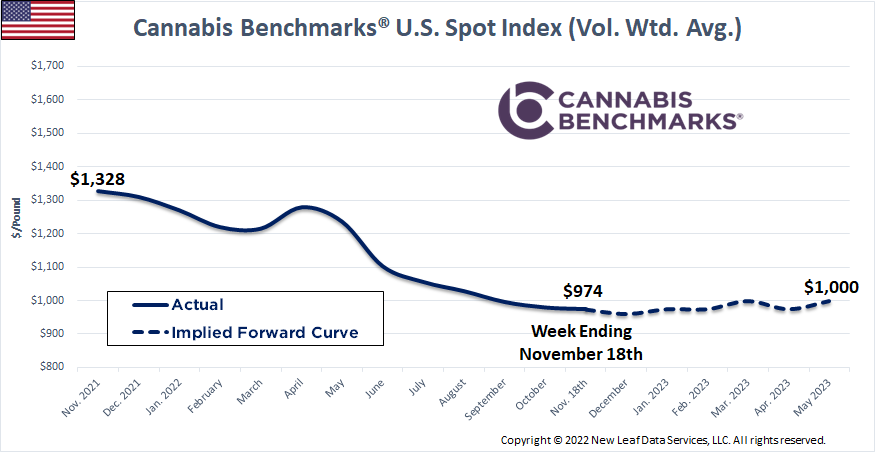

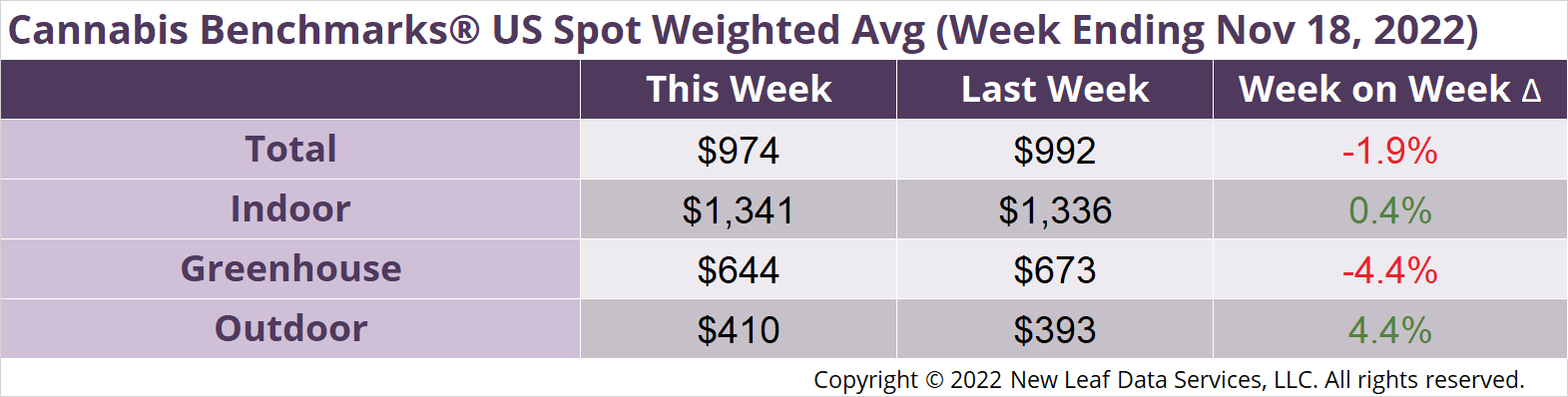

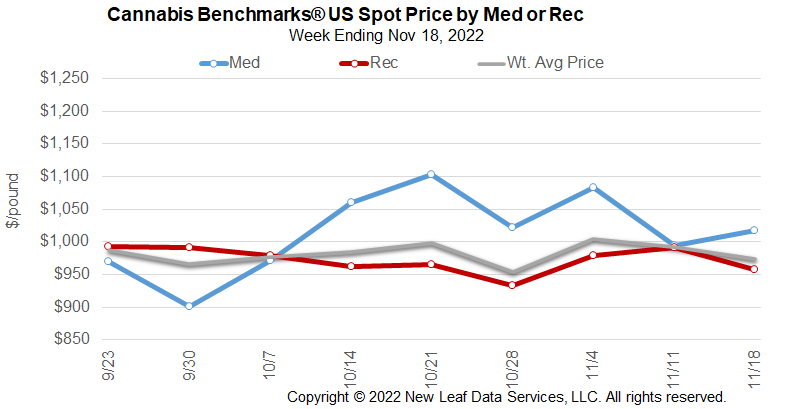

The U.S. Cannabis Spot Index decreased 1.9% to $974 per pound.

The simple average (non-volume weighted) price decreased $58 to $1,327 per pound, with 68% of transactions (one standard deviation) in the $503 to $2,150 per pound range. The average reported deal size was 2.5 pounds. In grams, the Spot price was $2.15 and the simple average price was $2.92.

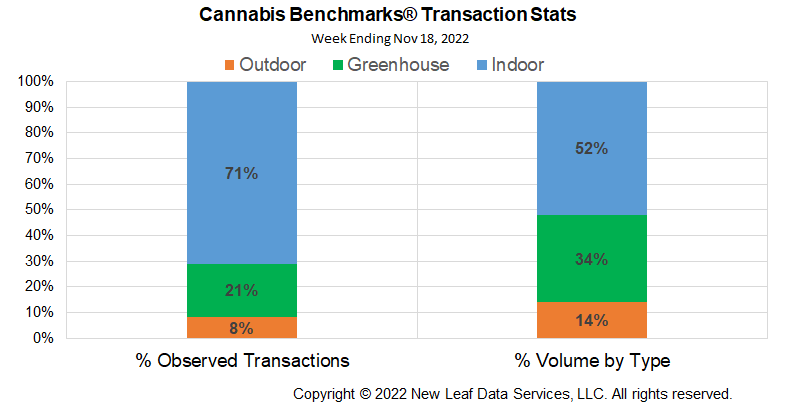

The relative transaction frequency of indoor product fell 1%, while that of greenhouse product rose 1%. Outdoor transaction frequency rose 1%.

The relative volume of indoor product fell 2%, while that of greenhouse product rose 3%. Outdoor flower’s relative volume fell 1%.

The U.S. Spot Index fell $18 this week on the back of legacy state price slippage and a price rout in the Southwest. U.S. spot price remains below the $1,000 per pound handle and looks set to return to the all-time low at $954. Widespread oversupply generated and distributed by both licensed and unlicensed actors is seeping across the country, enabled in part by the proliferation of legalization in contiguous states.

The “Sand States” – Arizona, New Mexico, Oklahoma, and Nevada – are a microcosm of the nation’s cannabis markets with prices in these contiguous states being driven ever-lower despite vastly different regulatory regimes. Additionally, this bloc is adjacent to major markets with severe oversupply issues. Colorado’s spot price is less than half of New Mexico’s. Nevada and Arizona share their longest state borders with California.

Arizona spot price fell $59 per wholesale pound this week, making a new all-time low. Oklahoma spot fell $49, New Mexico dropped $46 per pound, and Nevada spot fell $29 per wholesale pound.

New England, New York, and New Jersey will likely end up looking very much like the Sand States, but on a shorter time line; that is, the sun will shine on those states only as long as not all of them are open for business.

There is a cannabis oversupply issue across the nation, with some states suffering nearly immediate price meltdowns within a year of opening their adult use markets. The surrounding states have already been through the price cycle upon becoming well-supplied; in fact, they are so well-supplied that product inevitably makes its way into adjacent states. With the supply / demand question fully answered, it is well past time to attack the issue of cannabis industry viability on the federal level.

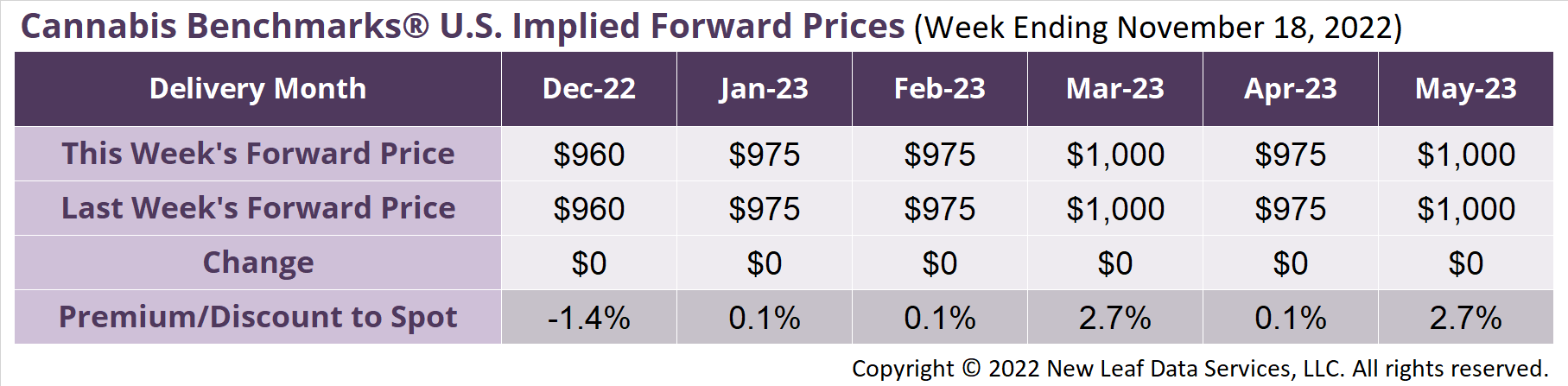

December 2022 Implied Forward unchanged at $960 per pound.

The average reported forward deal size was 74 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 45%, 43%, and 13% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 78 pounds, 71 pounds, and 70 pounds, respectively.

At $960 per pound, the December 2022 Implied Forward represents a discount of 1.4% relative to the current U.S. Spot Price of $974 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.