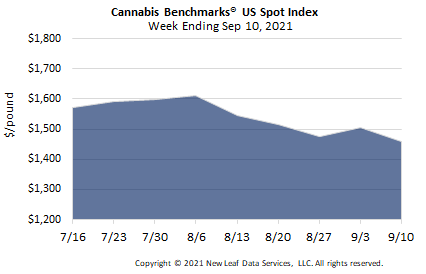

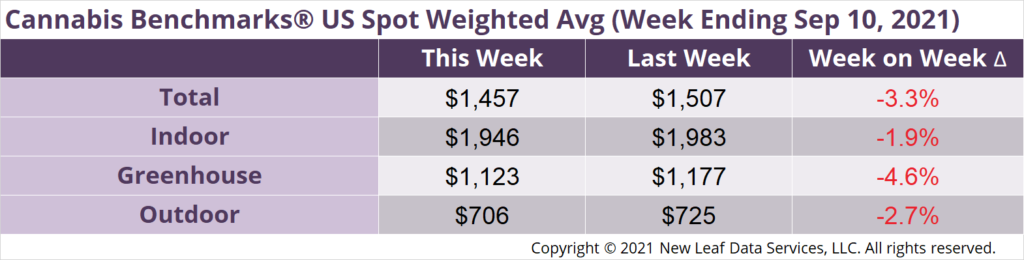

U.S. Cannabis Spot Index down 3.3% to $1,457 per pound.

The simple average (non-volume weighted) price decreased $46 to $1,741 per pound, with 68% of transactions (one standard deviation) in the $928 to $2,554 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $3.21 and the simple average price was $3.84.

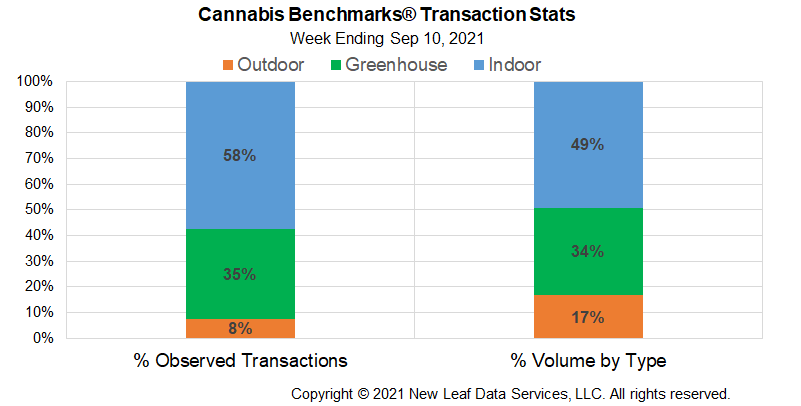

The relative frequency of transactions for indoor flower increased by 1% this week. The relative frequency of trades for greenhouse product and outdoor product were essentially unchanged this week.

The relative volume of indoor product fell by 1% this week. The relative volume of greenhouse flower was unchanged versus last week, while outdoor flower’s relative volume increased by 1%.

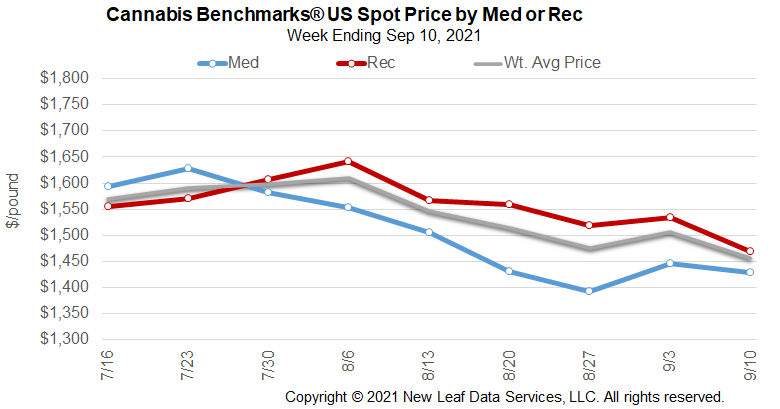

U.S. Spot Prices ticked up at the end of last week, after having sold off rather sharply since June 2021, losing $170 per pound after large volume, legacy state pricing came under pressure. Given recent developments in such states, Cannabis Benchmarks inquired after current and expected price trends in Oregon, an especially hard-hit state. We learned there may not be a reprieve in downward price pressures from upcoming holiday sales, as we discuss in more detail in this week’s Premium Report. In California, some members of our Price Contributor Network have reported prices for greenhouse and outdoor-grown product falling sharply. As a result, they stated that some growers are choosing to store their recent harvests due to decreasing interest from buyers and in hope of rebounding prices.

This week, the U.S. Spot returned to its downward trend after last week’s momentary interruption. We have already seen employment and consumer spending pull back as the Delta variant of the coronavirus has gained increasing traction, resulting in economic uncertainty. Retail sales fell in May and July and eked out only a 0.7% gain in June. When consumers pullback due to economic uncertainty, they cut discretionary spending. Cannabis is a primarily discretionary purchase, so it is reasonable to guess cannabis purchases could fall off, prompting lower prices if the economy does not regain its footing in Q4 2021.

While the pandemic and associated economic uncertainty did not dent cannabis sales in 2020, at this point federal programs that were in place last year to support individuals and the economy – e.g., stimulus checks, enhanced unemployment protections, and the eviction moratorium – have been allowed to lapse by the Biden administration.

The U.S. Spot remains driven mainly by states with higher trading volumes, but newer markets with high prices are in the mix and growing rapidly. The uptick in the U.S. Spot price may not last if large state markets continue to see prices trend lower and the Delta variant causes a more significant pullback in consumer discretionary spending.

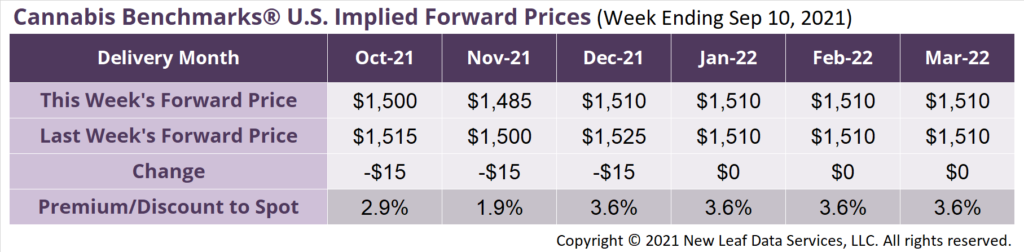

October 2021 Implied Forward down $15 at $1,500 per pound.

The average reported forward deal size was 70 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 45%, 39%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 92 pounds, 59 pounds, and 30 pounds, respectively.

National

U.S. Spot Cannabis Price Returns to Downward Trend

Oregon

Oregon Market Oversupply Here to Stay

Maine

Maine Adult-Use Sales Vault Over $10 million in August

Illinois

Illinois’ Adult-Use Sales Tick Down in August