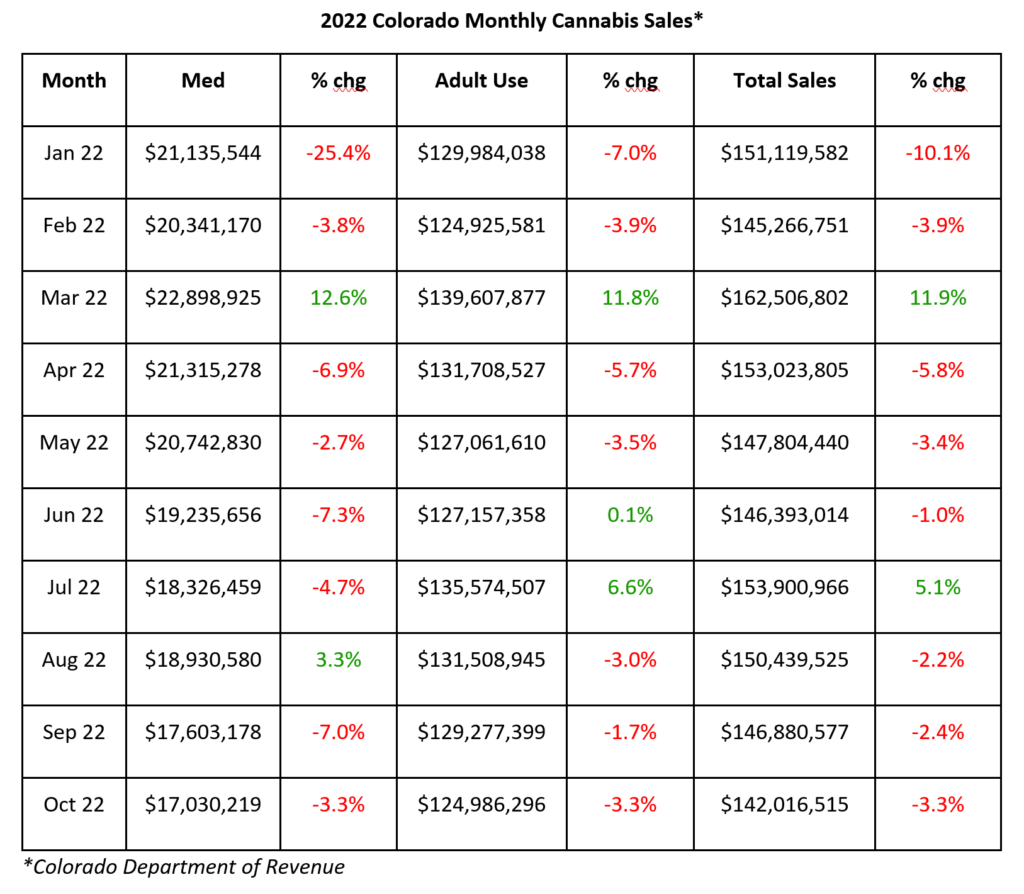

The Colorado Department of Revenue (CDOR) recently released the monthly Marijuana Sales Report for October 2022. October 2022 total combined sales, at $142 million, were down 3.3% from September 2022 total sales of $146.9 million and down 19.5% from October 2021 sales of $176.4 million. Year-to-date, total combined retail (adult use) and medical sales have reached $1.5 billion and are on pace to miss 2021 total combined annual sales by $430 million, or 19.3%.

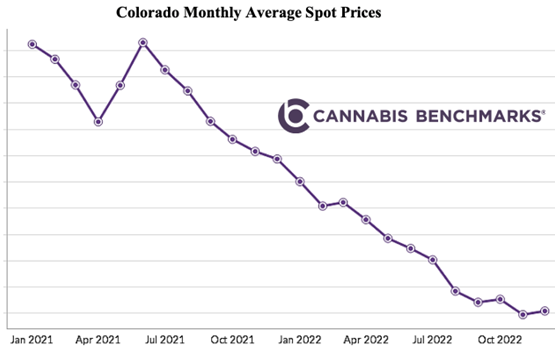

As of last week, the average monthly spot cannabis price in Colorado was down 25% from 2021’s average monthly price per wholesale pound. There are some signs legacy state cannabis prices are bottoming out as we see weekly losses narrowing. However, if growers feel they will not get a better price in the future, they will continue to flood the market with cannabis.

October 2022 adult use sales, at $125 million, were 3.3% lower than September 2022 sales of $129.3 million and down 15.1% from October 2021 sales of $147.1 million. Adult use sales have now declined for the past three months in a row and saw decreases in seven of ten months this year (as of October 2022). Adult use sales were 88% of total sales in October, unchanged from September 2022, but up from 83.4% of total sales in October 2021.

October 2022 medical sales, at just over $17 million, were down 3.3% from September sales of $17.6 million and down 41.7% from October 2021 sales of $29.2 million.

November 2022 tax data from the wholesale side of the market, which corresponds generally to wholesale transfers and transaction executed in October 2022, show the 15% excise tax on wholesale activity in Colorado’s adult use system resulted in $4.5 million accruing to state coffers, down 7.6% from September excise taxes of $4.85 million.

Average Market Rates (AMRs) used by the state to assess the wholesale excise tax on internal transfers of flower, trim, and other plant material between commonly-owned adult use licenses were stable from September to October. This suggests the downturn in excise tax revenue may be due at least in part to less wholesale activity in the adult use market.

New AMRs for Q1 2023 were released last week by CDOR. The rate for “bud” or flower was stable, while that for trim was fairly steady as well. Bud allocated for extraction saw a significant jump, perhaps due to transactions of fresher plant material from this year’s fall harvest. Q1 2023’s AMRs are median prices based on transactions that took place from September 1 through November 30, 2022. Trim for extraction and wet whole plants, meanwhile, will see their AMRs dip come next year.

Generally speaking, AMRs have been falling over the past year. The Q1 2023 rate for bud is down 31% from Q1 2022, the trim AMR is down 29% in the same span, and trim allocated for extraction’s AMR is down 76%. With the recent increase, only bud allocated for extraction’s AMR is up from Q1 2022, albeit very slightly.

As noted above, Colorado spot prices as assessed by Cannabis Benchmarks are starting to see some leveling out with week-to-week price changes narrowing. Outdoor price has turned higher recently, but it would be a mistake to say the downside is over with supply still abundant and price several times higher than the cost of production.

“The market is selling through inventory built on the belief the increase in pandemic demand would be permanent” is how Stan Zislis characterized the sell-off in cannabis wholesale prices over the past year and a half. Zislis is the Chief Development Officer and one of the original founders of Silver Stem Fine Cannabis in Colorado. The vertically integrated company operates in both the medical and adult use markets.

Zislis gave Cannabis Benchmarks the rundown on medical and recreational cannabis markets amid challenging times. He noted HB 1317, signed into law in 2021, has affected the medical cannabis business in various ways. The law significantly curtailed medical cannabis patients’ daily purchase limit for concentrate products, in addition to placing other restrictions on patients and new requirements on doctors who recommend medical cannabis. He feels this “hurt medical sales,” and said the bill particularly restricted 18-20 year old medical patient buying power. Zislis believes the bill was sold as a “health, safety, and welfare” measure, “but in reality, it’s driving sales to the recreational market.”

Of the overall Colorado market, Zislis said “people have learned to stop bleeding;” in other words, they have learned to live with the new economic reality of lower prices and are innovating to not just stay afloat, but profit in a tighter economic environment. “During COVID, we were all spoiled, it was like legalization began all over again,” but the post-COVID environment has forced adjustments. For Zislis, the “number one factor is customer convenience.” He explained customers are buying “more efficient” cannabis products, such as smaller size pre-rolls, which involve less waste and “lower prices for consumers, but retailers make more” on the products.

On a broader scale, Zislis acknowledged the opening of New Mexico’s adult use market has cut into sales in the southern part of Colorado. He noted Trinidad – a town in southern Colorado near the New Mexico border – “had the highest [per capita] sales in the state.” Now, however, “customer convenience” – referring to the shorter travel time between Texas and New Mexico – has cut into the southern Colorado market. When discussing Texas demand, Zislis stayed focused on customers, saying Texas consumers can now access “a thousand more varieties” of products rather than the “two or three strains” offered in their home illicit markets and, in some cases, the wide variety in licensed stores is offered at lower prices than the illicit market.

Regarding the vast New York, New England, and New Jersey markets recently opened or soon to open, Zislis said, “if history repeats, those first to market have a short amount of time to make big profits,” acknowledging the economic realities of proximity.

Zislis is optimistic about the industry overall: “the industry will ultimately grow,” he said. He envisions cannabis being regulated much the same as the alcohol industry, with a patchwork of regulations by states, rather than the federal government, governing a market made up of a few big players and “hundreds of smaller firms” with higher end products – much like the craft beer industry.