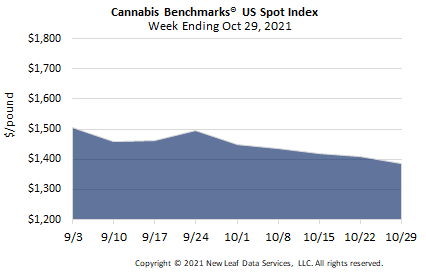

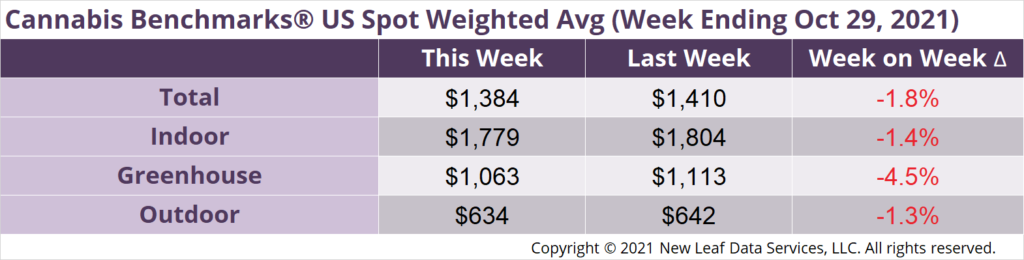

U.S. Cannabis Spot Index decreased 1.8% to $1,384 per pound.

The simple average (non-volume weighted) price decreased $6 to $1,673 per pound, with 68% of transactions (one standard deviation) in the $835 to $2,511 per pound range. The average reported deal size was 2.3 pounds. In grams, the Spot price was $3.05 and the simple average price was $3.69.

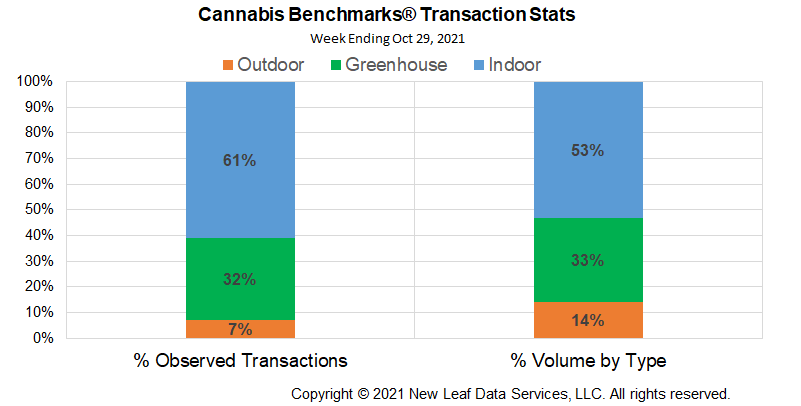

The relative frequency of transactions for indoor flower was largely unchanged this week, as was that for greenhouse product. The transaction frequency for outdoor flower was down 1% this week.

The relative volume of indoor product was unchanged this week, while that of greenhouse flower rose 1%. The relative volume of outdoor product fell 1% this week.

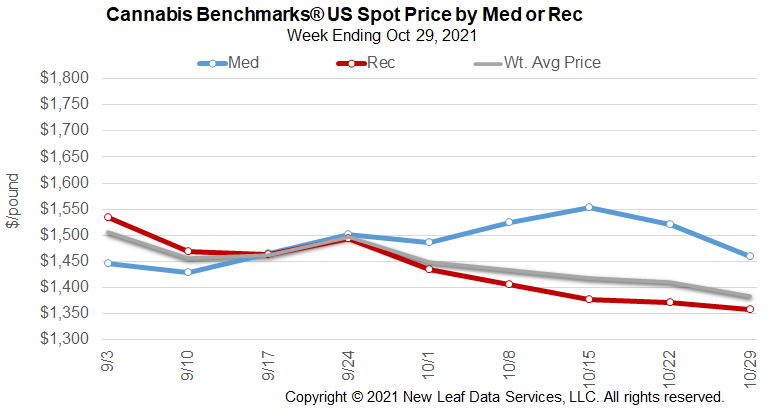

U.S. Spot prices were further weighed down this week as two legacy states, Colorado and Oregon, eked out week-on-week gains. Colorado spot was up $8 and Oregon was up $25 this week, though the downtrend in Washington, Oregon, Colorado, and California markets remains intact.

Oregon Spot price rose $25 this week as the OLCC extended its moratorium on new producer licenses. When asked if the OLCC license moratorium would help steady prices in Oregon, Will Fitzgerald, an independent grower, said, “in theory it should steady pricing, but it really doesn’t speak to the still oversupply Oregon has in light deprivation and outdoor markets.” Fitzgerald believes that “legalization takes a long time to figure out … and laws are typically reactionary.” He noted this does not mean “illegal stuff is not happening,” but he senses that West to East coast illicit traffic is slowing due to legalization efforts across the country.

Cannabis Benchmarks has previously noted price convergence in legacy markets. There is a reasonable expectation that high population markets will see price convergence in outdoor and greenhouse prices, even as bespoke, well-marketed, high end indoor product enjoys a large premium over other grow types.

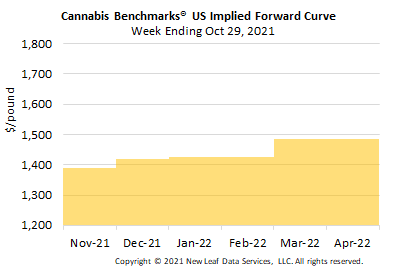

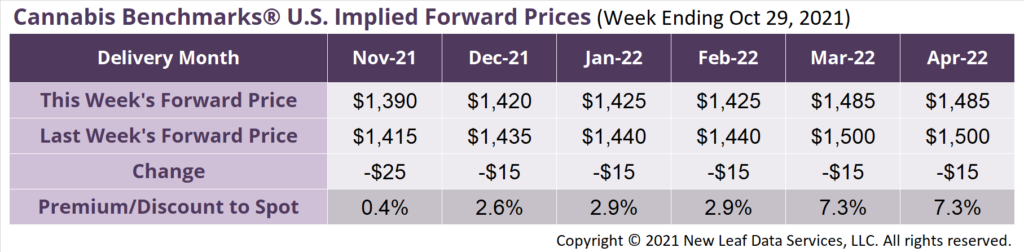

November 2021 Implied Forward closes down $25 to $1,390 per pound.

The average reported forward deal size was 66 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 38%, 46%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 98 pounds, 49 pounds, and 36 pounds, respectively.

At $1,390 per pound, the November Implied Forward represents a premium of 0.4% relative to the current U.S. Spot Price of $1,384 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Illinois

Cannabis Retailer Licensing Delays Piling Up

Michigan

Legislators and Manufacturers Association Backing Legislation to Impose New Requirements on Medical Cannabis Caregivers

Ohio

High Prices Drive Patients to Michigan