Photo: Gio Bartlett/Unsplash

Photo: Gio Bartlett/Unsplash

The California Department of Taxation and Fee Administration (CDTFA) issued data on taxable sales and cannabis tax collections for Q3 2022. Q3 2022 taxable retail sales, at $1.27 billion, were down 9.8% from upwardly revised Q2 2022 taxable sales of $1.4 billion and down 11% from $1.43 billion in sales in Q3 2021.

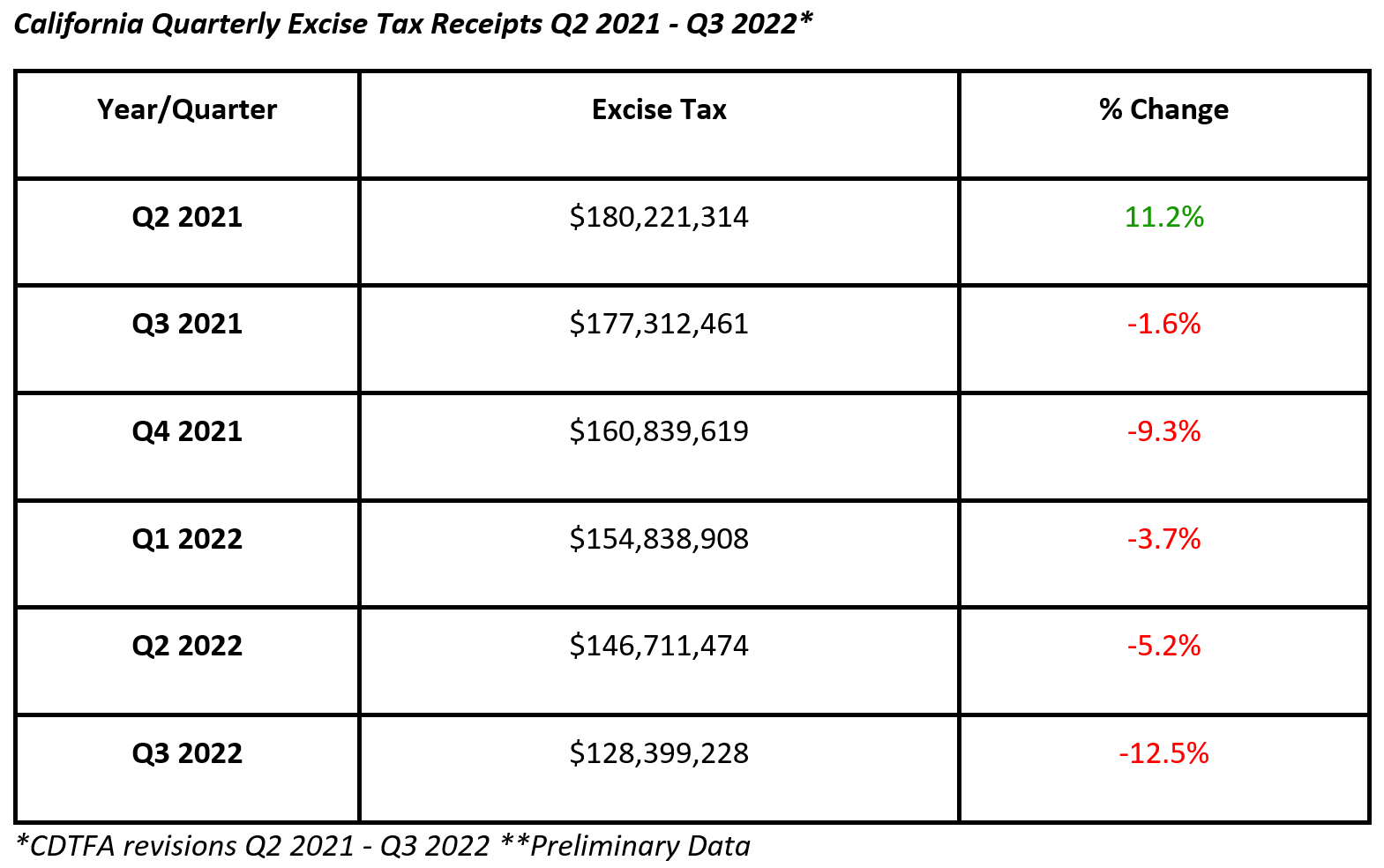

Total cannabis tax collected in Q3 2022 was $242 million, down 19.3% from $300 million in Q2 2022 and down 30.5% from the $348 million collected in Q3 2021. Q3 total tax receipts include excise taxes of $128.4 million and sales taxes of $113.6 million. Not included in the Q3 data are cultivation taxes, which were eliminated as of July 1, 2022.

California’s excise tax is levied on both adult use and medical retailers at a rate of 15% of the gross receipts of retail sales. Q3 2022 excise tax fell 12.5%, the fifth quarter in a row of lower excise tax receipts. The state had contemplated increasing the excise tax to make up for losses from the cultivation tax repeal but capped the excise tax at 15% for three years beginning July 1, 2022.

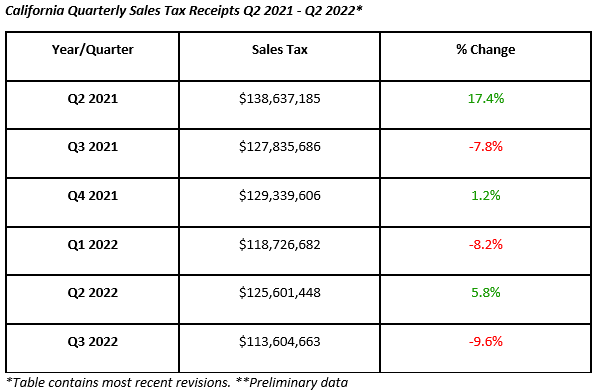

Sales tax data in the table below shows quarter-on-quarter changes in collections from Q2 2021 though Q3 2022. Q3 2022 sales tax collections fell 9.6% to $113.6 million from $125.6 million in Q2 2022 and are down 11.1% from $127.8 million in Q2 2021. California’s general sales tax is applied to retail cannabis purchases by adult use consumers, but not by medical cannabis patients, and varies by municipality.

There has been a good bit of variation across quarters, but year-on-year as of Q3 2022 the net quarterly loss is -3.7%.

California cannabis prices remain in a long-term downtrend with the all-time low for the Cannabis Benchmarks California Outdoor Grown Spot Index during November 2022. Greenhouse flower prices have been on a similar trajectory, having also reached an all-time average monthly low in November. The unrelenting price pressures in California are forcing cannabis companies to lower production costs through reduced labor and increased spending on technology, but, at the end of the day, lower profit margins seem unavoidable.

While indoor product prices show some variability week-to-week, the average monthly price shows a steady deterioration. As energy prices have risen in the inflation spiral, it is fair to say indoor production prices have risen sharply over the past year, squeezing margins on the top end.

If cannabis is legalized on the federal level, California cannabis prices may come to dictate prices across the country due to the sheer size of the state’s output.