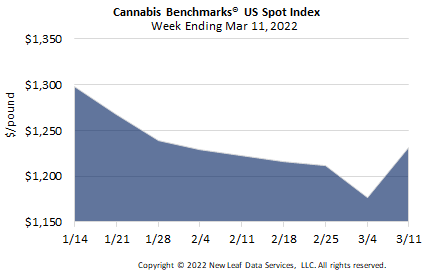

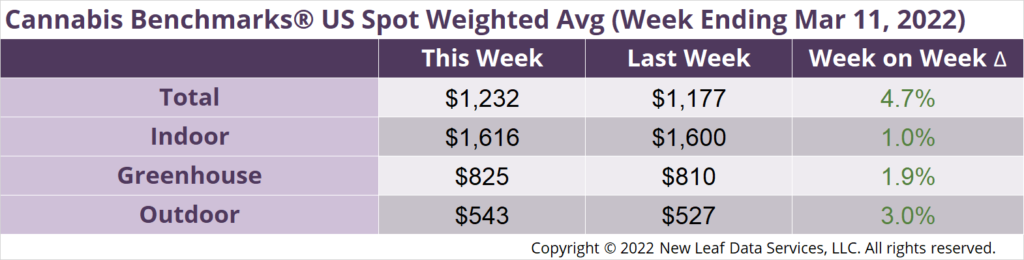

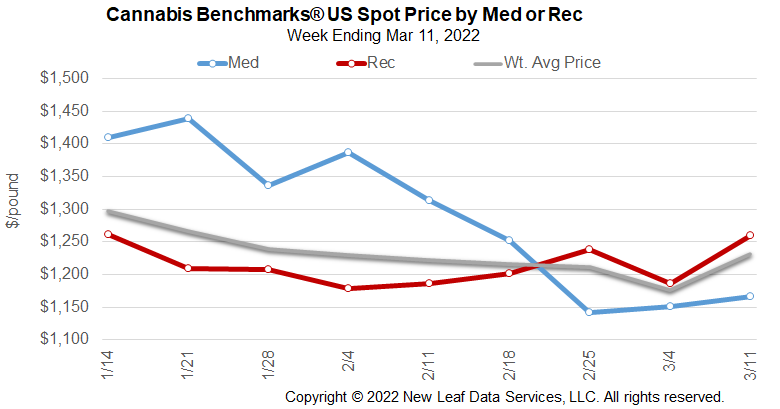

The U.S. Cannabis Spot Index increased 4.7% to $1,232 per pound.

The simple average (non-volume weighted) price increased $30 to $1,495 per pound, with 68% of transactions (one standard deviation) in the $669 to $2,320 per pound range. The average reported deal size was nominally unchanged at 2.5 pounds. In grams, the Spot price was $2.72 and the simple average price was $3.30.

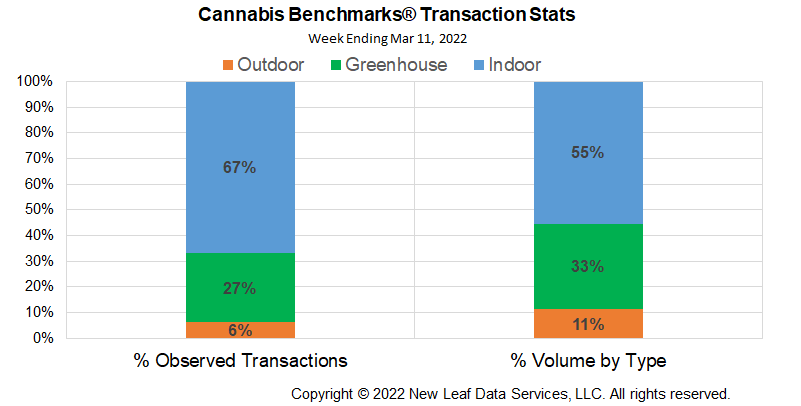

The relative frequency of transactions for indoor flower was up 2%, while greenhouse deal frequency was essentially unchanged this week. Outdoor transaction frequency fell 1%.

The relative volume of indoor flower rose 3%; that of greenhouse flower fell 1% and that of outdoor flower fell 4%.

Repercussions of cannabis oversupply are ricocheting around the industry as cannabis prices remain under pressure across much of the country. Publicly listed companies have been on a buying binge that has resulted in lower stock prices, cancellation of planned takeovers, and even scaled back production.

Ascend Wellness stock has lost over 67% of its value this year, trading around $4 per share after missing both earnings and revenue projections this week. Ascend Wellness’ CEO said the cannabis industry has been “caught off guard by current price competition in the market.” He went on to add, “due to competitive market conditions and our lack of new assets coming online in the first half of this year, we do not anticipate any revenue growth or margin expansion.”

Scotts Miracle-Gro lowered earnings expectations citing their Hawthorne division, which sells supplies to cultivators, saying, “sales in the segment have been challenged for several months due to an oversupply of cannabis, which is leading to a slowdown in both indoor and outdoor cultivation.” The CEO said the company “no longer expects a significant acquisition in 2022,” having ended merger and acquisition discussions with an unnamed firm.

M&A activity has dried up in the Midwest after last year saw companies paying $25 million for Illinois dispensaries on the supposition such outlets would generate $14 million per year in sales. Players interviewed by Grown In say assets are now overpriced and buyers are awaiting new licenses to be issued in Illinois, noting they also expect a “bearish” economy and depressed MSO (multi-state operator) stock prices in 2022.

While companies may have shot a hole in their own boats by going on acquisition and expansion sprees even in the face of falling cannabis prices, regulatory changes and legal woes are nipping at their heels. Illinois looks set to consolidate regulatory agencies with an eye toward protecting and expanding social equity programs, according to Grown In. New York announced a program that will grant the first 100 to 200 adult use cannabis licenses to social equity applicants. The White House has banned cannabis equity investments by federal employees seeking security clearances, according to Bloomberg, which also reported the Russian attack on Ukraine is weighing on Curaleaf’s stock price due to company executives’ Russia connections.

Lower cannabis prices underlie nearly every issue affecting cannabis markets – as acknowledged by some large firms, as well as plenty of growers – but few are willing to pull back on growing to steady the market. Enter economics and the notion of “creative destruction.” While the cannabis industry is “new,” it is also old: methods of production and distribution have been scaled up and professionalized, but at their cores remain largely unchanged even as the industry has expanded across the country. MSOs did not innovate so much as buy a place in the industry.

Meanwhile, the takeover targets of MSOs and other large firms have become expensive, due in no small part to their own bidding up of those targets during periods of rapid acquisitions. They built out massive canopies, undercut prices to gain market share, and are now suffering because prices are low, and headed lower. The situation is an echo of that which has been taking place amongst publicly traded Canadian companies, which we have covered via our Canada Cannabis Spot Index reports. While some MSOs will survive spending sprees on expensive takeovers and the price rout, the next round of companies entering the market may do so based on new models more suited to interstate trade or full legalization, where being the middleman is more lucrative than being the everyman. The details remain to be sorted, but what is certain is that MSOs are expecting a rough 2022.

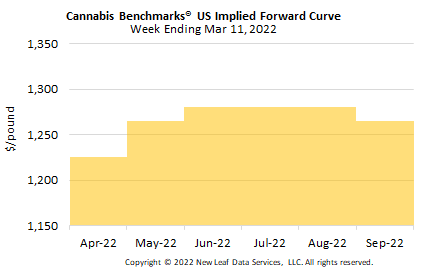

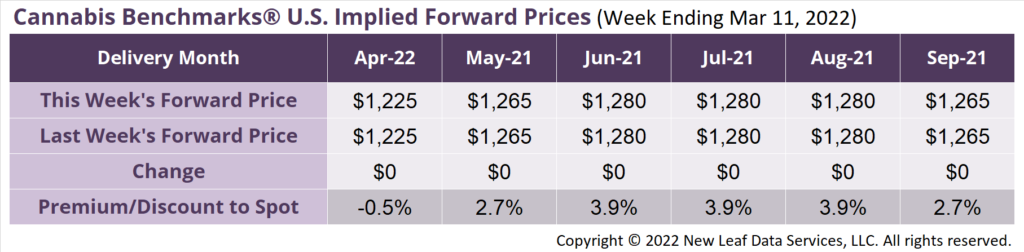

April 2022 Implied Forward unchanged at $1,225 per pound.

The average reported forward deal size increased 2 pounds to 77 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 33%, 52%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 94 pounds, 72 pounds, and 59 pounds, respectively.

At $1,225 per pound, the April 2022 Implied Forward represents a discount of 0.5% relative to the current U.S. Spot Price of $1,232 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

January Sales Fall 10% Month-on-Month

Maine

Steady as She Goes – Maine Sales up 2.8%

Michigan

Michigan Cannabis Businesses Must Insure

National

Confluence of Events: Russia and Inflation Weigh on Cannabis Businesses