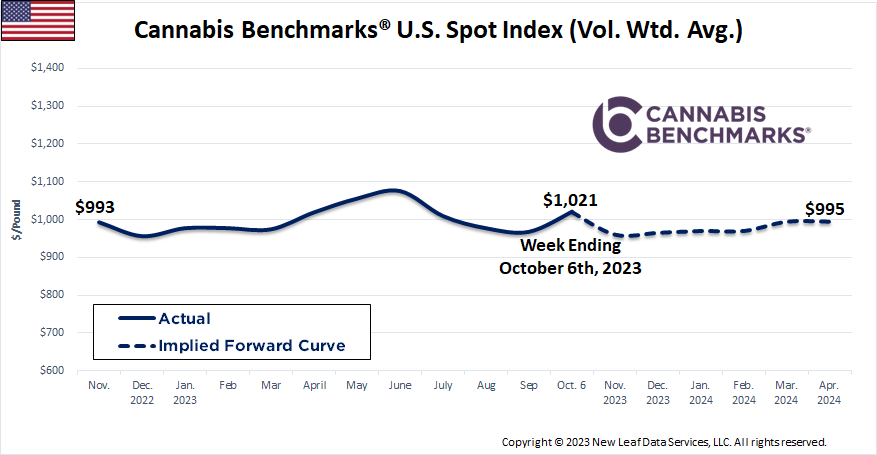

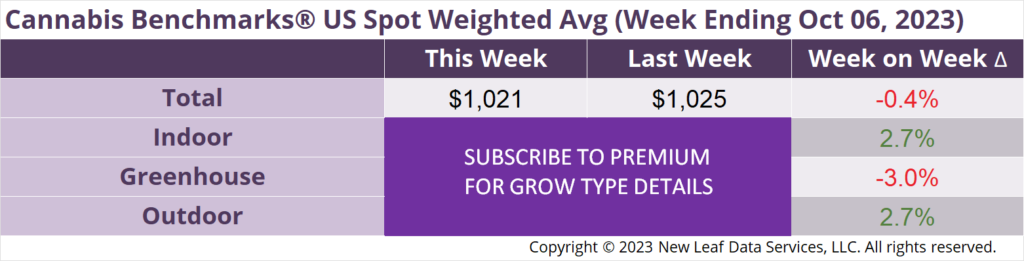

The U.S. Cannabis Spot Index decreased 0.4% to $1,021 per pound.

In grams, the Spot price was $2.25.

The U.S. Spot wholesale flower price held relatively steady this week, declining slightly to settle at $1,021 per pound. Recent trends in grow type price movement held as well, with indoor flower’s weighted average price climbing as the national greenhouse product price declined and the U.S. outdoor flower spot rate was stable.

The recently-concluded quarter saw the U.S. Spot Index trend down for most of the period, before jumping in the final two weeks of the quarter. In what follows, we review regional and state-by-state price movement in Q3.

West Coast States + Arizona

Q3 of any given year is typically a dynamic period for wholesale prices on the West Coast, with summer harvests coming to market as the full-term Autumn crop progresses. Most states in the region saw their spot wholesale flower prices largely trend down. Even with official data and reports from the field telling of pullbacks in production, sales growth has slowed or even ceased in these well-established markets. Washington, the only market in this group with limited licensing and production capacity, has staked out an elevated position as the rest vie for the distinction of most inexpensive wholesale cannabis in the country.

Colorado, Oklahoma, New Mexico, Nevada

Colorado and Oklahoma – two other markets with notably low wholesale prices – also saw their spot rates trend down in Q3. Despite year-on-year declines in the number of plants being cultivated in Colorado and in the number of active cultivation licenses in Oklahoma, prices in those states appear intractable at the low levels reached after declining sharply from the second half of 2021 through the following year. All states in the group ended the period with prices on the rise, with upward momentum strongest in Nevada and New Mexico. Outdoor crops in Colorado and New Mexico should push down prices in Q4. Nevada and Oklahoma will also see seasonal price pressures from within, as well as from product flowing east from California.

Midwest + Pennsylvania

Despite outdoor growing not being allowed in Illinois or Pennsylvania, both markets saw downturns in their spot wholesale flower prices in Q3. While Pennsylvania remains a medical-only market, both states have similar regulatory structures, with about two-dozen cultivation / production licenses in each state supplying roughly 150 storefronts. Both states are also experiencing a comedown from extremely elevated prices – around and even above $4,000 per pound – just two years ago. As in other states, sales in both markets have plateaued recently and production, though limited, is apparently ample.

Michigan’s spot price began to rise gradually about halfway through the period. As we’ve reported this year, supply has tightened as the pace of demand growth has exceeded increases in production. However, outdoor growers will bring in what is likely to be the state’s largest Fall crop since the adult use market opened in late 2019, which could reverse the recent modest gains.

New England

Legal cannabis markets in New England resisted any coherent regional trends in Q3, with a number of relatively new adult use markets variously displaying high volatility (Vermont), consistently climbing prices (Connecticut), and relative stability (Rhode Island). New Hampshire is the only state that has not legalized for adult use and prices are sliding in what is a quite small medical cannabis program.

Massachusetts, the region’s most mature adult use market, saw wholesale prices rise into late August before turning downward. The amount of canopy licensed in the state has expanded a great deal in recent years, including a number of outdoor growers who hold licenses in the largest production tiers. While sales revenue has stagnated, prices are down significantly, indicating that demand has grown alongside production. Despite still displaying volatility, Massachusetts’ spot price settled into a tighter range in Q3 than it has in prior periods over the last 18 months.

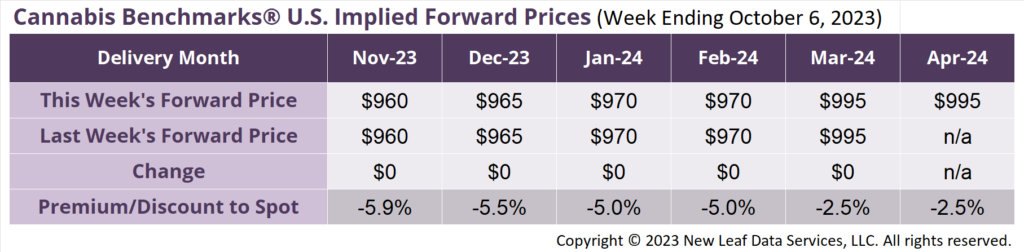

April 2024 Implied Forward initially assessed at $995 per pound.

At $960 per pound, the November 2023 Implied Forward represents a discount of 5.9% relative to the current U.S. Spot Price of $1,021 per pound.

July – September Outdoor Harvest Volume Down 19% YoY

Wholesale Price Cools Down as Retail Competition Heats Up

July Retail Sales Down 13% YoY; Wholesale Flower Prices Dip 28%

Q3 Wholesale Price Downtrend Echoes Last Year’s Trend