Photo: Stephen Leonardi/Unsplash

Photo: Stephen Leonardi/Unsplash

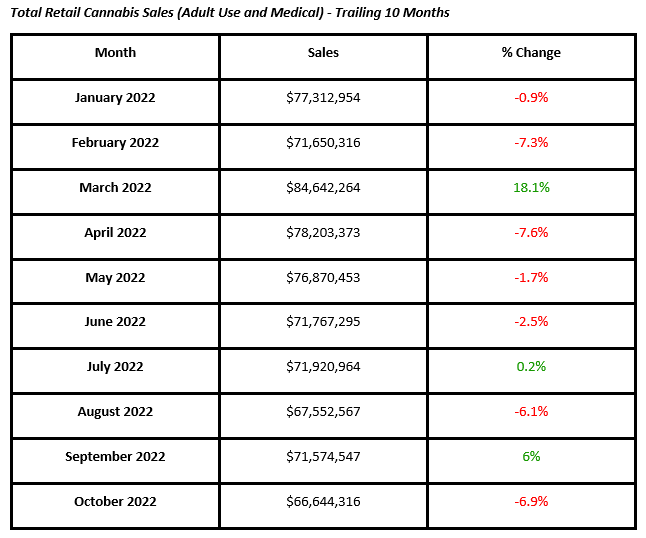

The Nevada Department of Taxation (NDOT) issued Cannabis Tax Revenue and sales data for August, September, and October 2022.

August 2022 combined recreational and medical cannabis retail sales were $67.6 million, down 6.1% from combined medical and recreational sales of $71.9 million in July 2022 and down 23.7% from August 2021 combined sales of $88.6 million.

August 2022 adult use cannabis sales, at $61.7 million, fell 6.4% from July 2022 adult use sales of $65.9 million; they were also down 22.4% from August 2021 sales of $79.5 million. August 2022 adult use market share was 91.3% of combined medical and recreational sales, up from July’s market share of 86.5%.

August 2022 medical cannabis sales, at $5.9 million, were down 2.5% from July 2022 medical sales of $6 million and were down 35.2% from August 2021 medical sales of just over $9 million.

September 2022 adult use sales, at $64 million, were up 3.7% from August, but down 13.9% from September 2021 sales of $74 million. September 2022’s adult use market share fell back to 89.4% of total sales.

September 2022 medical sales, at $7.6 million, were up 10.6% from August 2022 medical sales of $5.9 million and up 59.9% from medical sales of just over $3 million in September 2021.

October 2022 adult use cannabis sales, at $67.2 million, were up 5.1% from September, but were down 15.4% from October 2021 sales of $79.5 million.

NDOT total sales figures for October 2022 do not exceed recorded adult use sales tax collections so October 2022 medical sales cannot be extrapolated from NDOT’s data.

Data from the Las Vegas Convention and Visitors Authority shows tourism declining by 8.6% on a monthly basis in August 2022, followed by a 5.2% increase in September and an 8.5% increase in October. Local sources have said tourism makes up about 20% of monthly cannabis sales, with some nuances depending on the type of tourism each month, which can vary from the NBA draft to trade conventions.

On the production side, Nevada’s 15% wholesale excise tax applies to transfers of product in both the adult use and medical sectors of the state’s legal cannabis industry. Receipts from the state’s supply-side excise tax in August rose by 25% from the prior month, to over $5.1 million, but dropped by over 22% in September and by another 9.3% in October 2022.

Nevada’s wholesale spot price has been in a downtrend for the past two years. The downtrend steepened in 2022 and continued into this year, with spot price falling 25.9% from January 2022 through last week. The market is likely oversupplied while complaints about the quality of cannabis grown in the state have proliferated. Flower One, a Canadian firm, has filed for reorganization of its debt and will cease operations in Canada, while the company continues operating in Nevada. Given Flower One is the largest cultivator in the state, it bears watching as the loss of that product could help steady and perhaps reverse the downtrend in wholesale cannabis prices.