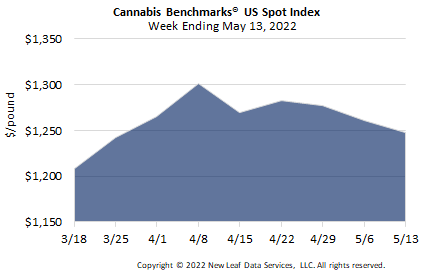

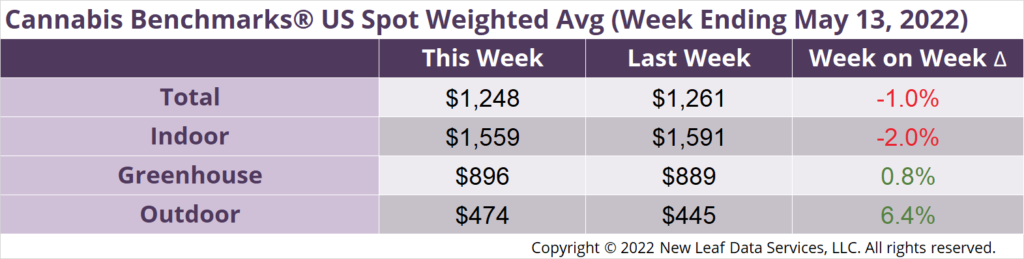

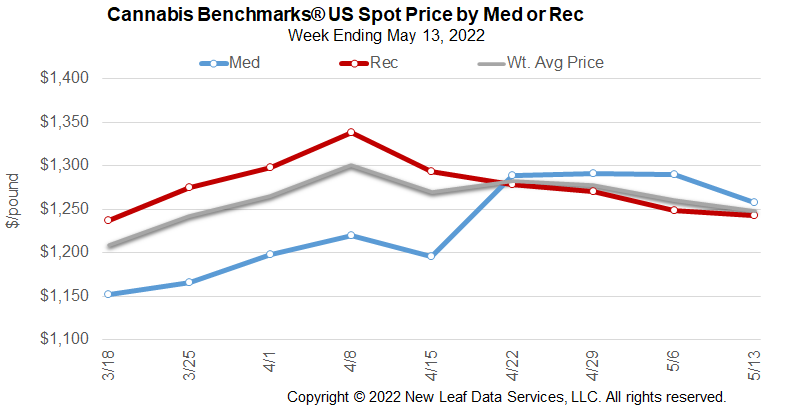

The U.S. Cannabis Spot Index decreased 1.0% to $1,248 per pound.

The simple average (non-volume weighted) price decreased $12 to $1,506 per pound, with 68% of transactions (one standard deviation) in the $685 to $2,326 per pound range. The average reported deal size was nominally unchanged at 2.3 pounds. In grams, the Spot price was $2.75 and the simple average price was $3.32.

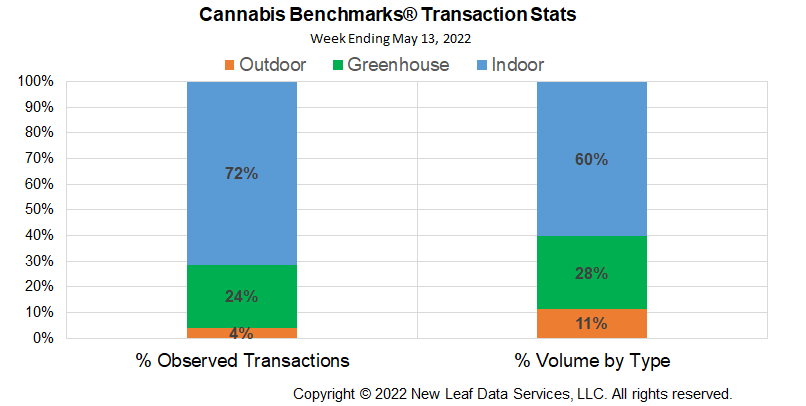

The relative frequency of transactions for indoor flower rose 1%, while that of greenhouse flower fell 1%. Outdoor transaction frequency was unchanged.

The relative volume of indoor flower was unchanged, while that of greenhouse flower fell 2%. The relative volume of outdoor flower was unchanged.

U.S. Spot price slid $13 this week to trade at $1,248 per pound on legacy state net change of +$4 per pound. All legacy state spot prices are trading below the $1,000 per pound handle.

Massachusetts, Illinois, and Michigan netted a +$14 per pound change this week with Michigan gaining $59 this week. Michigan’s recent price crash is overdone by any measure. Moves of this magnitude in any market tend to revert back to a mean level, either in a rather spectacular run or over a period of months, or even years. A rapid return to the midway point of the crash is just below $1,800, but such a move would be in opposition to Michigan market fundamentals; specifically, the uncapped licensing scheme and burgeoning outdoor production capacity.

Massachusetts prices fell $92 per pound this week. Losses so far in 2022 are $1,245 per pound, or 36.3%. Spot price is at an all-time low in the state, having taken out the 2018 low of $2,292 in the last week of April 2022.

Illinois spot price rose $19 per pound this week, representing a 19.1% loss since fall 2021. Spot is now trading at levels not seen since July 2020 when price was ramping up with pandemic demand. In short, Spot is nearing pre-pandemic levels.

Even with these rather spectacular price moves, the fact remains newer states are still trading at a fat premium to legacy states, due in part to new states’ lack of large amounts of outdoor production, which tends to drag legacy state prices down. That being said, there is some scope for a bifurcated nationwide market in which states without huge amounts of outdoor production maintain a premium over states with extremely voluminous outdoor cultivation. A bifurcated market supports the notion of using outdoor-grown product as the basis for a futures contract, as it would be a direct hedge for the largest volume crop type. States without a large outdoor crop that trade at a premium to legacy states would be able to ratio hedge, adding significant liquidity to the base contract.

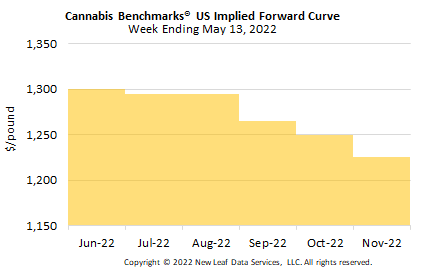

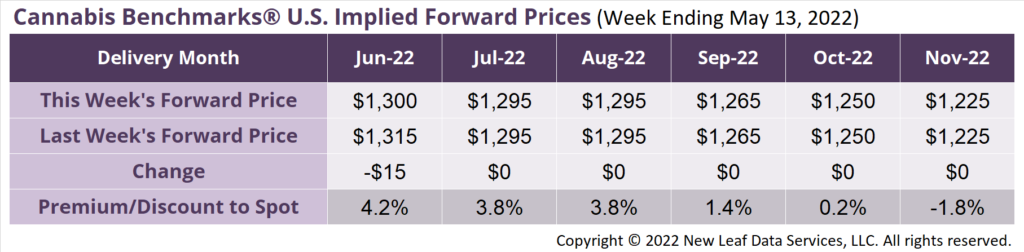

June 2022 Implied Forward assessed down $15 to $1,300 per pound.

The average reported forward deal size was 79 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 44%, 43%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were nominally unchanged at 86 pounds, 76 pounds, and 60 pounds, respectively.

At $1,300 per pound, the June 2022 Implied Forward represents a premium of 4.2% relative to the current U.S. Spot Price of $1,248 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

March Sales Figures Surge

Massachusetts

Adult Use Retail Sales Gain Slows to 1.7% M-o-M

Maine

Monthly Sales Hit Record High – Again!

Connecticut

State’s First Lottery Will Award 12 Retailer Licenses