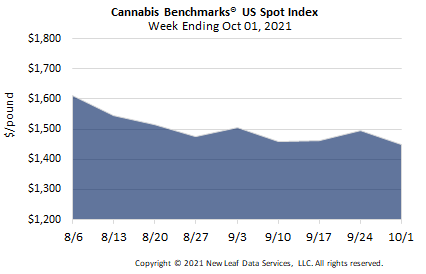

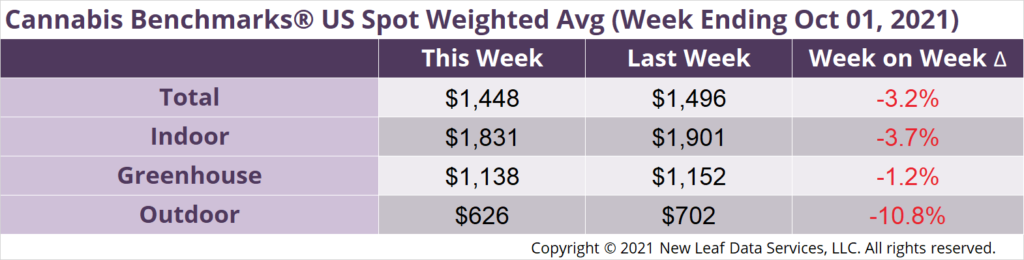

U.S. Cannabis Spot Index decreased 3.2% to $1,448 per pound.

The simple average (non-volume weighted) price decreased $28 to $1,694 per pound, with 68% of transactions (one standard deviation) in the $868 to $2,520 per pound range. The average reported deal size was nominally unchanged at 2.1 pounds. In grams, the Spot price was $3.19 and the simple average price was $3.73.

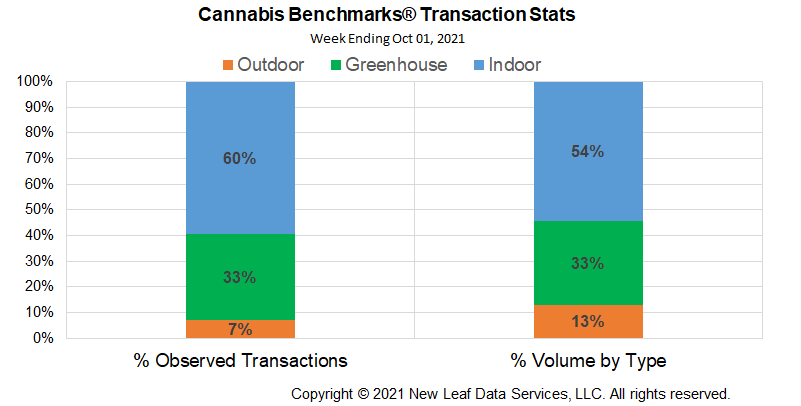

The relative frequency of transactions for indoor flower was largely unchanged this week, as was that for deals outdoor flower. The relative frequency of trades for greenhouse flower was down about 1% this week.

The relative volume of indoor product was unchanged this week. The relative volume of greenhouse flower rose 1% and the relative volume of outdoor flower fell 1%.

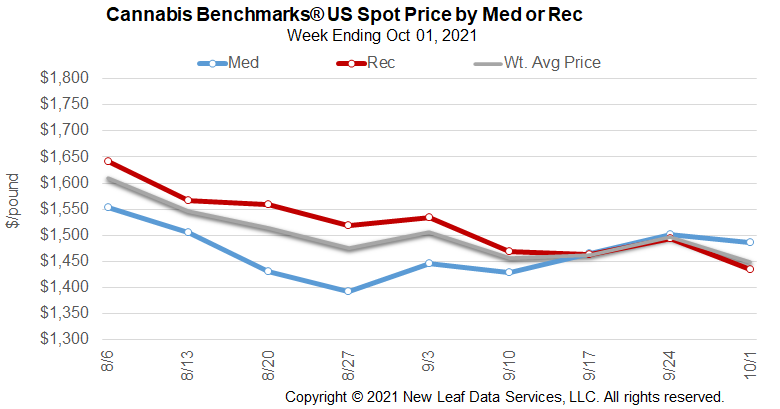

As we have covered recently, U.S. Spot prices for cannabis flower have come under a good bit of pressure, particularly in mature markets in the West. However, high population states that are newer to adult-use legalization have generally seen price increases as consumption expands and growers track demand higher as the market seeks equilibrium.

Illinois and Massachusetts are both relative newcomers to the market. In Illinois, the younger of the two markets where adult-use sales started in January 2020, prices have been in a strong uptrend for two years. In Massachusetts, where adult-use sales commenced over a year earlier, prices have stuck to a $120 price range during the last two years; the more mature market appears to have found some price stability even as sales continue to grow this year.

Michigan is another relative newcomer to adult-use legalization, having begun sales in late 2019. Michigan’s adult-use market opened about a year after Massachusetts’ and it has exhibited more price volatility, due in large part to decisions made by state officials. The pandemic effect saw prices run higher from April 2020 to January 2021, taking the state Spot up almost 20% in that period, after which price fell over $470 per pound through September 2021.

Much of the price loss is due to the proliferation of production licenses in the state stemming from a rule change earlier this year. Beginning in March 2021, Michigan opened adult-use processor, retailer, and class B and C grower licenses to all applicants. Previously, one had to hold an equivalent medical cannabis business license from the state in order to obtain the aforementioned adult-use permits. Total adult-use grower licenses shot up from 327 in December 2020 to over 900 by July 2021. More cultivation operations coming online has increased available supply and put downward pressure on prices in the state.

So, while markets seek equilibrium between supply and demand, state-initiated rule changes can reset the supply / demand dynamic and set the stage for price fluctuations. We expect that this will be the case in Illinois once legal battles over 185 new adult-use retailer licenses are resolved and those businesses can work toward opening their doors and making sales to consumers. Once all 185 retailers are operational, that will roughly triple the number of adult-use storefronts in Illinois, a major shakeup to market dynamics.

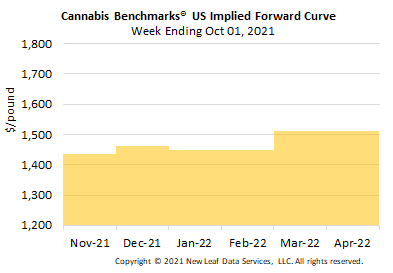

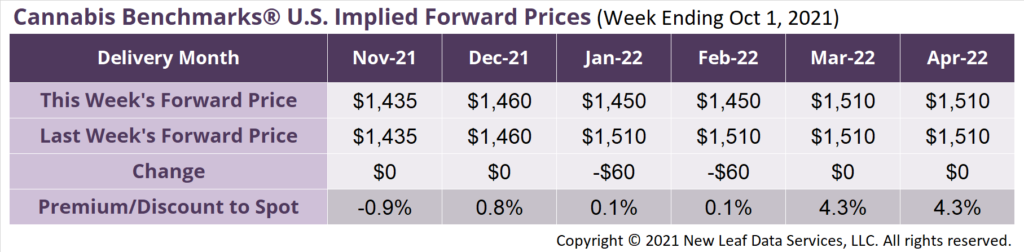

April 2022 Implied Forward initially assessed at $1,510 per pound. The average reported forward deal size was 61 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 39%, 44%, and 17% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 91 pounds, 47 pounds, and 30 pounds, respectively.

At $1,435 per pound, the November Implied Forward represents a discount of 0.9% relative to the current U.S. Spot Price of $1,448 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Humboldt County to Support Growers with Micro-Grants

Oregon

State to Take Second Bite at the Producer License Moratorium Apple

Illinois

Adult-Use Retailer Licensing Case Still Moving at a Glacial Pace