benjamin Suter

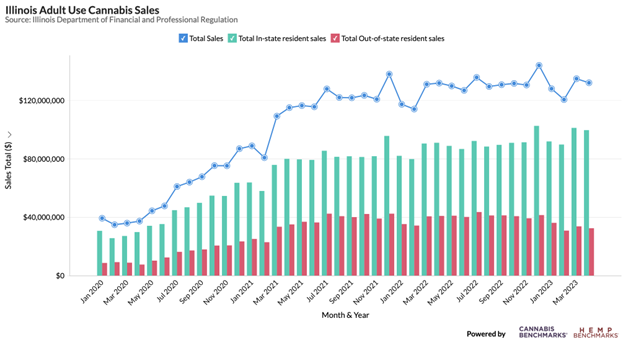

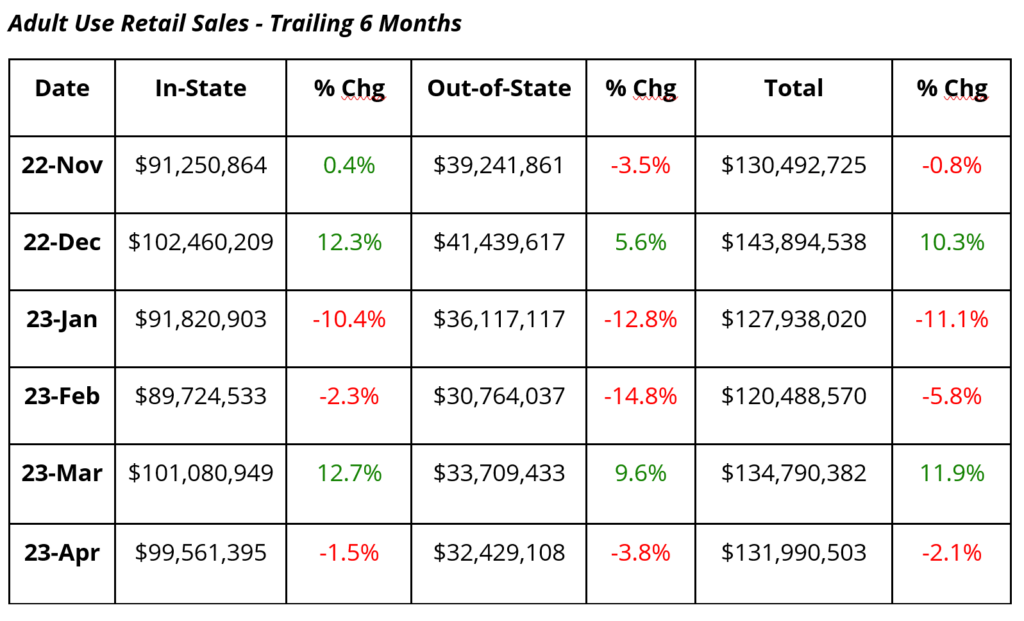

The Illinois Department of Financial and Professional Regulation (IDFPR) issued April 2023 adult use sales figures. April 2023 combined sales to in-state and out-of-states residents, at $132 million, were down 2.1% from March 2023 combined sales of $134.8 million and were up 0.2% from April 2022 combined sales of $131.8 million.

April 2023 in-state sales, at $99.6 million, were down 1.5% from March 2023 sales of $101.1 million, but up 9.5% from April 2022 sales of $90.9 million. The in-state market share inched up 0.4% in April 2023 to 75.4%, bringing the average in-state market share in 2023 to 74.2%, up 5.1% from the full year 2022 in-state market share of 69.1%.

April 2023 out-of-state sales, at $32.4 million, fell 3.8% from March 2023 sales of $33.7 million and were down 20.6% from April 2022 out-of-state sales of $40.9 million. April 2023 out-of-state market share, at 24.6%, is down 0.4% from March 2023 and down 7.4% from April 2022 behind Missouri’s adult use legalization earlier this year. Thus far in 2023, the average out-of-state market share is 25.8%, down from the full year 2022 market share of 30.9%.

Missouri demand is still ramping up and sources say low supply has doubled price, which is likely the reason for Illinois’ softer out-of-state market share this month. Missouri has, at last count, 50 active cultivators with 16 more licensed cultivators in the wings.

Illinois sales reversed nearly all the January / February 2023 losses with gains in March 2023. While April sales came in a bit softer, gearing up for the summer tourist season and higher prices in Missouri might see Illinois post strong sales figures in the coming months.

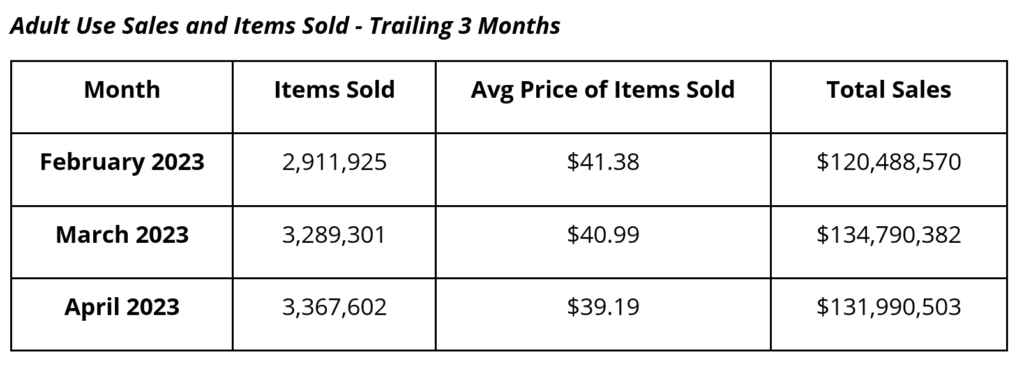

IDPFR supplies monthly transaction data in the form of “items sold.” The number of items sold in April 2023 increased by 2.4% to 3,367,602. Average price per item fell below $40 for the first time, shedding $1.80 per or 4.4% in what appears to be discounting both against competition from Missouri and heading into high season. Although the Illinois market cannot be said to be competitive within the state despite more retailers coming on line, retailers are clearly feeling the heat from nearby states.

Illinois prices continue to undergo a concerted sell-off, albeit at a slower pace since March 2022. The sell-off from October 2021 through present amounts to a 43.9% price drop. The pace of losses has slowed, but the downtrend is firmly intact. As production technology gets better, prices will continue to fall and – while they are unlikely to ever match prices in Michigan due to the fact Illinois does not bring in an outdoor harvest – increasing competition within and outside the state will still weigh on price.