Image: 2H Media/Unsplash

Image: 2H Media/Unsplash

Similar to California, as we discussed in our February 6th Wholesale Market Observer post, Colorado has also seen a significant contraction in active cultivation licenses since the height of the Covid-19-fueled cannabis sales boom.

According to data from the state, cultivation licenses in Colorado peaked in the first half of 2022; adult use cultivation licenses hit their high point in June that year at 817, while medical cultivation licenses crested in February 2022, at 485. All in all, there were generally just under 1,300 active cultivation licenses of both types during the first six months of 2022.

As of September 2023, the latest data available, total cultivation licenses stood at 984. There were 655 active adult use cultivation licenses in September 2023, down almost 20% from their peak about 15 months earlier. Medical cannabis cultivation licenses numbered 329 in September 2023, down by about 32% from their high point roughly 18 months prior. The peak number of plants being grown in the state also decreased by about 26% from 2022 to 2023, showing a general correspondence with the proportional decline in license numbers.

Meanwhile, the number of licensed adult use retailers has grown consistently. As of September 2023, 685 adult use storefronts held active licenses, up from 665 in September 2022 and 644 in September 2021.

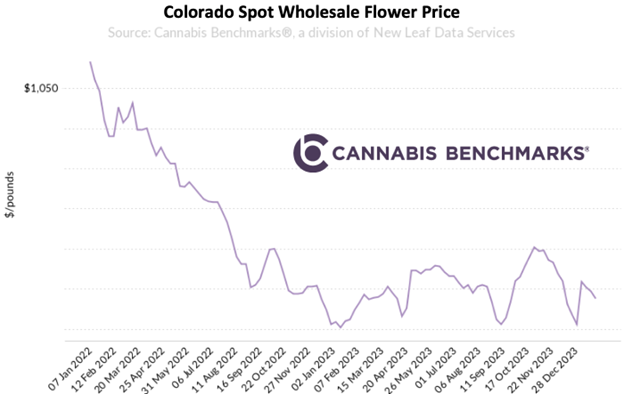

Despite increasing shelf space to fill and a decreasing number of growers, wholesale flower prices have remained locked within a roughly $100 range since August 2022. We pointed out in a recent report that even in 2020, when Colorado’s cannabis market saw record-breaking sales, cultivators produced about 40% more flower than was purchased by consumers and patients. Production then increased in 2021, as sales began to decline in the second half of the year.

While 2023’s production looks to be down by about a quarter relative to 2022, sales have slowed significantly, with November 2023 retail revenues hitting their lowest point since 2017. Overall, the oversupply situation in Colorado looks to have been much more pronounced than anyone cared to admit in 2020 and 2021. With sales depressed and no signs that they will bounce back significantly anytime soon, it will take more significant contraction on the production side to balance supply and demand.