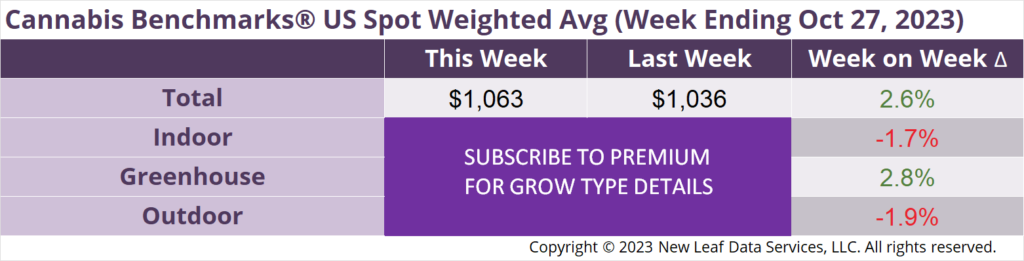

The U.S. Cannabis Spot Index increased 2.6% to $1,063 per pound.

In grams, the Spot price was $2.34.

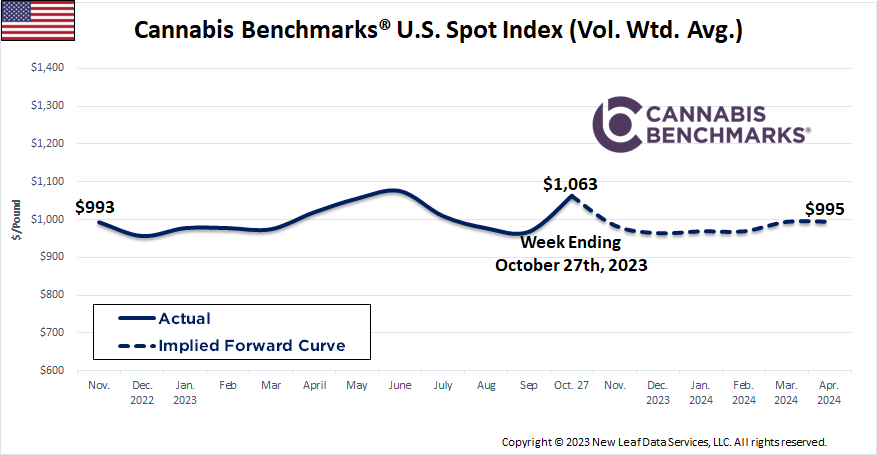

The U.S. Spot Index continued to climb this week, reaching $1,063 per pound, not far off from the current year-to-date high of $1,096, established in the first week of June. Wholesale flower prices rising through much of October is fairly anomalous and was last observed in 2020, when prices spiked through the spring, summer, and fall to peak in the final week of October.

From mid-September to this week, the national average flower price has increased 13.6%, outpacing the 6.1% jump from mid-September through the end of October 2020. In 2021 and 2022, the U.S. Spot slipped 5.6% and 5.5%, respectively, in the same timeframe.

Even with pandemic-boosted demand in 2020, wholesale prices subsequently dropped 11.3% from the final week of October 2020 to mid-January 2021. 2021 saw a similarly steep decline post-October, while downward momentum leveled off in the wake of the 2022 harvest.

While the floor that was set just above $950 per pound in late 2022 and early 2023 was pierced this year in mid September when the U.S. Spot dropped to its all-time low of $936 per pound, historical data suggests that may have been the bottom for wholesale flower prices for the time being. The current rally recalls that which occurred in 2019, after wholesale prices had slid from mid-2016 through to November 2018.

Aided by low prices, 2019 saw legal markets begin to capture more consumer demand and absorb the large outdoor harvests that had swamped relatively young markets in prior years. The U.S. Spot climbed through mid-November that year and, while it did see a post-harvest downturn, its eventual bottom, reached in May 2020, was up significantly year-on-year, in addition to being well above where the national wholesale flower price had begun 2019.

On a state level, the current wholesale price rally is underpinned by Michigan, Colorado, Oregon, Arizona, and Nevada. We’ve noted that production is down significantly this year in Colorado and Oregon – to the tune of roughly 25% in both markets – while the expansion of demand in Michigan has outpaced increases in cultivation. Less product flowing east from California may be helping boost wholesale prices in Arizona and Nevada, though the latter state also saw the closure of its largest cultivator earlier this year.

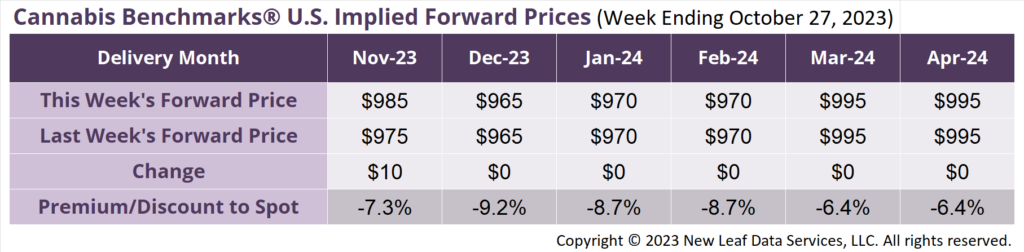

November 2023 Implied Forward assessed up $10 to close at $985 per pound.

At $985 per pound, the November 2023 Implied Forward represents a discount of 7.3% relative to the current U.S. Spot Price of $1,063 per pound.

Daily Sales Grow Modestly in September; Wholesale Price Volatility Diminishing

Sales Slump Continued in August, Followed by Record-Low Prices in September

How Much Flower Has Been Sold at Growers Showcases?

Report: Lifting Purchase Cap, New Stores Could Lead to Sales Boost