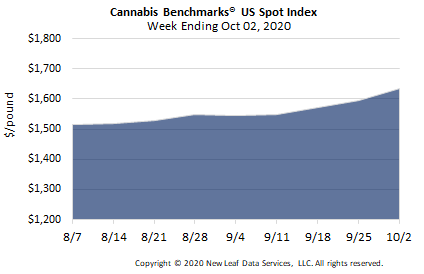

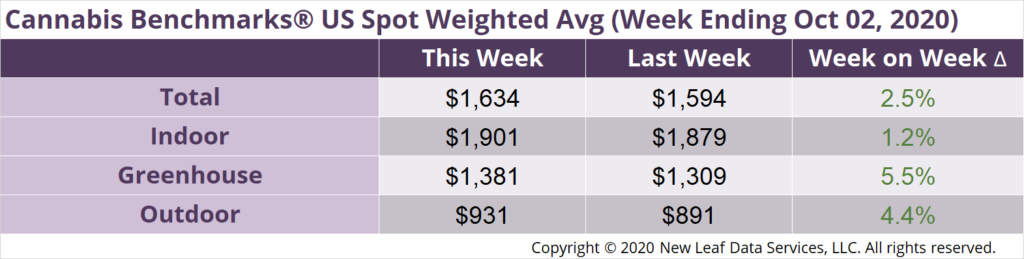

U.S. Cannabis Spot Index up 2.5% to $1,634 per pound.

The simple average (non-volume weighted) price increased $2 to $1,770 per pound, with 68% of transactions (one standard deviation) in the $1,013 to $2,526 per pound range. The average reported deal size decreased to 2.1 pounds. In grams, the Spot price was $3.60 and the simple average price was $3.90.

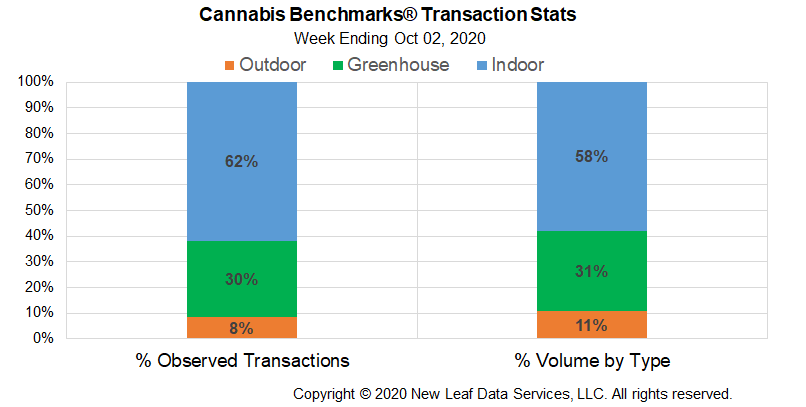

The relative frequency of trades for greenhouse flower increased by 1% this week. The relative frequency of transactions for indoor product decreased by the same proportion, while that for deals involving outdoor flower was unchanged.

The relative volumes of each individual grow type were essentially stable this week, with shifts of less than 1% observed.

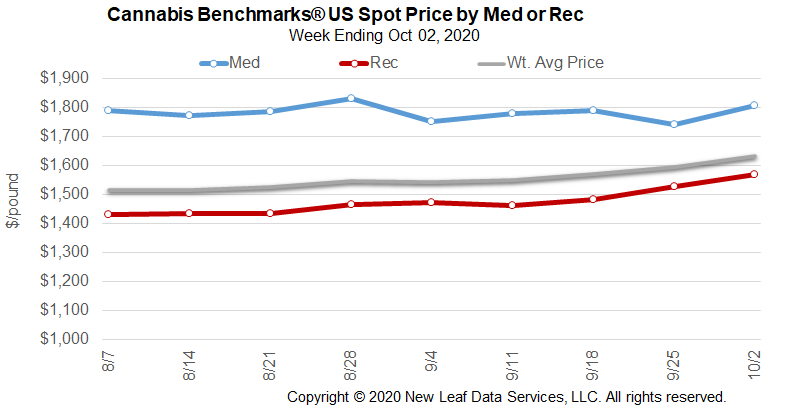

The U.S. Spot Index averaged $1,564 per pound for September, up 2.4% from August. September is the fourth straight month to see an increase in the monthly mean U.S. composite price. After it trended downward from late March through late May, in the early days of the COVID-19 pandemic, the U.S. Spot has since climbed almost ceaselessly.

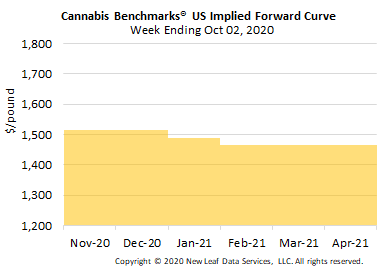

Some market participants expect such behavior to continue. Forward prices submitted by members of our Price Contributor Network in California last week show that agreed-upon wholesale prices for deals to be executed this month were 4.6% higher than the state’s average Spot price for September. The Forward deals show an expectation that rates will dip somewhat in November and December, but remain higher than current levels, before increasing even more dramatically in the coming year.

However, the combination of uncertainty regarding the fall outdoor crop – due to wildfires on the West Coast and the early snow that hit Colorado a few weeks ago – and unprecedented demand could very well push wholesale rates up through the end of the year. In 2019, when sales growth was occurring at a significantly slower pace than this year, the U.S. Spot Index continued to rise into November. Additionally, wholesale rates in states such as Michigan, Illinois, and Massachusetts are very high due to expanding adult-use markets. At this time last year, recreational sales had not yet begun in Michigan and Illinois, and demand was much lower in Massachusetts.

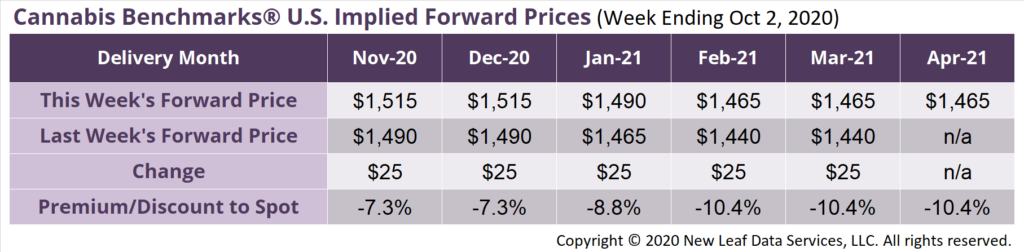

April 2021 Forward initially assessed at $1,465 per pound.

The average reported forward deal size was 22 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 35%, 39%, and 26% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 24 pounds, 17 pounds, and 26 pounds, respectively.

At $1,515 per pound, the November Forward represents a discount of 7.3% relative to the current U.S. Spot Price of $1,634 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

National

Legislation Introduced to Make State-Licensed Cannabis Businesses Eligible for Federal Disaster Relief

California

Fresno to Begin Process of Licensing Cannabis Businesses

Oregon

State Economists Expect Some COVID-Related Sales Gains Could be Permanent

Michigan

Caregiver Product No Longer Allowed to be Sold Into Licensed Medical Market

Massachusetts

Rules Proposed for Two Types of Adult-Use Delivery Businesses