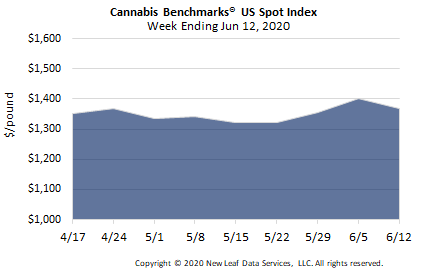

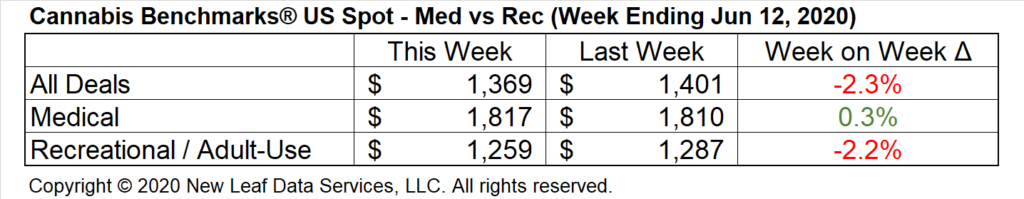

U.S. Cannabis Spot Index down 2.3% to $1,369 per pound. The simple average (non-volume weighted) price decreased $66 to $1,570 per pound, with 68% of transactions (one standard deviation) in the $846 to $2,293 per pound range. The average reported deal size decreased to 2.2 pounds. In grams, the Spot price was $3.02 and the simple average price was $3.46.

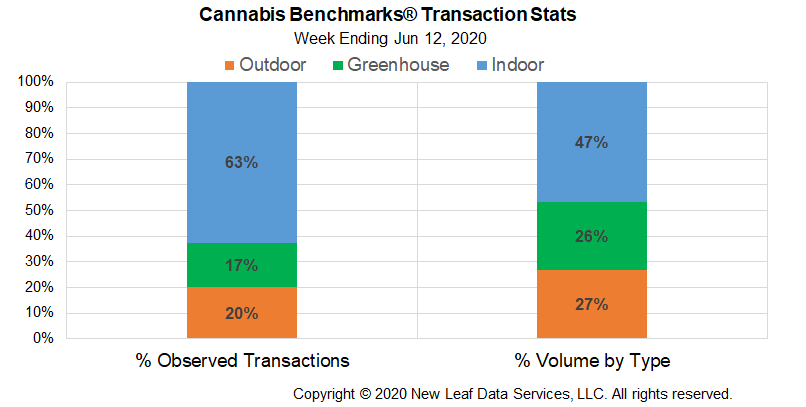

The relative frequency of trades for greenhouse flower decreased by almost 2%. The relative frequency of transactions for outdoor product increased by the same proportion, while that for deals for indoor flower was unchanged.

Indoor flower’s share of the total reported weight moved nationally was also stable this week. Greenhouse product’s relative volume shrank by 1%, while outdoor flower saw a 1% expansion in this metric.

New sales data out of various markets this week provides a clearer picture of the impact of the COVID-19 pandemic on the legal cannabis industry. For the most part, it appears that the unique situation created by the novel coronavirus and the accompanying regulatory response has resulted in increased demand, though there are some exceptions.

May sales out of Oregon, Oklahoma, and Illinois’ medical market show continued, sometimes dramatic, expansions, with all three of the aforementioned markets seeing new record revenue figures in May. An analysis of March sales from Washington State also reveals an outsized boost in demand in the country’s second-oldest legal cannabis market in the month that the COVID crisis arrived. In Massachusetts, adult-use retailers were permitted to open for the final week of May after being closed since late March, with sales picking up where they left off prior to the pandemic.

The exceptions to the elevated demand being seen in many legal cannabis markets across the country are Colorado and Nevada. Unsurprisingly, March sales in Nevada dropped significantly. Tourist numbers show that the number of visitors to Las Vegas in March was less than half the levels seen normally, indicating that tourist demand was impacted significantly even prior to the lockdown initiated in the state in late March.

April sales in Colorado followed familiar seasonal trends for the most part, though an examination of year-over-year changes indicates that the strong demand growth seen in 2019 and the first two months of this year is subsiding. Adult-use sales slipped notably from March to April in Colorado, suggesting that tourist demand could account for a more significant percentage of sales in the state than is typically acknowledged. Contrastingly, medical cannabis sales in Colorado in April boomed to their highest level in years, even after a big increase in March.

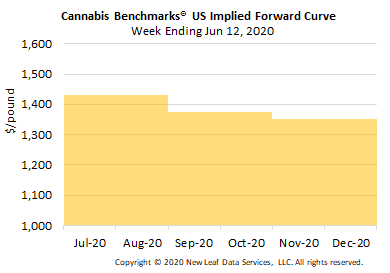

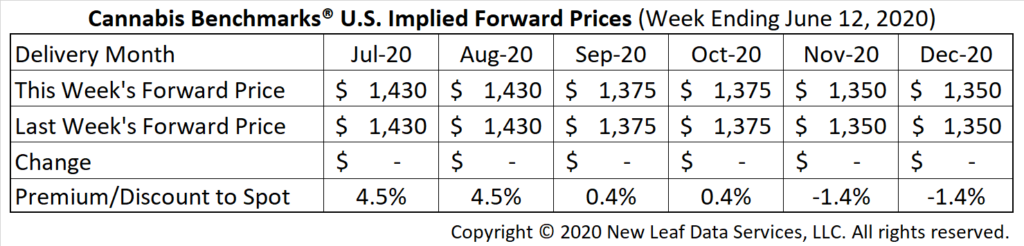

July Forward unchanged at $1,430 per pound.

The average reported forward deal size was 37 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 48%, 34%, and 18% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 43 pounds, 29 pounds, and 35 pounds, respectively.

At $1,430 per pound, the July Forward represents a premium of 4.5% relative to the current U.S. Spot Price of $1,369 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

Sales Growth Observed Prior to COVID-19 Slowed Further in April

Oregon

Demand Continues to Boom During Pandemic as Monthly Sales Top $100 Million in May

Washington

Analysis Shows Outsized Spike in Sales in March as Coronavirus Arrived

Nevada

Demand Contracted Significantly in March as Las Vegas Saw Less than Half the Usual Number of Visitors

Oklahoma

Retail Revenue has Spiked to Record Levels in Recent Months; May Sales Exceeded Those in Many Adult-Use Markets