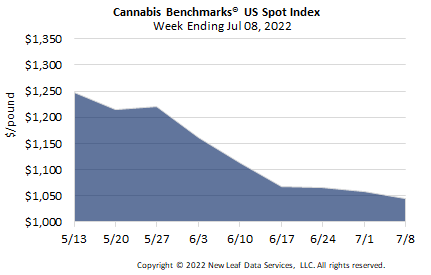

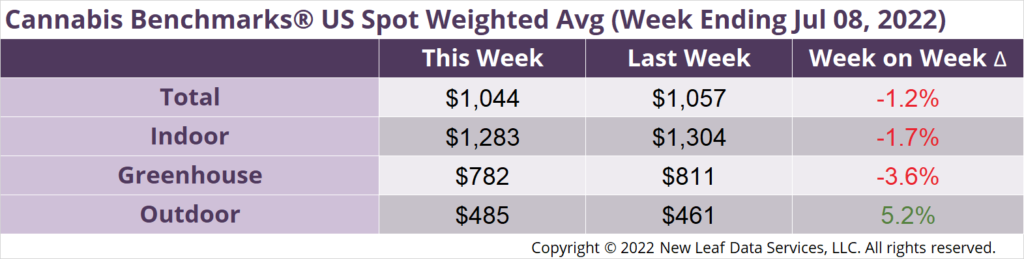

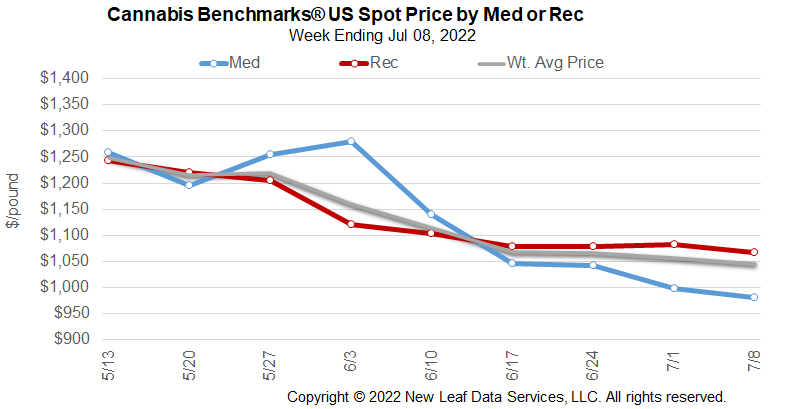

The U.S. Cannabis Spot Index decreased 1.2% to $1,044 per pound.

The simple average (non-volume weighted) price decreased $21 to $1,333 per pound, with 68% of transactions (one standard deviation) in the $594 to $2,073 per pound range. The average reported deal size was 2.4 pounds. In grams, the Spot price was $2.30 and the simple average price was $2.94.

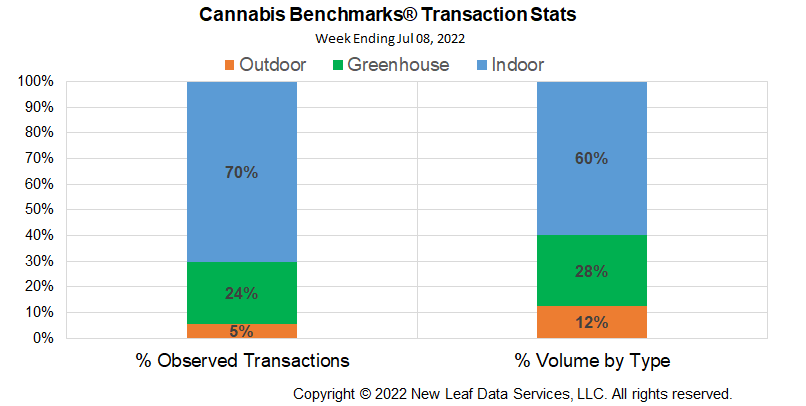

The relative transaction frequency of indoor product rose 1%, while that of greenhouse product fell1%. Outdoor transactions were unchanged.

The relative volume of indoor grown rose 1%, while that of greenhouse flower was unchanged. Outdoor volume fell 1%.

The most expensive wholesale adult use cannabis markets tracked by Cannabis Benchmarks are Alaska, Illinois, Maine, Massachusetts, Nevada, and New Mexico. Every state market saw a rise in cannabis prices leading into adult use legalization and a drop in price as markets became well supplied. The common factor among the most expensive markets is non-existent or limited outdoor supply, along with other state-specific factors.

Massachusetts regulators say they encourage outdoor cultivation through various license incentives. However, the market is certainly not flooded with outdoor flower and, given the state’s climate, it is doubtful outdoor growers will be able to produce supply sufficient to challenge the indoor market monopoly. Massachusetts prices have undergone a brutal sell-off this year, losing 39% in the spot market in what has been characterized as a money raising effort by large firms needing to pay down expansion costs.

Illinois cannabis is likely to remain at the top of the most expensive cannabis markets due to limited licensing, licensing delays due to lawsuits, and the fact that the state is surrounded by states with no legal adult use cannabis market. Additionally, outdoor cultivation is not permitted in the state. Illinois spot has also tanked this year despite growing demand and a monopolized market. There is some that speculation large players in this market needed to raise money and did so by shedding inventory on a massive scale.

Alaska prices remain high due to the lack of significant outdoor product and the presence of a tax-induced hard floor under price. As well, contacts in the state say customers prefer very high THC potency, the demand for which is crowding out less expensive product. While local option rules have restricted retail locations, price competition remains well above the tax-determined hard floor of $800 per pound of flower. Alaska spot price did sell off this spring, dropping from over $3,600 down to near $2,800 per pound, but there has been a bit of a rebound to just over $2,900 per pound as tourists return in a post-pandemic rush.

Nevada cannabis prices have remained within a $400 per pound range since February 2021, holding steady as the end of pandemic economic support met with a surge in jobs and a return to post-pandemic tourism figures. Local contacts say there is some outdoor product in the market, although it does not appear to have significantly affected spot pricing.

These states are likely to remain at the top end of cannabis prices unless state-specific rules change or outdoor growers proliferate due to a combination of innovation and / or massive land and licensing investment.

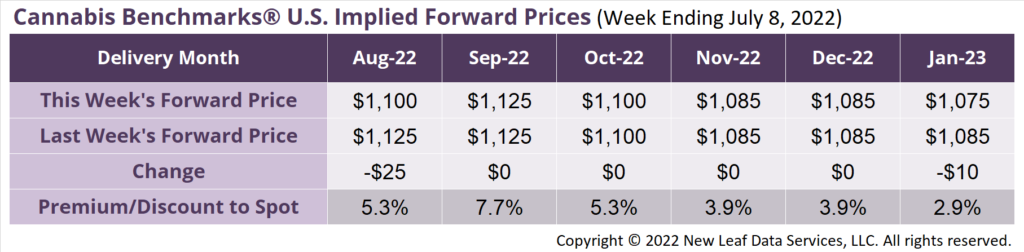

August 2022 Implied Forward assessed down $25 to $1,100 per pound.

The average reported forward deal size was 90 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 35%, and 19% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 94 pounds, 95 pounds, and 69 pounds, respectively.

At $1,100 per pound, the August 2022 Implied Forward represents a premium of 5.3% relative to the current U.S. Spot Price of $1,044 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

New Mexico

June Sales Soften; 2nd Straight Decline After Adult Use Market Opened in April

Oregon

June Harvest Drops YoY for the First Time

Nevada

April Sales Return to Trend, Down 7.6%

Illinois

June Sales Slip 2.3%