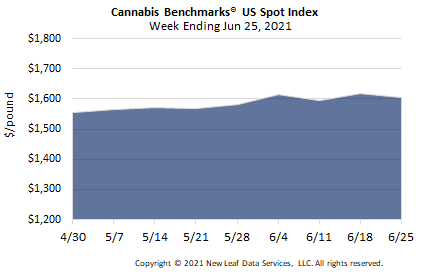

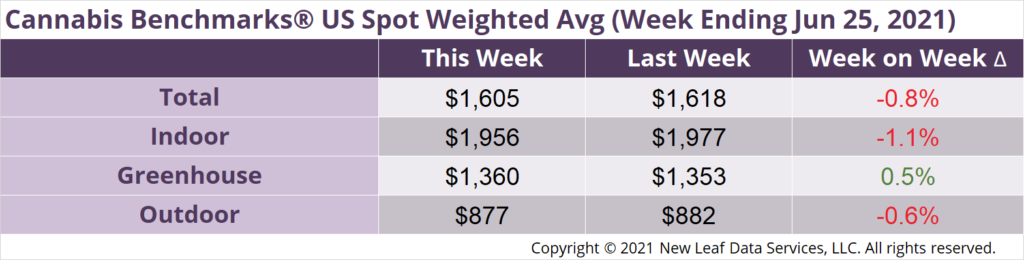

U.S. Cannabis Spot Index decreased 0.8% to $1,605 per pound.

The simple average (non-volume weighted) price decreased $15 to $1,844 per pound, with 68% of transactions (one standard deviation) in the $1,049 to $2,640 per pound range. The average reported deal size decreased to 2.3 pounds. In grams, the Spot price was $3.54 and the simple average price was $4.07.

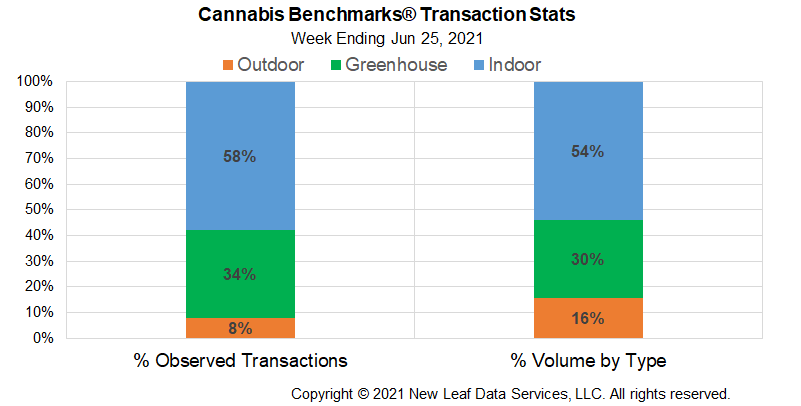

The relative frequency of transactions for indoor flower decreased by almost 2% this week. The relative frequency of trades for greenhouse product increased by the same proportion, while that for deals for outdoor flower was steady.

The relative volume of outdoor flower expanded by 1% this week. The relative volume of greenhouse product contracted by the same proportion, while that for warehouse flower was unchanged.

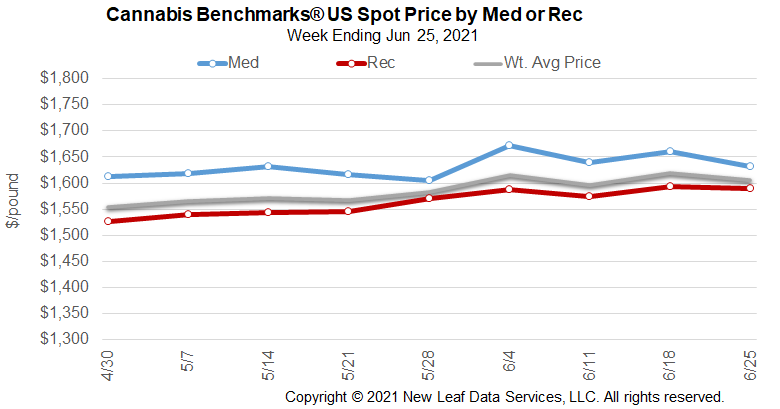

The U.S. Spot Index in June continued its recent upward trend, suggesting that the now-expected summer uptick in demand is getting underway, even as sales data published recently by several states showed that retail revenues subsided uncharacteristically from April to May. The recent rise in the national wholesale cannabis flower price is being driven primarily by climbing rates in California, Colorado, and Oregon.

In Michigan, on the other hand, wholesale flower prices have been trending downward for months. This is occurring even as adult-use and medical retailers in the state have posted impressive sales figures. However, state data for May, examined in detail in today’s Premium Report, shows that licensed cultivators appear to be hitting their stride and have expanded production capacity consistently in recent months, while monthly revenue figures declined from April.

Similar trends appear to be taking place in other younger adult-use markets. For example, the state Spot Indices of Illinois and Massachusetts, while still the highest amongst the markets covered by Cannabis Benchmarks, have plateaued recently at lower levels than those observed at the end of 2020. Additionally, in Arizona, the state’s wholesale flower price declined in May even as reported adult-use sales continued to increase, suggesting that licensed producers have begun to bring in expanded harvests after the unexpectedly early opening of the recreational market in late January.

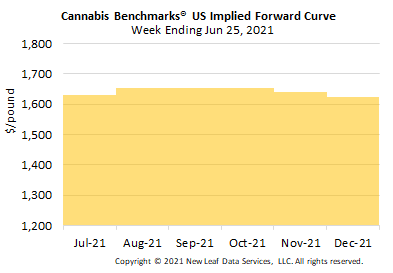

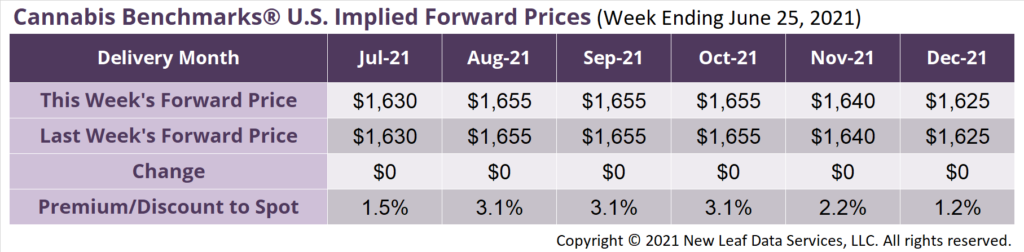

July 2021 Implied Forward closes unchanged at $1,630 per pound.

The average reported forward deal size was 59 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 55%, 34%, and 11% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 71 pounds, 48 pounds, and 33 pounds, respectively.

At $1,630 per pound, the July Implied Forward represents a premium of 1.5% relative to the current U.S. Spot Price of $1,605 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Report: State Officials Making Efforts to Ensure Provisional License Holders are Not Forced Out of Regulated Market, But Some Fear Proposals Are Insufficient

Michigan

May Sales Revenue Subsides Month-Over-Month in Part on Lower Prices, as Flower Sales Volume in the Adult-Use Sector Continues to Expand

Arizona

Reported Adult-Use Sales Rise Over 40% from March to April; State Data Shows that Medical Cannabis Sales Volume Continued to Decline in May

Connecticut

Cannabis Legalized by Adult-Use in the State this Week, Sales Expected to Begin by the End of 2022