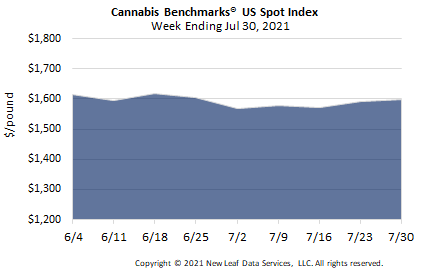

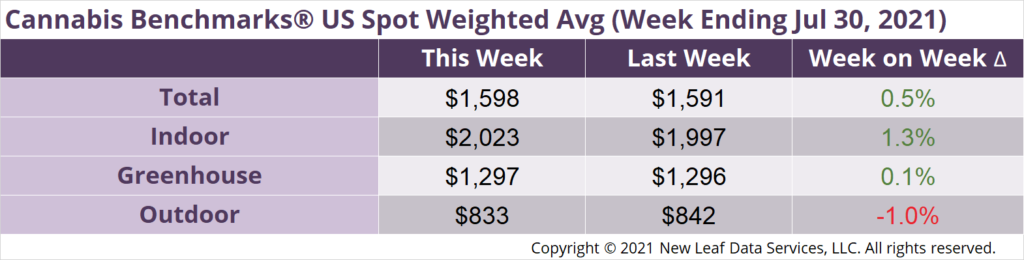

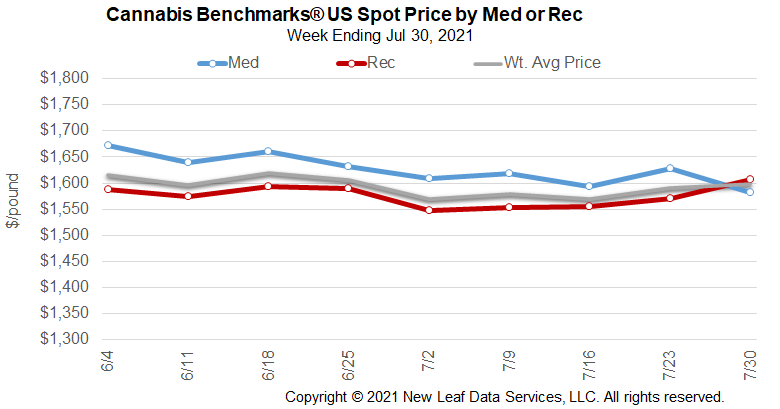

U.S. Cannabis Spot Index increased 0.5% to $1,598 per pound.

The simple average (non-volume weighted) price increased $27 to $1,881 per pound, with 68% of transactions (one standard deviation) in the $1,063 to $2,699 per pound range. The average reported deal size increased to 2.6 pounds. In grams, the Spot price was $3.52 and the simple average price was $4.15.

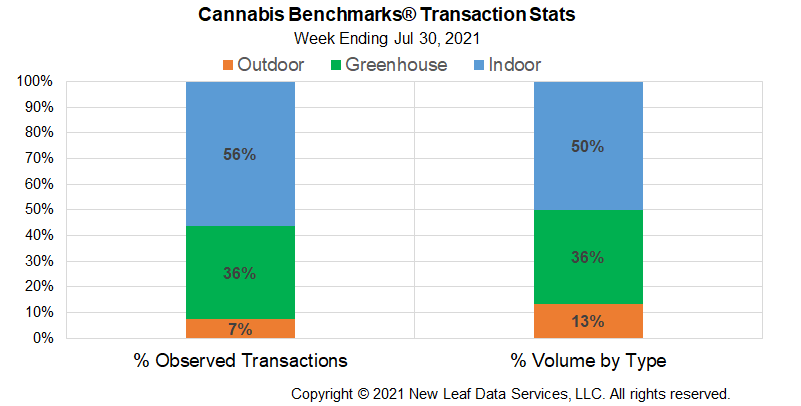

The relative frequency of transactions for greenhouse flower decreased by almost 2% this week. The relative frequency of deals for indoor product increased by the same proportion, while that for trades for outdoor flower was unchanged.

The relative volume of greenhouse flower contracted by almost 2% this week. The relative volume of outdoor product expanded by the same proportion, while that for warehouse flower was unchanged.

The U.S. Spot Index has been back on the upswing in recent weeks. However, for July as a whole it averaged $1,581 per pound, down 1.7% from June’s mean national composite price. The downturn from June to July 2021 is in contrast to the 6.4% rise in the U.S. Spot observed in the same period last year, although July 2021’s monthly average price remains up 7.6% year-over-year. As we have covered in recent reports, sales growth is slowing in legal cannabis markets across the country after the dramatic and unexpected surge in demand that occurred in the late spring and summer last year.

A report from New Cannabis Ventures expects Q2 2021 earnings reports from Multi-State Operators (MSOs) in the U.S. cannabis industry to be “strong,” with smaller MSOs also expected to show “robust growth.” According to the report, Curaleaf’s annual growth rate is expected at 164%, Greenthumb Industries’ and Trulieve’s annual growth rates are projected at 72%, and Cresco Labs’ is estimated at 102%. It must be noted that the robust year-over-year upticks are due in part to the fact that such companies have stronger presences in younger legal cannabis markets – including Illinois, Massachusetts, and Florida – that are experiencing more substantial overall growth rates than mature markets. Still, the analysis illustrates how much demand captured by state-licensed cannabis businesses has expanded in the past year, fueled both by new and growing legal markets, as well as the surge of sales that coincided with the COVID-19 pandemic’s arrival in the U.S.

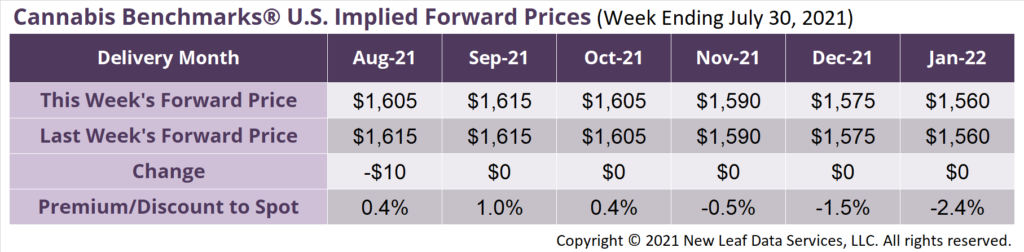

August 2021 Implied Forward down $10 to close at $1,605 per pound.

The average reported forward deal size was 62.5 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 53%, 35%, and 11% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 78 pounds, 50 pounds, and 30 pounds, respectively.

At $1,605 per pound, the August Implied Forward represents a premium of 0.4% relative to the current U.S. Spot Price of $1,598 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

State Health Department Report Shows Cannabis Usage Prevalence and Frequency Increasing Among Adults, While Consumption Methods Are Shifting

Washington

Regulators Reiterate Licensed Processors Are Not Allowed to Manufacture THC from Hemp-Derived CBD

Illinois

State Issues New Conditional Retail Licenses After Holding Lottery This Week

New Mexico

Report: Officials Expect Product Shortages Upon Commencement of Adult-Use Sales