Photo by Content Pixie on Unsplash

Photo by Content Pixie on Unsplash

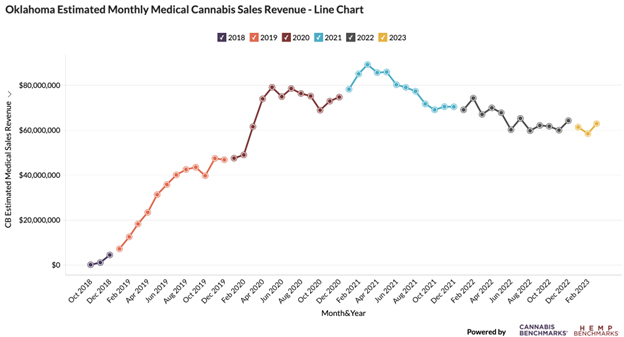

The Oklahoma Medical Marijuana Authority (OMMA) recently published tax data for April 2023, from which March 2023 sales totals can be extrapolated. March 2023 medical cannabis sales, at $62.8 million, were up 7.7% from sales of $58.3 million in February 2023, but down 6.4% from sales of $66.9 million in March 2022. It’s reasonable to assume the year-on-year drop in sales is due to the sell-off in wholesale cannabis prices and not weakening demand.

As of April 3, 2023, OMMA reports 369,515 registered patients, a 0.4% increase from the March 2023 patient count of 368,023. The April 2023 patient count has fallen 3.4% from 382,599 registered patients as of April 10, 2022.

Oklahoma has an over 21 population of 2.4 million; using Gallup’s estimate that 16% of those over 21 are regular cannabis consumers. In Oklahoma, 16% of the over 21 population is 382,979 persons, surprisingly close to the registered patient numbers.

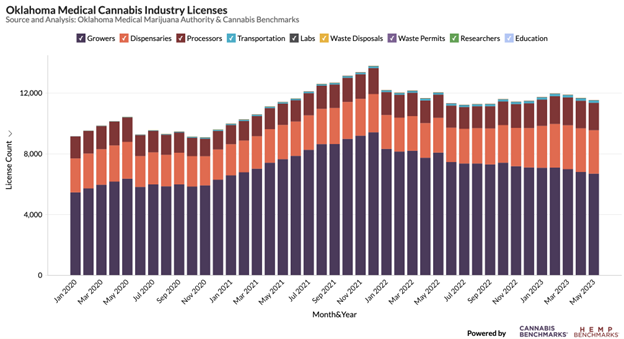

OMMA Licensing

OMMA reports 6,675 licensed growers in the state as of May 1, 2023, down from 6,788 as of April 3, 2023. As of April 3, 2023, there is one cultivator for every 55 registered patents.

The number of dispensaries fell by 12 in March 2023 to 2,881 or 128 registered patients for every one retailer, unchanged from February 2023.

It’s clear there is not enough demand in the state for the number of licensed growers or dispensaries and that much of Oklahoma’s production is going to nearby states like Texas, Kansas, Arkansas, and Louisiana where adult use cannabis is not legal and medical cannabis programs, where they exist, are quite limited.

While it’s clear the number of cultivation licenses has fallen from the 9,402 active in December 2021, it’s also clear that license reductions have stalled in the post-moratorium environment with only a slight declination in cultivation licenses – approximately 9.1% – since August 2022.

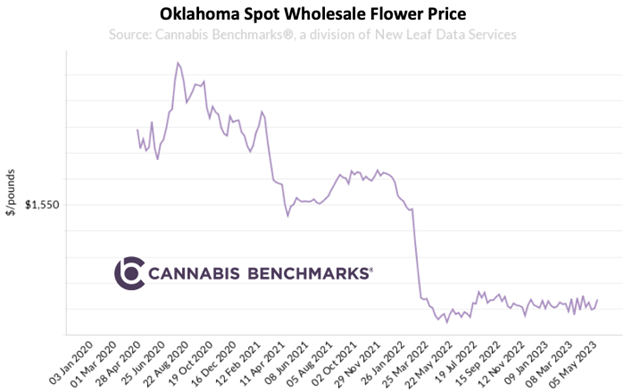

The Oklahoma wholesale cannabis spot price bottomed out in May 2022. The price recovery since then has risen nearly 20% to reach its peak and holding steady at roughly 5% above the low point. The steadiness of the state’s wholesale market will help commoditize the in-state market by making cannabis products more uniform in the state. Because so much product is exported to other states, those markets might also start to become commoditized to Oklahoma standards; so if or when those states pass adult use licensing, they will be expected to offer the same products now being imported, at the same price.

Governor Kevin Stitt just signed a bill to extend the state’s moratorium that was to end on August 1, 2024 out to August 1, 2026. Moratoriums are not especially effective at reducing licensing – even amid a price rout, as in Oregon – but they do stop license expansion. While the moratorium is in effect, OMMA is said to be stepping up enforcement actions, but the results have been modest to this point.