Photo: Martijn Baudoin/Unsplash

Photo: Martijn Baudoin/Unsplash

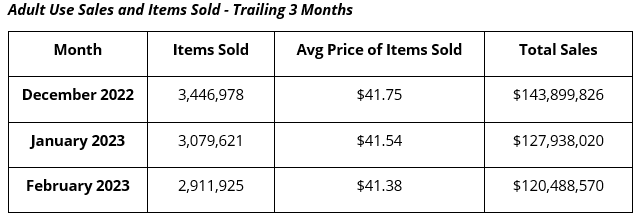

The Illinois Department of Financial and Professional Regulation (IDFPR) issued adult use sales figures for February 2023. Combined sales to in-state and out-of-state residents, at $120.5 million, were down 5.8% from sales of $127.9 million in January 2023 and up 5.7% from February 2022 sales of $114 million.

February 2023 in-state sales, at $89.7 million, were down 2.3% from sales of $91.8 million in January 2023, but up 12.5% from February 2022 sales of $79.8 million. In-state sales were 74.5% of total sales in February 2023, up from the January 2023’s in-state market share of 71.8%.

February out-of-state sales, at $30.8 million, were down 14.8% from January 2023 sales of $36.1 million and down 10.2% from February 2022 sales of $34.2 million. February out-of-state sales were 25.6% to total sales, down from a 28.2% share in January 2023.

In February 2023 the number of items sold, at 2,911,925, fell by 5.4% from 3,079,621 in January 2023, but rose by 12.6% from 2,586,830 items sold in February 2022.

The average price of items sold fell again in February 2023, by $0.16 per item, off about 0.4% from January 2023’s average price of items sold of $41.54.

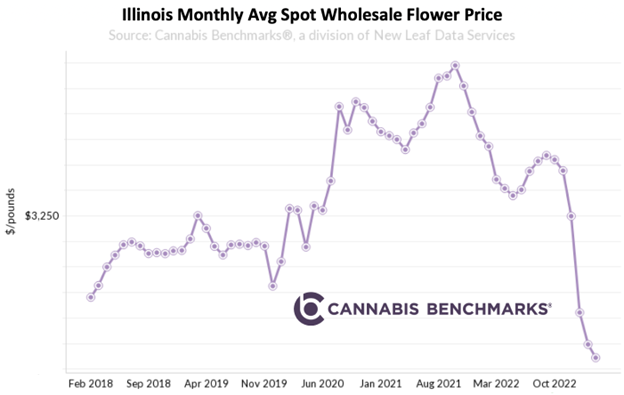

Illinois wholesale spot prices have taken a shellacking since they peaked in October 2021 at $4,132 per wholesale pound. The initial sell-off took price from over $4,000 down to $3,367 per pound in May 2022, after which prices rose through September 2022. The most recent sell-off has taken the average monthly price down considerably, although still much higher than the average wholesale price in Michigan.

The sell-off that commenced in September 2022 closely coincided with the issuance of 185 Conditional Adult Use retail licenses in 2022. In November, IDPFR issued their first Social Equity Cannabis Dispensing Organization licenses, suggesting the Fall 2022 to present sell-off may have been sparked by the knowledge the market was about to become much more competitive. Michigan, and now Missouri, are also competitors with lower prices and, at least in Missouri, appreciably better cannabis, according to sources.

There is little in the way of technical price support on daily or monthly charts and the path of least resistance is clearly down. It’s expensive to grow cannabis in Illinois, but production costs are well below the current wholesale spot price, so it is reasonable to expect price to move lower toward production costs, at least until Spring demand comes in.