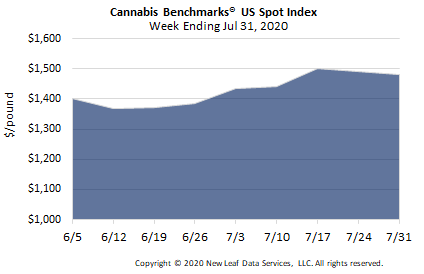

U.S. Cannabis Spot Index down 0.8% to $1,480 per pound.

The simple average (non-volume weighted) price decreased $12 to $1,726 per pound, with 68% of transactions (one standard deviation) in the $919 to $2,533 per pound range. The average reported deal size was nominally unchanged at 2.2 pounds. In grams, the Spot price was $3.26 and the simple average price was $3.81.

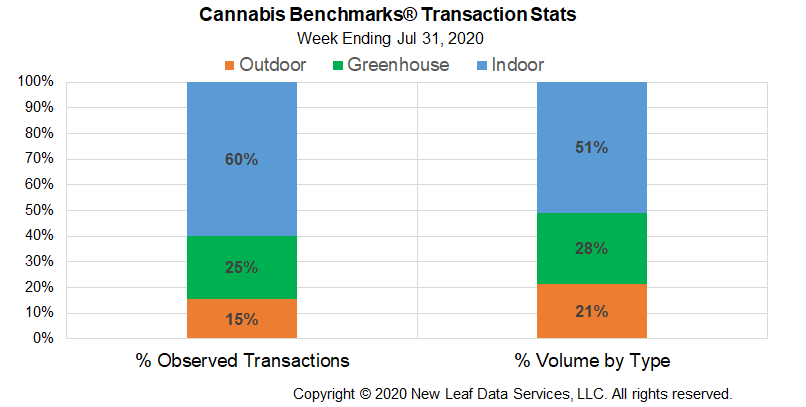

The relative frequency of trades for greenhouse flower increased by 7% this week. The relative frequencies of transactions for indoor and outdoor product decreased by 4% and 3%, respectively.

The relative volume of greenhouse product expanded by 4%. The relative volumes of warehouse flower contracted by the same proportion, while that for outdoor product was unchanged.

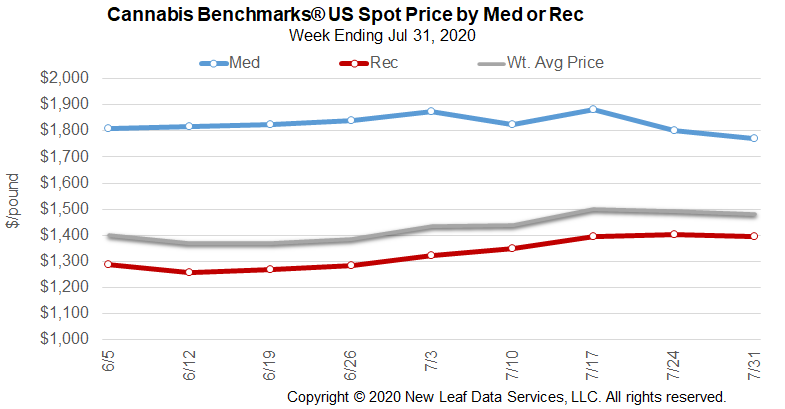

Despite the turbulence caused this year by the COVID-19 pandemic, the U.S. Spot Index has been relatively stable, while also broadly echoing the course it followed in 2019. Similar to last year, monthly average national composite prices were steady from January to February 2020, then fell in both March and April. In 2019, May saw the commencement of an upward trend in the U.S. Spot that would persist through November. This year, positive movement did not begin until June. However, with July’s monthly average U.S. Spot price of $1,470 per pound, the last two months have seen the national composite price make gains as increased, in many cases record-breaking demand has spiked sales in numerous state-legal cannabis markets. July’s monthly mean U.S. Spot is up by 6.4% from the month prior.

Elevated demand has contributed to pushing wholesale flower prices above where they were observed a year ago. July 2020’s mean Spot rate represents an 11.4% year-over-year increase, from $1,320 per pound in July 2019. Prices for all three grow types are currently up compared to the same month last year, reflecting the general expansion of demand that has lifted sales of all product types.

As noted, the U.S. Spot climbed through late spring, summer, and fall of last year. In normal times, the onset of August would be welcomed by cannabis retailers, as it is typically the strongest sales month of any given year in many markets, particularly adult-use ones and larger medical programs. However, as we covered in last week’s report, the most recent available sales data shows sales growth slowing, or even reversing a bit in June, after several months of sharp spikes. Whether the steadily rising sales that usually characterize the summer months will manifest this year remains to be seen, as does whether consumers and patients will maintain the elevated levels of purchasing reported recently.

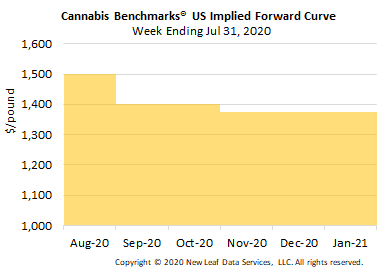

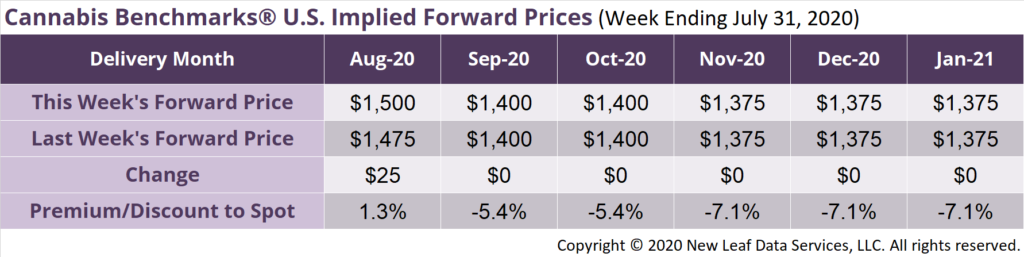

August Forward closes up $25 to $1,500 per pound.

The average reported forward deal size was 30 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 43%, 32%, and 25% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 31 pounds, 26 pounds, and 34 pounds, respectively.

At $1,500 per pound, the August Forward represents a premium of 1.3% relative to the current U.S. Spot Price of $1,480 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

Market Consolidation Will Not be as Rapid, Dramatic as Last Year’s M&A Announcements Suggested

Washington

Rulemaking for Required Pesticide and Heavy Metals Testing May be Delayed Further

Maine

Officials Reportedly Expect First Adult-Use Sales to Occur Late this Year

Rhode Island

FY2020 Medical Cannabis Sales Reach Almost $60 Million