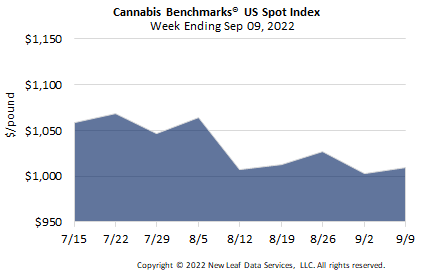

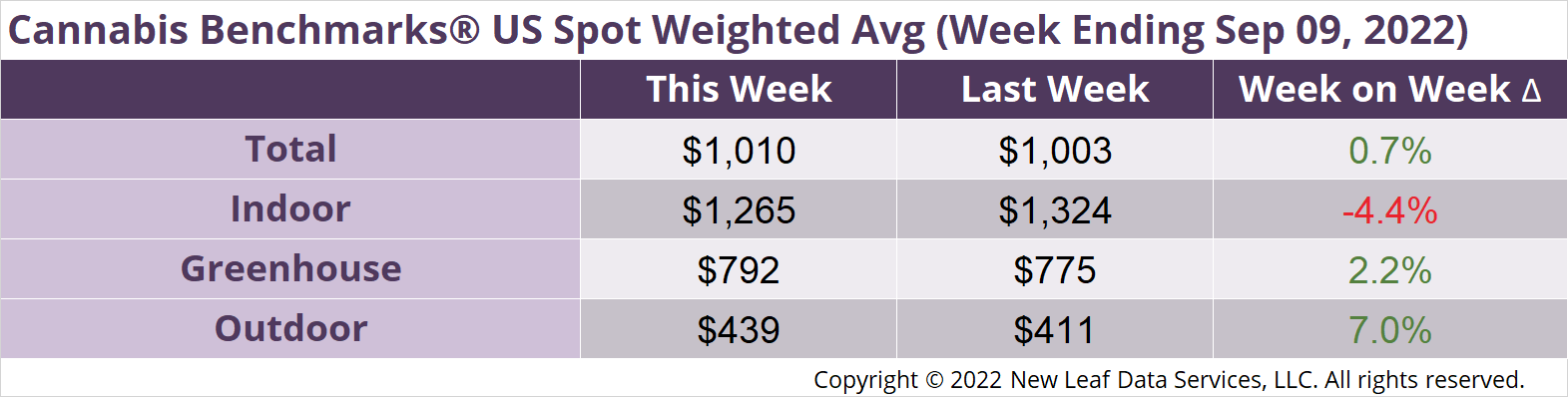

The U.S. Cannabis Spot Index increased 0.7% to $1,010 per pound.

The simple average (non-volume weighted) price decreased $24 to $1,246 per pound, with 68% of transactions (one standard deviation) in the $541 to $1,951 per pound range. The average reported deal size was nominally unchanged at 2.5 pounds. In grams, the Spot price was $2.23 and the simple average price was $2.75.

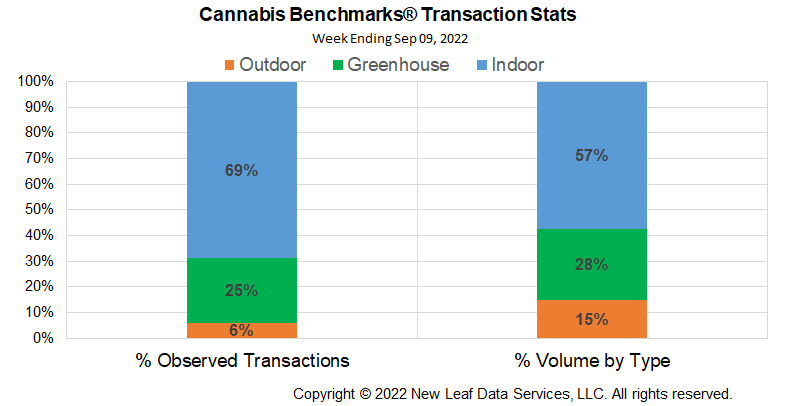

The relative transaction frequency of indoor product rose 2% this week, while that of greenhouse flower fell 1%. Outdoor transaction frequency fell by 1% in the week.

The relative volume of indoor product rose 3%, while that of greenhouse flower was unchanged. Outdoor flower’s relative volume fell 3%.

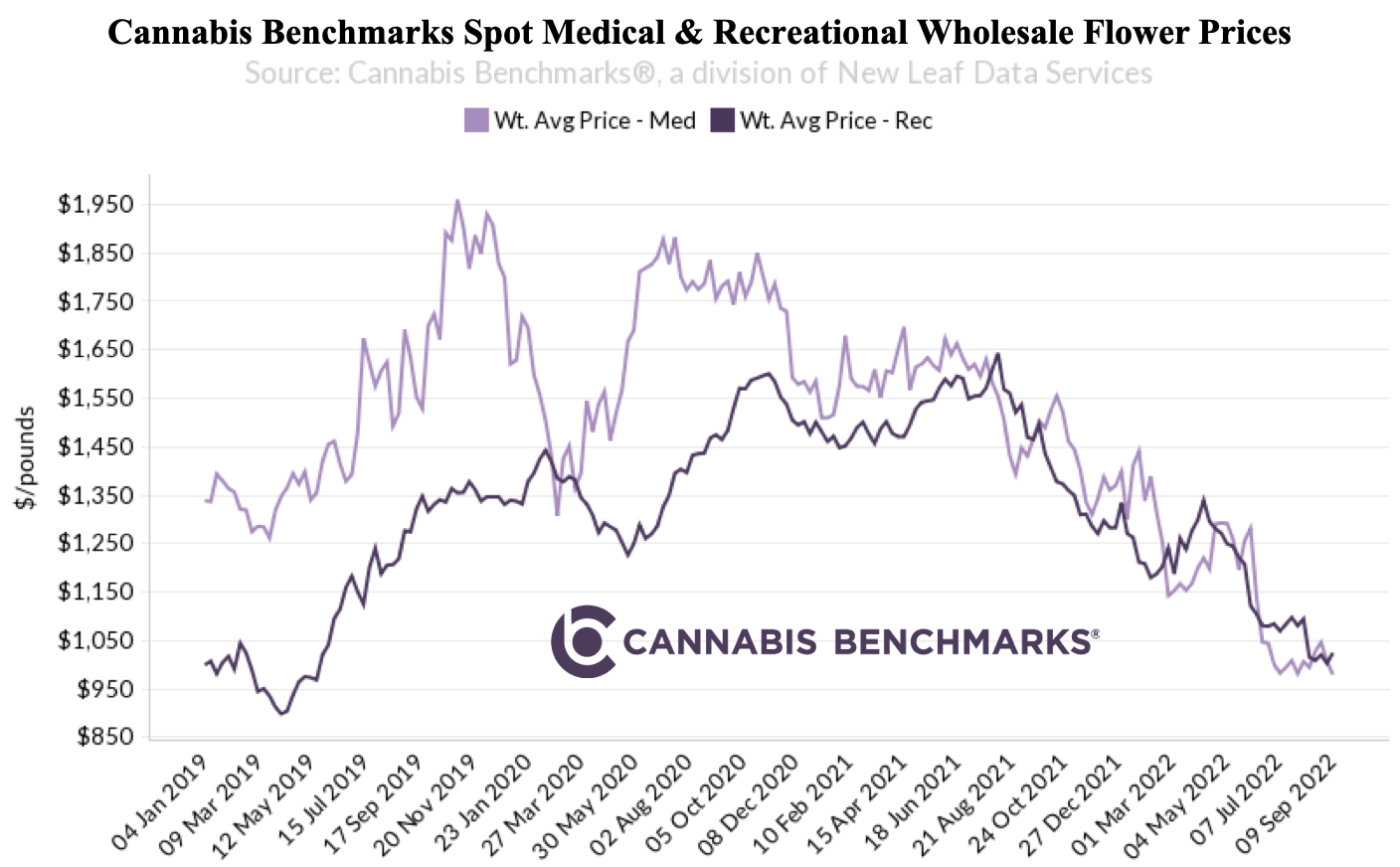

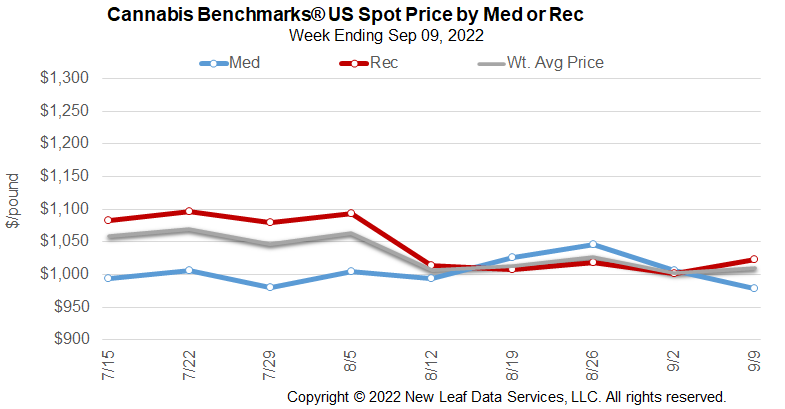

U.S. Medical and Recreational cannabis prices have settled into a long-term downtrend post-COVID due to fundamental economic crosswinds including very hot inflation, virtually full employment, and shrinking median incomes. In short, consumers are cutting back on discretionary spending, as well as non-discretionary items, through discount shopping and switching to less expensive products, including cannabis.

In 2019 and 2020, medical cannabis prices mostly outpaced those of recreational cannabis, but the two categories have nearly merged in 2021. In addition to lower discretionary spending, this phenomenon can be attributed to the proliferation of adult use cannabis sales in the U.S. Upon adult use legalization, most states give a regulatory nod to medical cannabis consumers by not taxing such purchases. However, when medical patients gain access to less expensive, or at least price-competitive, cannabis through the adult use market, they comparison shop and the cheaper overall purchase wins. Consumers in markets with medical and adult use legalization must also weigh the expense and effort required to maintain a medical cannabis certification, versus simply walking into an adult use retailer at their convenience, into the equation.

COVID was a great leveler between medical and recreational cannabis prices, as depicted in the chart below. U.S. spot medical and recreational cannabis prices converged in the post-pandemic market, with economic forces driving consumers to buy less expensive and often more convenient recreational cannabis. To take a snapshot of a market that opened adult use sales relatively recently, data out of Illinois on the number of medical cards issued shows fairly steady increases even as recreational sales grow, suggesting some consumers are adding or renewing medical cards to maintain a choice when it comes to buying cannabis. In other words, consumers are making the rational decision to maintain medical card status to tap whichever market is less expensive and / or offers better choices.

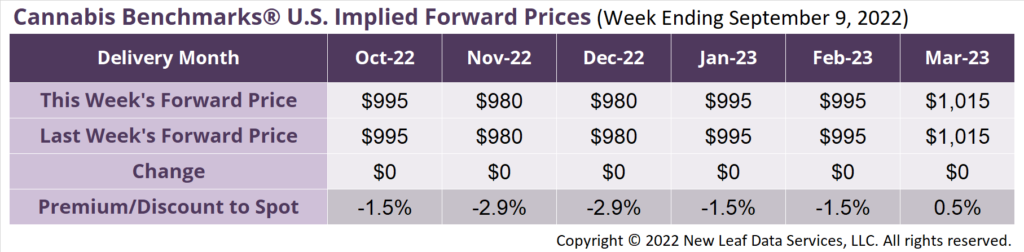

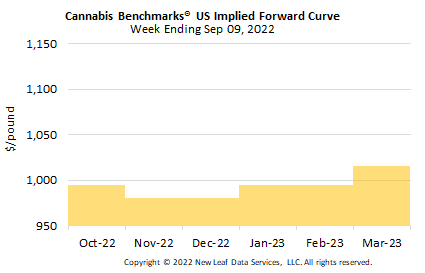

October 2022 Implied Forward unchanged at $995 per pound.

The average reported forward deal size was 74 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 53%, 33%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 83 pounds, 65 pounds, and 63 pounds, respectively.

At $995 per pound, the October 2022 Implied Forward represents a discount of 1.5% relative to the current U.S. Spot Price of $1,010 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.