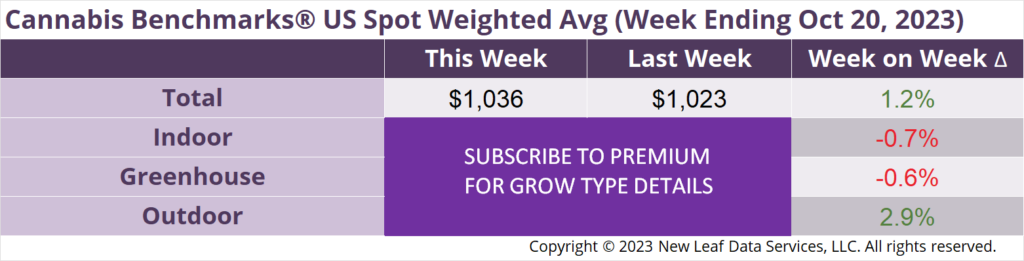

The U.S. Cannabis Spot Index increased 1.2% to $1,036 per pound.

In grams, the Spot price was $2.28.

U.S. wholesale cannabis flower prices continued to hold largely steady this month as the full-term autumn harvest is brought in. The most notable week-on-week shift in national wholesale prices was a nearly 3% uptick in the rate for outdoor flower. In observing wholesale cannabis prices over the years, short-lived price rises in the early portion of the harvest season as fresher, more appealing product comes to market have come to be expected.

On the state level, Colorado, Oregon, and Washington all saw spot prices for outdoor-grown flower climb this week.

Despite much anecdotal talk of pullbacks in production and cultivators leaving the California market, the Golden State has shown one of the more pronounced and consistent downtrends in outdoor flower pricing in the second half of this year among the major western markets. After California outdoor flower prices climbed 15.7% through the first six months of the year, they’ve fallen 13.4% from the first week of July to this week to essentially match where they opened 2023.

Moving east, Michigan’s wholesale price spike continued this week. The state’s spot wholesale flower rate has seen an uninterrupted 8.4% ascension since the end of August, accelerating the uptrend that began in mid-March. Extremely inexpensive flower prices in a rapidly expanding, highly competitive market and demand from neighboring states have combined to make Michigan a national leader in flower sales volume, which has tightened inventories relative to prior years.

On the other hand, Michigan’s neighbor Illinois has seen remarkably stable prices from early September. Illinois’ spot wholesale flower price is also more than double Michigan’s. Such price behavior can be attributed to limited licensing on the production side, along with a lack of seasonal outdoor cultivation in the state.

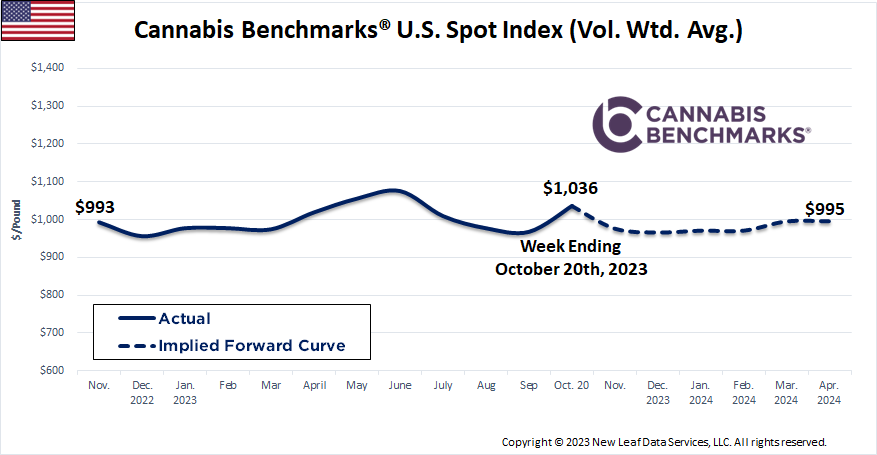

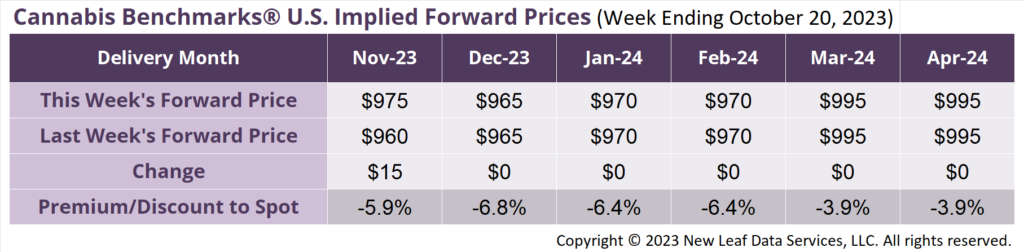

Based on reported data from our Price Contributor Network, market participants are still expecting the traditional impact on the U.S. Spot from the fall harvest; that is, reported forward deals indicate national wholesale rates are anticipated to continue to slide. Our Implied Forward Curve incorporates those reports and reflects the sentiment that the market expects wholesale prices to fall in each of the next two months, bottoming out in December before climbing through the first four months of 2024.

November 2023 Implied Forward assessed up $15 to $975 per pound.

At $975 per pound, the November 2023 Implied Forward represents a discount of 5.9% relative to the current U.S. Spot Price of $1,036 per pound.

Analysis: Sales Revenue & Flower Sales Volume Data

Average Daily Sales Rise to New High in September

Two New Retailers Open; 25 Licensed Stores Now Selling

Adult Use License Application Period Extended