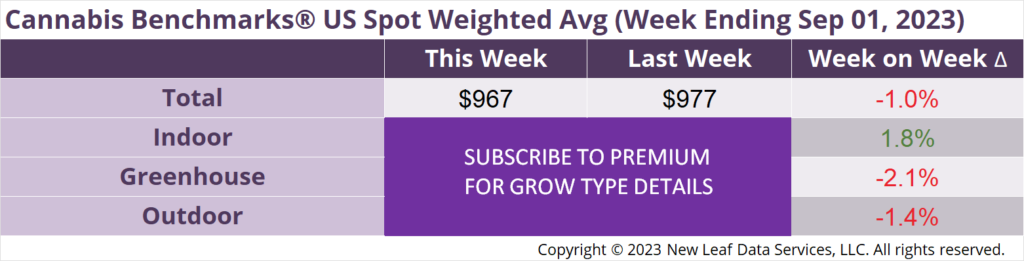

The U.S. Cannabis Spot Index decreased 1.0% to $967 per pound.

In grams, the Spot price was $2.13.

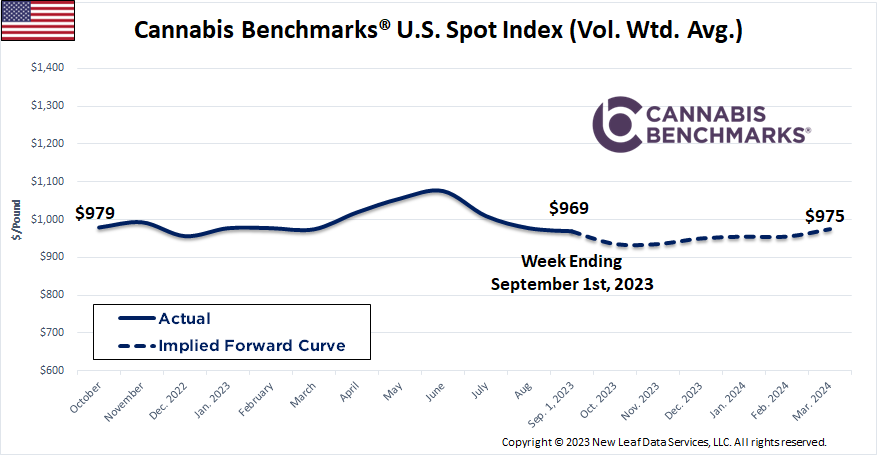

After ticking up in each of the last two weeks, the U.S. Spot Index resumed its leg down this week, indicating that the downtrend that commenced in June this year is likely to continue. Seasonality suggests so as well, as we enter the final third of the year, which is typically marked by relatively slower sales and a surge of supply from late summer harvests and the full-term fall crop.

Historical data shows a familiar pattern emerging in wholesale cannabis flower price movement in the wake of the anomalous, Covid-driven fundamentals of 2020. Wholesale flower prices have risen to peak in the spring or summer in each of the last two years – in June in 2021 and in April in 2022. This year, it appears that the June 9 U.S. Spot price of $1,096 per pound may well hold as 2023’s annual high point.

Prior to the disruption of the pandemic, it was fairly typical to see prices fall in the wake of the autumn harvest and trend downward into the following year. Depending on the size and quality of the outdoor crop, prices would often then see some upward momentum in the spring and summer as the prior year’s harvest was drawn down, only to resume falling again as mid-late summer and autumn crops came in. Such trends were observed in the early years of Cannabis Benchmarks price reporting – from 2015 through 2017 – and it appears that they are re-emerging.

Another return to form is prices proceeding consistently downward, with each year’s H2 decline resetting the floor lower than the one before. However, the pace of decline has subsided a good deal in the past 12 months or so. While we expect wholesale prices to continue to soften with the seasonal increase in supply and decrease in demand, it is unlikely they will plunge as dramatically as they did in the latter portions of 2021 and 2022, when a reset from the event-driven price elevation of the pandemic was occurring.

Finally, cannabis market observers are undoubtedly aware of this week’s major news – the U.S. Department of Health and Human Services’ (HHS) recommendation that cannabis be moved from Schedule I to Schedule III on the federal government’s controlled substances list. Although cannabis equities saw big jumps on the development, HHS’s recommendation does not yet have any material impact on the fundamentals of state-regulated markets or their participants. As such, we do not expect it to influence wholesale prices in the near term.

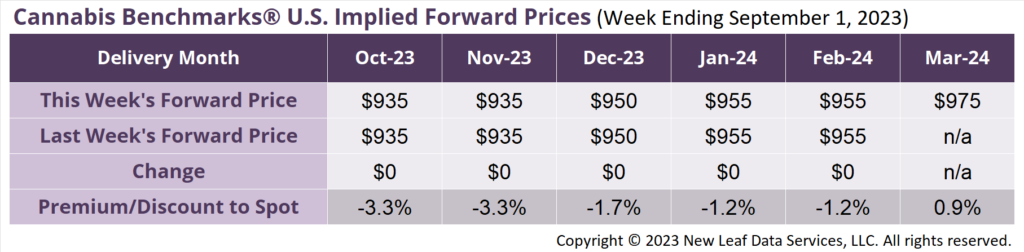

March 2024 Implied Forward initially assessed at $975 per pound.

At $935 per pound, the October 2023 Implied Forward represents a discount of 3.3% relative to the current U.S. Spot Price of $967 per pound.

HHS Recommends Cannabis be Moved to Schedule III

Q2 Sales Come in Slightly Lower Sequentially

Aspergillus Testing Halted After Industry Lawsuit

Adult Use Retail Licensing at Standstill as Inventory Piles Up