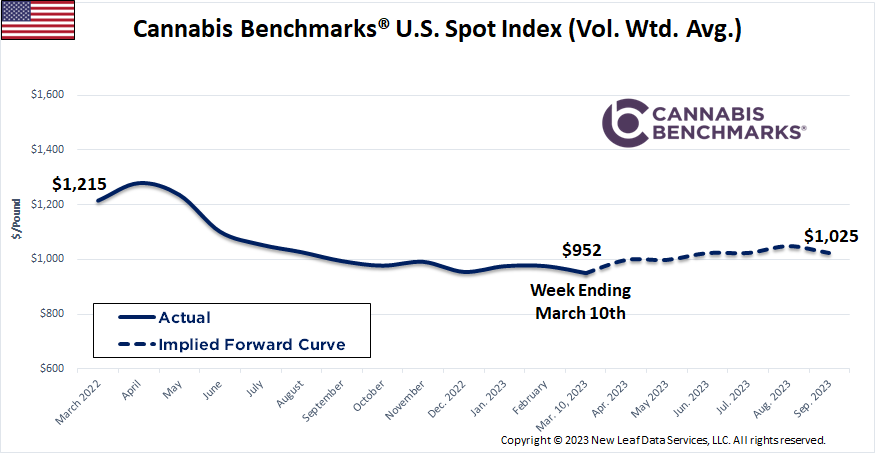

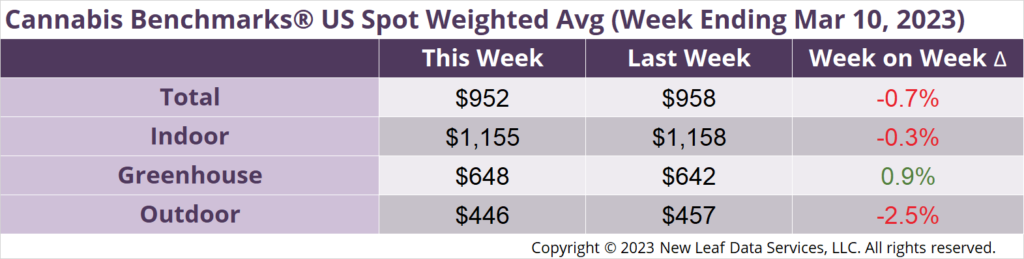

The U.S. Cannabis Spot Index decreased 0.7% to $952 per pound.

In grams, the Spot price was $2.10.

U.S. wholesale spot price is trading just two dollars off the all-time low as legacy spot markets churn within tight ranges. California spot slipped $12 per pound this week, but remains $105 off the all-time low made in January 2023. Oregon spot skidded $13, but is trading up $108 from the all-time low reached in March 2022. Colorado spot inched up by one dollar and is up $38 from the all-time low reached in January 2023. Washington State ticked up by one dollar as well and has been trading in just an $18 range for the past five weeks.

Range trading around recent lows as we move into spring demand season is actually a good sign in the market. In short, technically, the market is less volatile, is range trading and forming a solid base near recent lows, which should provide support for price gains when demand picks up. In addition, prices in legacy state outdoor flower markets, led by California, are less volatile even as they trade near all-time lows. One can never call the exact bottom in the market, but the past several months of price action suggest gains can be made – and held – in the weeks going forward.

Oklahoma finally broke the $1,000 cap basis spot. Oklahoma has seen the steadiest prices in the nation even as its per capita licensing ratio shows an astonishing one cultivator for every 52 medical card holders, a situation officials are taking in stride, as indicated in our interview in this week’s Premium report. Oklahoma spot price most closely mirrors that of the U.S. Spot Market. There is a non-zero chance that Oklahoma’s widely distributed cannabis has created consumer expectations for price and thus relatively steady spot prices over the past several months.

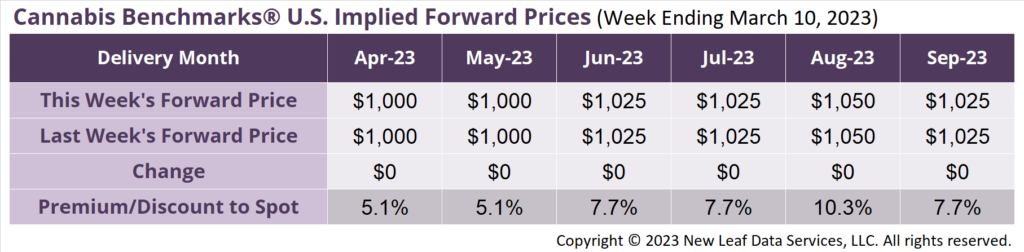

April 2023 Implied Forward unchanged at $1,000 per pound.

At $1,000 per pound, the April 2023 Implied Forward represents a premium of 5.1% relative to the current U.S. Spot Price of $952 per pound.

February Sales Slip 3.8%; Down 9.6% Year-on-Year

Adult Use Voted Down Amid Abundant Medical Supply – Interview

2022 Sales Tank – Down 15.4% Year-on-Year

Adult Use Sales Fall as Out-of-Staters Buy Local