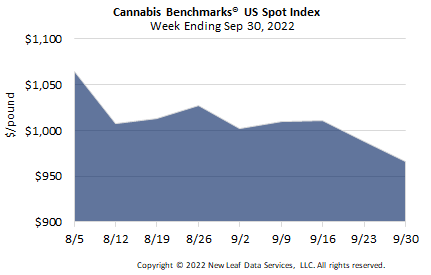

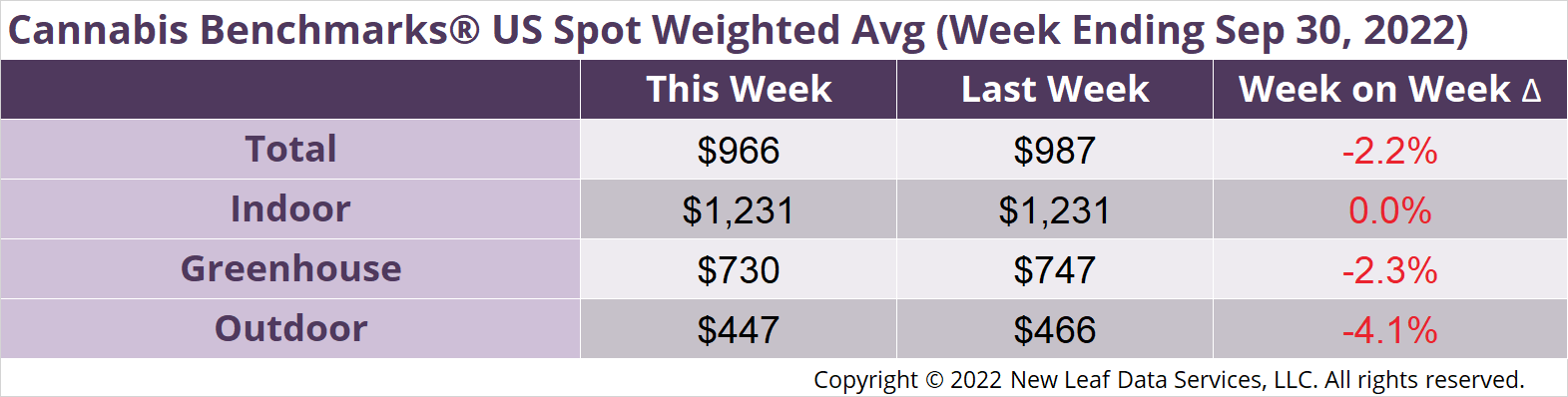

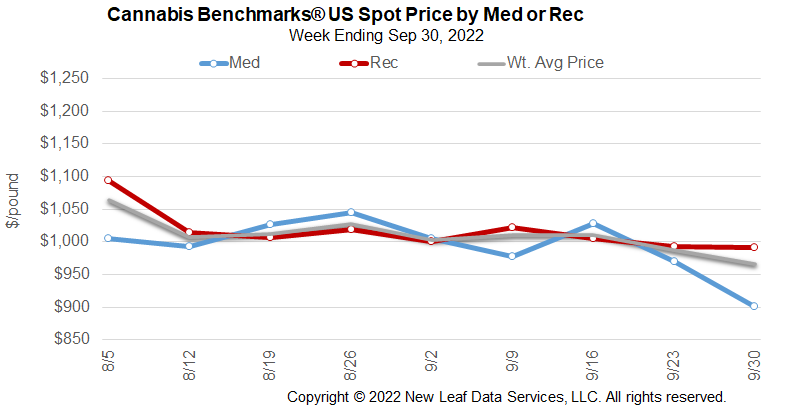

The U.S. Cannabis Spot Index decreased 2.2% to $966 per pound.

The simple average (non-volume weighted) price decreased $10 to $1,204 per pound, with 68% of transactions (one standard deviation) in the $540 to $1,869 per pound range. The average reported deal size increased to 2.8 pounds. In grams, the Spot price was $2.13 and the simple average price was $2.66.

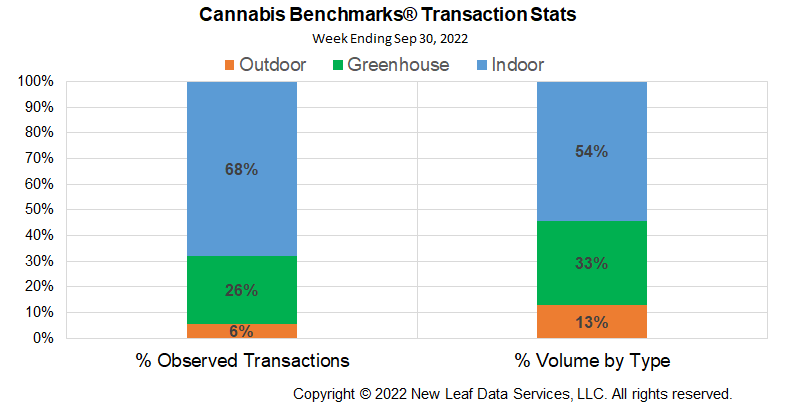

The relative transaction frequency of indoor product was unchanged this week, as were those of greenhouse and outdoor product.

The relative volume of indoor product fell 2%, while that of greenhouse product rose 1%. Outdoor flower’s relative volume rose 1% this week.

The Cannabis Benchmarks U.S. Spot Index fell $21 this week, making a new all-time low on net losses of $25 per pound across legacy states. In the interview this week about Colorado companies’ requests to state officials for a license moratorium and a tax holiday, the interviewee reminds us that the brutal sell-off in cannabis prices in 2017 and 2018 in his state should have caused a cannabis business shakeout. Instead, the pandemic sales surge saved untold numbers of cannabis businesses in legacy states.

Now, however, the post-pandemic fallout may prove to be the final straw in some legacy state markets. States that implement license moratoriums may save most cannabis businesses for a time, but as more states come online in the adult use space, competition will heat up across state borders and price convergence will start occurring, even at the higher end of the market. The outdoor market will move toward the price of production and new businesses will have to predicate business plans based on lower prices and profit margins.

It is worth tracking the price spread between contiguous western states and noting that convergence is already taking place at the high end of the market with Arizona indoor flower prices dipping below those of California, while Colorado indoor prices have breached the $900 per pound level. Nevada and New Mexico indoor prices are still well above those of legacy states, but Nevada indoor is already down over 17% this year. New Mexico indoor prices are down over 23% this year and production is still ramping up in the state.

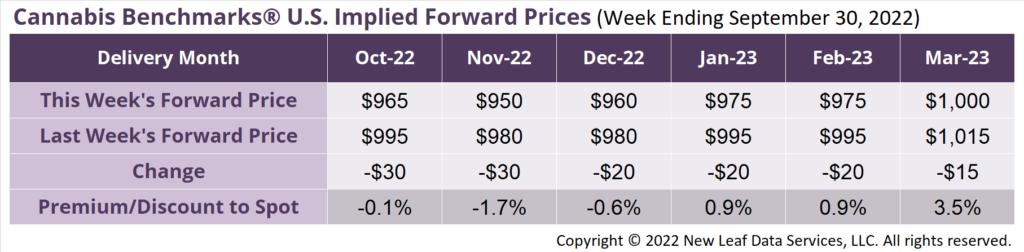

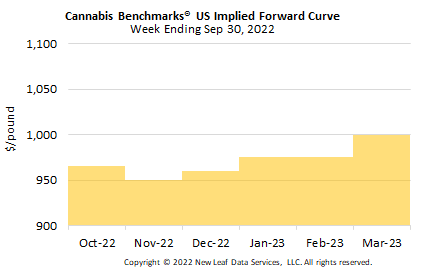

October 2022 Implied Forward assessed down $30 to close at $965 per pound.

The average reported forward deal size was 74 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 52%, 34%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 81 pounds, 68 pounds, and 64 pounds, respectively.

At $965 per pound, the October 2022 Implied Forward represents a discount of 0.1% relative to the current U.S. Spot Price of $966 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.