Image: Thiago Patriota/Unsplash

Image: Thiago Patriota/Unsplash

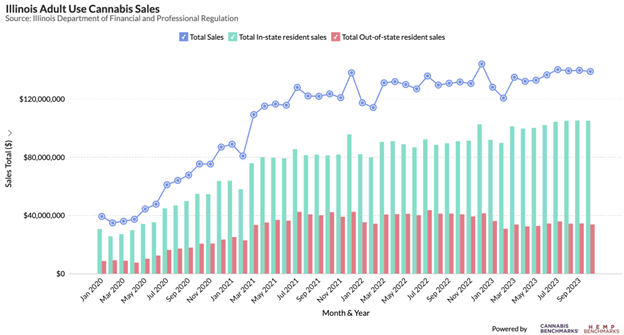

The Illinois Department of Financial and Professional Regulation (IDFPR) issued October 2023 adult use sales figures this week, along with medical cannabis sales data for the month. Combined adult use and medical sales reached $165 million in October, down 0.3% from $165.5 million in September.

October adult use sales reached $138.8 million, down 0.6% from September sales of $139.5 million, but up 5.5% year-on-year.

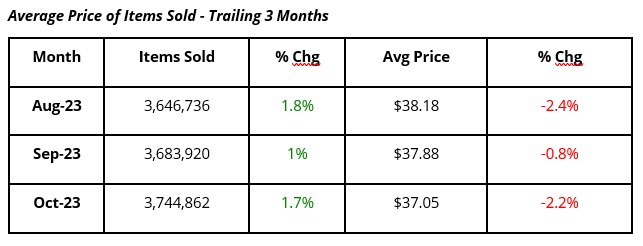

The average price of items sold continued to decline as the volume of items sold climbed. October 2023 items sold were up 20.7% year-on-year, while the average item price declined 12.6% in the same period, from $42.40 in October 2022.

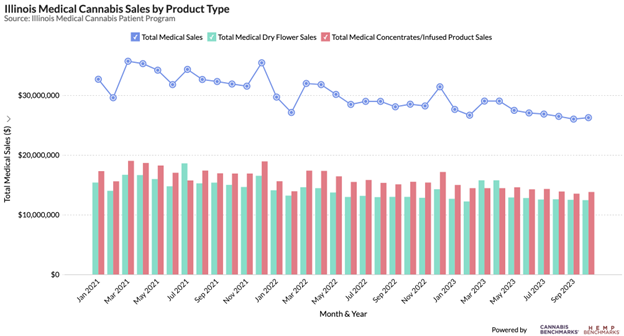

October medical sales rose 0.8% to $26.2 million, from $26 million in September.

Sales volume has been steady in recent months; it slipped slightly from 1.27 million grams of flower sold to patients in August to 1.26 million grams in September, but October saw flower sales to patients bounce back to 1.27 million grams. October 2023’s flower sales volume was up 12.7% year-on-year. The average retail price paid by patients for a gram of flower was $9.78 in October, down 2.2% from $9.90 in September 2023 and down 15% year-on-year from $11.51 in October 2022.

Overall, similar to the adult use market, medical cannabis sales in Illinois are seeing growth in volume terms, but sales revenues are trending downward due to price compression.

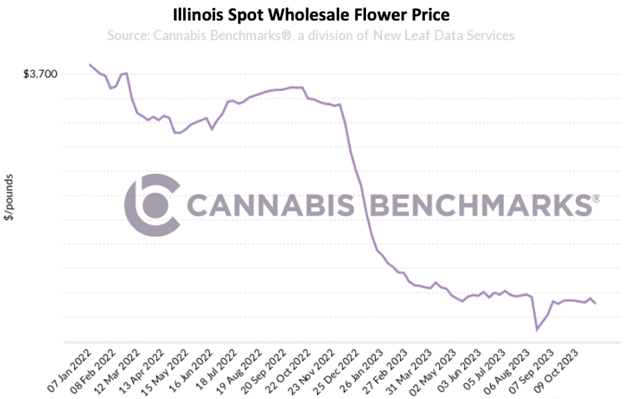

Illinois’ spot wholesale flower price has in recent weeks returned to stability after a brief drop that took place beginning in early August. Overall, a gradual downtrend has emerged following the steep downturn in wholesale flower prices in Illinois that commenced in late 2022. Interestingly, as noted by a report from the Illinois Answers Project (IAP), the wholesale price decline occurred even as very few new cultivators entered the market.

The IAP report states that of the 87 licensed “craft cultivators” in Illinois, only 10 were actually up and running as of mid-October 2023. Additionally, craft cultivators are initially limited to only 5,000 square feet of canopy.

However, the fact that only a handful of craft cultivators have entered the market does not mean that production capacity in Illinois has not increased. The 21 existing cultivation licensees that originated in the state’s medical cannabis program were permitted to expand to up to 200,000 square feet of canopy when the adult use market was legalized. Most recently, 4Front Ventures last month announced the imminent opening of a new cultivation facility in Illinois that will constitute “a more than fourfold expansion of our production capacity in the state over the next twelve months.”

4Front’s press release points to another reason for declining wholesale prices in Illinois. As the cannabis industry’s Covid-linked boom of 2020 and 2021 recedes further in the rearview and overall macroeconomic conditions have worsened, the availability and cost of credit has become increasingly unfavorable to businesses that are dealing with slowing growth and price compression. Sources have previously noted that MSOs have moved product at lower prices in order to ensure cash flow to service debt and other obligations.