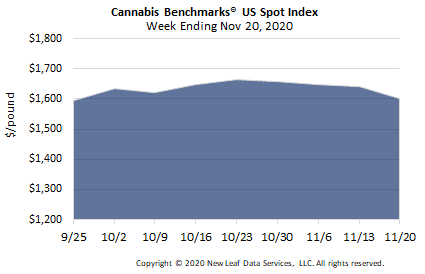

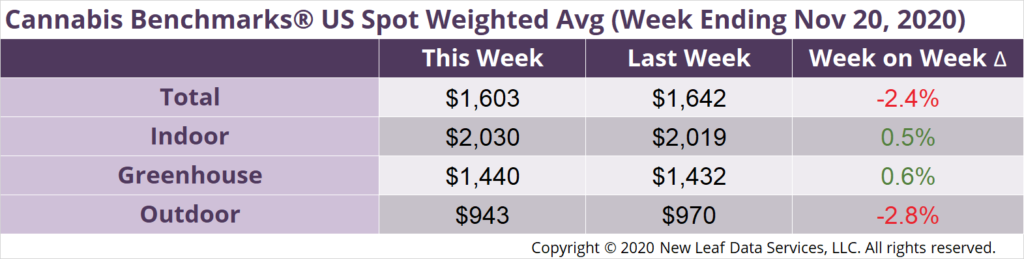

U.S. Cannabis Spot Index down 2.4% to $1,603 per pound.

The simple average (non-volume weighted) price decreased $29 to $1,827 per pound, with 68% of transactions (one standard deviation) in the $1,124 to $2,529 per pound range. The average reported deal size was nominally unchanged at 2.2 pounds. In grams, the Spot price was $3.53 and the simple average price was $4.03.

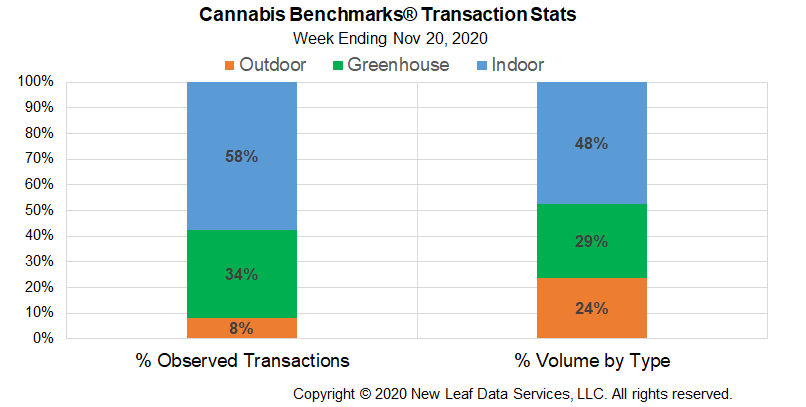

The relative frequency of trades for greenhouse flower expanded by 3%. The relative frequency of deals for indoor product decreased by the same proportion, while that for transactions for outdoor flower was unchanged.

The relative volume of warehouse flower contracted by almost 5% this week. The relative volumes of greenhouse and outdoor product expanded by about 1% and 4%, respectively.

The U.S. Spot Index has leveled off in the first three weeks of this month on slowing sales growth in numerous major markets, as well as new supply from this year’s autumn crop beginning to make its way to market in the West Coast states and Colorado.

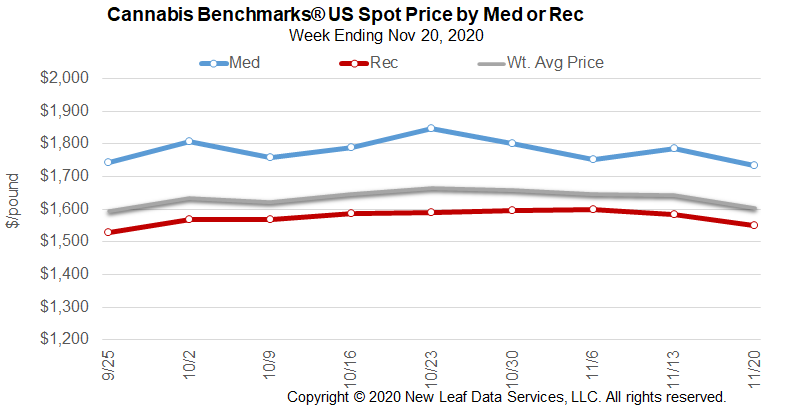

As Thanksgiving and the end-of-year holidays approach, the COVID-19 pandemic is reaching new levels of severity in the U.S. This has resulted in many states and localities with legal cannabis markets tightening restrictions recently. Based on data and observations from earlier this year, when even more strict coronavirus-related restrictions were implemented and sales soared to record levels, we do not expect that the current situation will on its own suppress demand in legal markets. Legal cannabis businesses were also declared essential and permitted to remain open during lockdowns imposed in the spring – with the exception of adult-use retailers in Massachusetts – and there have been no signs yet that state regulators are contemplating a different position should new stay-at-home orders be issued in the coming weeks.

On the other hand, no new stimulus or relief legislation has been forthcoming from the federal government since March. New restrictions on businesses could result in more furloughed and laid-off workers. Additionally, a “benefits cliff” will occur the day after Christmas for certain types of pandemic-related unemployment insurance unless Congress and the President act to renew it. Notably, however, these larger economic trends have not negatively impacted legal cannabis demand to this point.

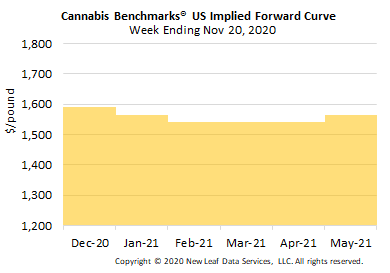

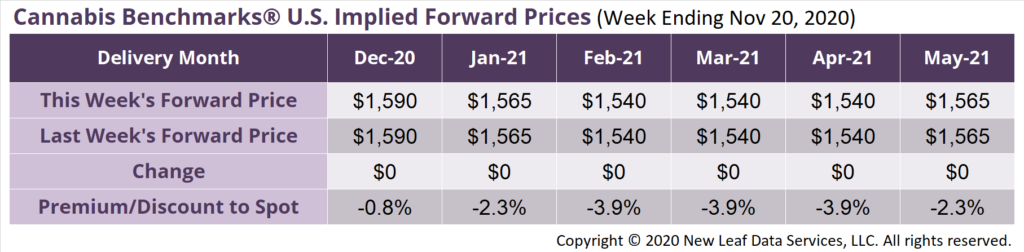

December Forward unchanged at $1,590 per pound.

The average reported forward deal size increased from 27 to 31 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 32%, and 22% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 41 pounds, 17 pounds, and 28 pounds, respectively.

At $1,590 per pound, the December Forward represents a discount of 0.8% relative to the current U.S. Spot Price of $1,603 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

State Working Toward Changing Product Testing Rules, Including Adding Screenings for Heavy Metals and Mycotoxins

Washington

Rulemaking to Implement New Mandatory Testing and Allow Tier 1 Producers to Expand Continues

Michigan

State Officials Release Instructions on Applying for Adult-Use Licenses; Recreational Market Will Open to Any Eligible Applicant Beginning March 2021

Arizona

Sales Volume Figures Jump to New Record in October; Wholesale Prices Rise on Strong Demand and New Required Testing