Image: Brian Beckwith/Unsplash

Image: Brian Beckwith/Unsplash

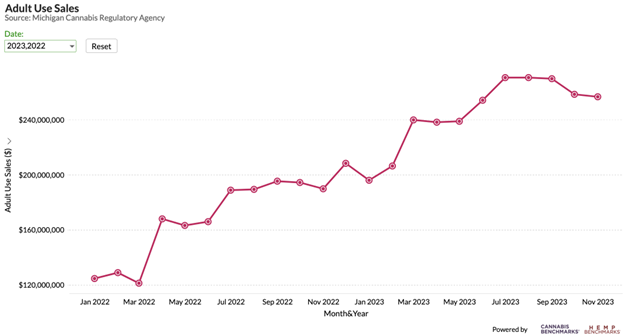

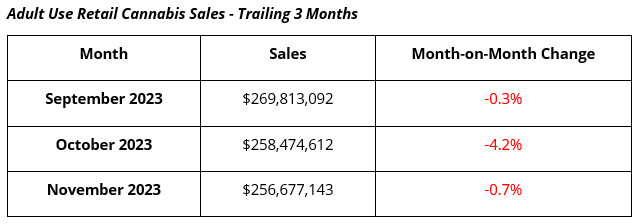

The Michigan Cannabis Regulatory Agency (CRA) issued its November 2023 monthly report. Combined medical and adult use sales were $260.5 million, down 0.9% from October’s $262.9 million total. November 2023 combined sales were up 28.1% year-on-year, from $203.4 million in November 2022.

November 2023 adult use retail sales were up 35.2% from November 2022 sales of $189.8 million. While overall monthly sales were down, average daily sales in November 2023 rose to $8,555,905, up 2.6% from $8,337,890 the prior month.

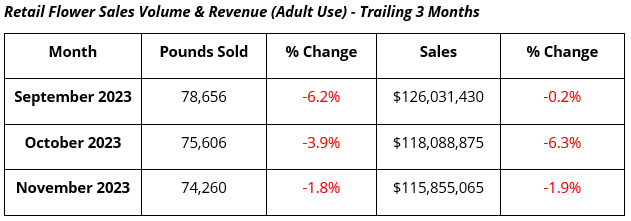

Pounds of flower sold in November 2023, shown in the table below, were up 24.3% year-on-year compared to 59,752 pounds sold to consumers in November 2022. Year-on-year growth in flower sales volume has slowed considerably in recent months; it was as high as 71% as recently as August.

Inventory of unsold flower held by growers that passed the state’s required testing was 121,104 pounds at the end of November 2023, up 52.3% from a month prior after expanding by 41% month-on-month in October and reflecting the autumn crop being brought in. Combined with 113,860 pounds of unsold flower held at retailers (up 14.9% month-on-month), the amount of immediately available flower inventory at the end of November 2023 was 234,964 pounds, up 31.6% from the previous month and equivalent to 3.2 months of supply based on November flower sales.

For comparison, the amount of unsold flower held by growers and retailers at the end of November 2022 was 175,040 pounds, which amounted to 2.9 months of inventory based on sales volume at the time.

The amount of product held by processors as of the end of November 2023 is as follows:

While inventories of plant material and concentrates at processors generally shrank month-on-month, they remained extremely robust relative to a year ago. Additionally, the volume of concentrates held by processors represents over 36 times the amount sold to adult use consumers in November 2023, compared to flower’s inventory to sales multiple of 3.2. Although concentrates are shelf-stable and should retain potency and quality, the sheer amount of unsold inventory is surely weighing on price.

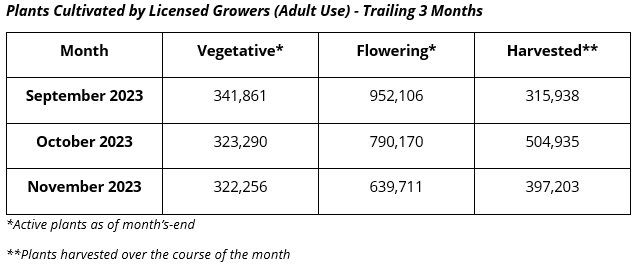

Vegetative plant numbers held fairly steady from October to November and may represent a new baseline for indoor cultivation in the state, compared to about 290,000 vegetative plants counted in Q1 2023, prior to seasonal outdoor production getting underway. Vegetative plants were up 15.5% year-on-year in November 2023, from 279,000.

Flowering plant count as of the end of November 2023 is similarly up from the under 600,000 counted at the end of March 2023. November 2023’s flowering plant count was up just 1.8% year-on-year.

The number of plants harvested in November 2023 was up 15.8% from November 2022, when 342,483 plants were cut down. From July – November 2023, 1,837,575 plants have been harvested in Michigan’s adult use market, up 28% from 1,435,756 plants in the same span in 2022. Overall, it appears that seasonal production in Michigan grew by a little under a third compared to last year.

Average retail flower prices for the trailing three months can be found below. November 2023’s mean retail flower price is up 2.5% year-on-year.

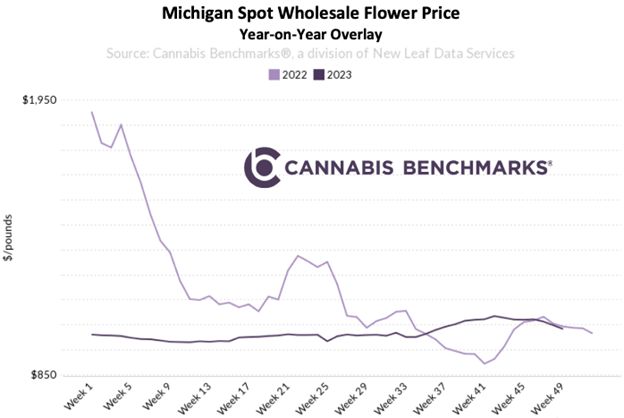

As seen in the chart below, in early November Michigan’s spot wholesale flower price began to converge with the course it tracked last year. In roughly the month prior to this week, wholesale rates in Michigan have followed those of last year very closely, but are slightly lower this year. However, the current downtrend is very gradual and it does not yet appear that 2022’s low price, which is also the all-time low for the state’s market, is set to be tested in the immediate future.

While Michigan’s outdoor production expanded by over a quarter in terms of plants harvested this year, flower purchase volume by consumers grew by an even greater proportion, keeping supplies from piling up. As we noted above, extractors processing excess plant material and stockpiling concentrates has also helped to keep flower supplies from ballooning into a glut. These two factors have likely worked to keep Michigan’s spot wholesale flower price at levels significantly higher than those observed currently in the West Coast markets and Colorado, the only states where comparable volumes are being produced and traded.