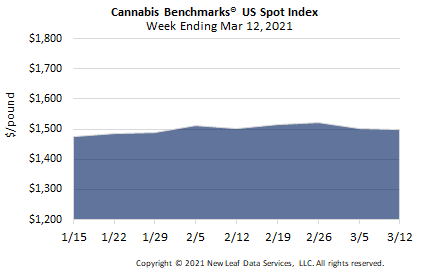

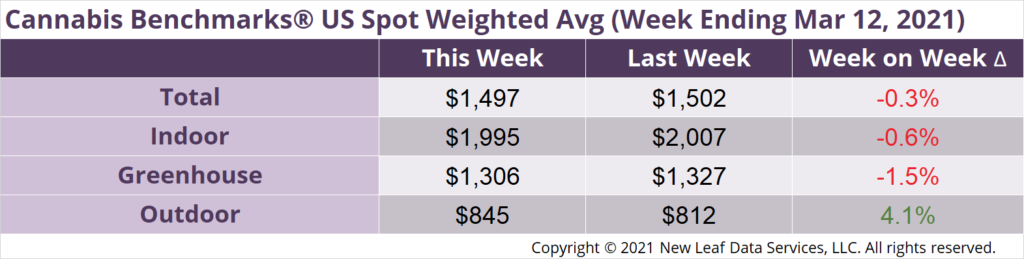

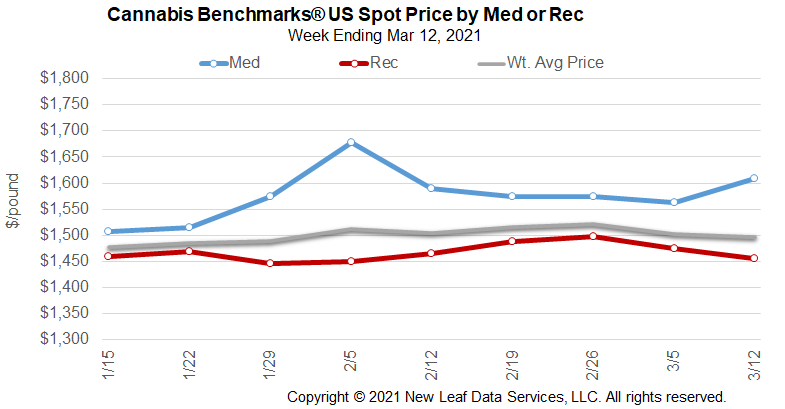

U.S. Cannabis Spot Index down 0.3% to $1,497 per pound.

The simple average (non-volume weighted) price decreased $23 to $1,769 per pound, with 68% of transactions (one standard deviation) in the $981 to $2,557 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $3.30 and the simple average price was $3.90.

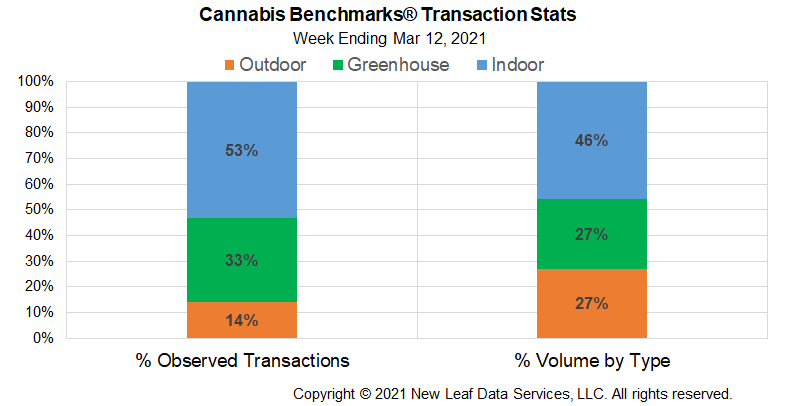

The relative frequency of trades for indoor flower decreased by 1%. The relative frequency of deals for outdoor product increased by the same proportion, while that for transactions for greenhouse flower was unchanged.

The relative volume of greenhouse flower expanded by 2% this week. The relative volumes of warehouse and greenhouse product each contracted by 1%.

As we have noted in previous reports, officials and economic analysts in many states have stated that they expect sales growth to slow in 2021, relative to the boom in demand seen last year during the COVID-19 pandemic. Sales in numerous markets did see a downturn from December 2020 to January 2021, which at this point has come to be expected in any given year.

However, sales figures published by Colorado officials this week – discussed in more detail below – show an uncharacteristic increase in demand from December 2020 to January 2021, a phenomenon not observed in the state since January 2015. The figures out of Colorado raise the possibility that demand could continue to expand in some markets at rates comparable to, or even greater than those observed in 2020. Time will tell whether this trend is borne out.

Also in this week’s Premium Report, we analyze February’s medical cannabis sales out of Arizona. February is the first full month in which adult-use and medical cannabis sales have taken place simultaneously in the state and the data shows that the commencement of the former is having a major impact on the latter. February’s medical cannabis sales volumes represent significant declines from the month prior, as well as the same month a year ago, the first time that an annual contraction in monthly sales has occurred since the opening of Arizona’s medical cannabis system in 2011.

While not completely unsurprising, previous examples of established medical cannabis programs that added adult-use markets have not shown such a dramatic and immediate impact on purchasing by patients. In Colorado for example, medical cannabis patient counts and sales continued to grow through 2014 and 2015, the first two years of adult-use sales in the state, before beginning to decline in subsequent years. When adult-use sales began in Illinois in 2020, monthly medical cannabis sales still saw significant increases compared to 2019 and only began to plateau in the latter portion of the year.

Arizona cannabis business operators are working to bring additional production capacity online to meet the new demand created by the unexpectedly fast start to adult-use sales, but when such projects will start producing significant amounts of new supply is not yet clear.

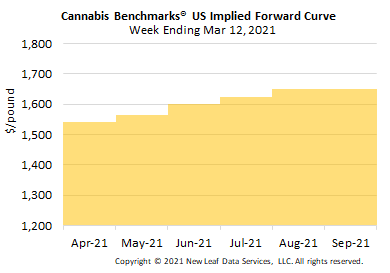

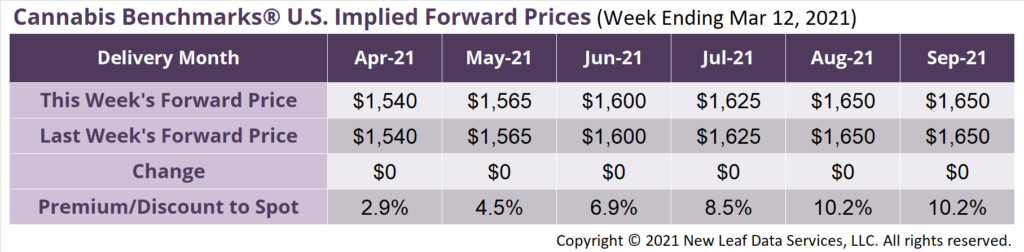

April Implied Forward unchanged at $1,540 per pound.

The average reported forward deal size was unchanged at 47 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 59%, 31%, and 10% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 61 pounds, 29 pounds, and 25 pounds, respectively.

At $1,540 per pound, the April Implied Forward represents a premium of 2.9% relative to the current U.S. Spot Price of $1,497 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

January 2021 Sales See Small Increase from Prior Month, Breaking with Behavior Observed Over Previous Five Years

Washington

Bill Advancing Through State Legislature Would Exempt Registered Patients from 37% Retail Excise Tax

Arizona

February Medical Cannabis Sales See Significant Declines in First Full Month of Adult-Use Market Being Open

Maine

Adult-Use Sales and Store Openings Stagnate in February, Just a Few Months After the Market Opened