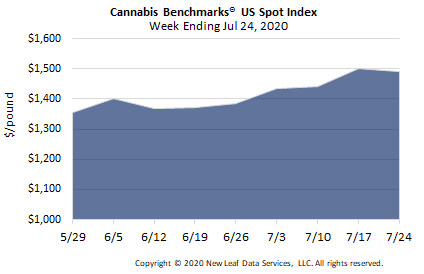

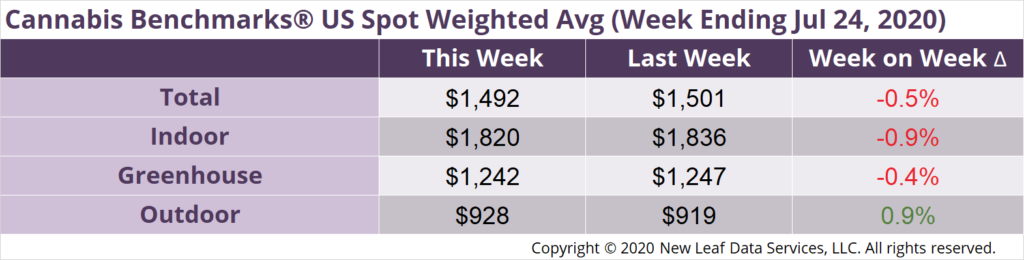

U.S. Cannabis Spot Index down 0.5% to $1,492 per pound.

The simple average (non-volume weighted) price decreased $7 to $1,738 per pound, with 68% of transactions (one standard deviation) in the $938 to $2,538 per pound range. The average reported deal size was nominally unchanged at 2.2 pounds. In grams, the Spot price was $3.29 and the simple average price was $3.83.

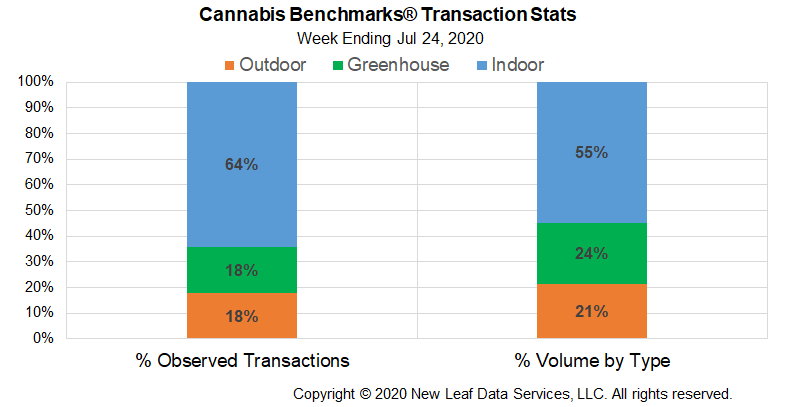

The relative frequency of trades for indoor flower decreased by over 2% this week. The relative frequency of transactions for greenhouse product increased by the same proportion, while that for deals for outdoor flower was unchanged.

The relative volume of greenhouse product expanded by 3%. The relative volumes of warehouse and outdoor flower contracted by 1% and 2%, respectively.

Sales data out of Oklahoma and Illinois showed that the dramatic growth experienced from March through May slowed in June. Increasing sales continued for the most part, albeit at a slower pace, with the exception being the medical sector of Illinois’ market, which saw a small decline in revenue last month.

New data published since then shows similar trends in other states. As we detail below, sales continued to rise in Michigan, but revenue generated by the medical market largely plateaued and flower sales volume in that sector contracted slightly. In Oregon, which has seen perhaps the most stark increase in demand during the COVID-19 pandemic, sales dipped a bit in June after setting new records for three consecutive months.

As reporting of sales data has a two-month lag in Colorado, it was recently revealed that May sales in the state boomed to unprecedented heights after March and April saw slowing growth. This could be related to the state beginning its “reopening” in late April, leading to more people venturing out of their homes. However, as alluded to above, stay-at-home orders did not dampen demand in other states.

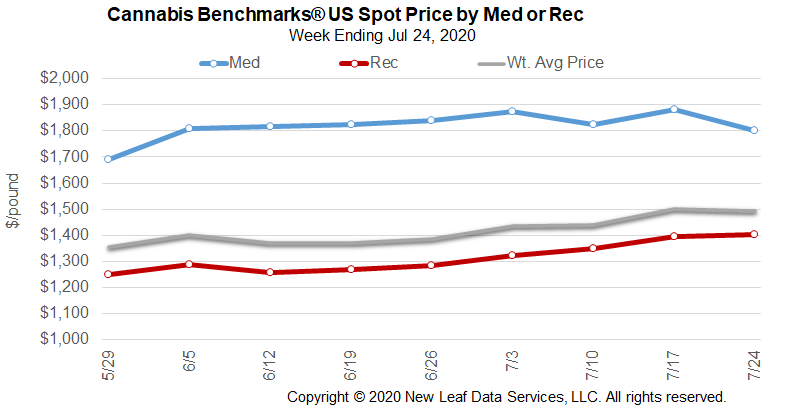

National wholesale flower prices trended downward slightly from March through late May, despite the robust demand across nearly every sizable state market covered in our reporting. The U.S. Spot has been on the ascent since late May, which is not uncommon given that summer is typically a period of rising demand that usually peaks in August. Just as seasonal sales trends typically observed in Q2 of any given year have already been disrupted, though, the same could occur for the current quarter.

While the early signs indicate that cannabis could be a recession-proof commodity, the current recession is unique and still in its early days. Many have pointed out in recent weeks that the CARES Act, passed into law in March, expires this week. The expiration of the legislation will bring to an end expanded unemployment benefits, as well as a moratorium on evictions for those with federally-backed mortgages or federally-subsidized rent, among other provisions that millions have depended on to weather the current crisis.

This is taking place as the pandemic is undergoing a resurgence on the back of states loosening restrictions and reopening businesses, as well as other activities and services that were previously closed to stem the spread of the virus. Increased COVID case counts have prompted the rollback of some reopening measures and the imposition of new restrictions in some states, a trend that could expand if the virus continues to spread relatively unabated.

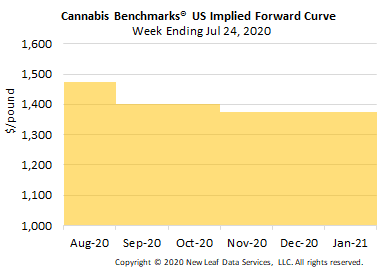

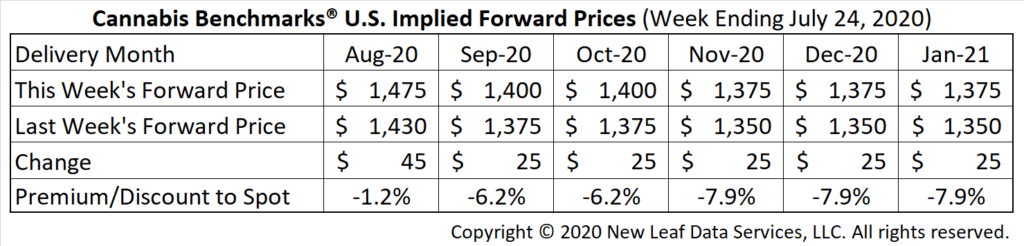

August Forward up $45 to $1,475 per pound.

The average reported forward deal size was 34 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 45%, 32%, and 23% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 39 pounds, 27 pounds, and 35 pounds, respectively.

At $1,475 per pound, the August Forward represents a discount of 1.2% relative to the current U.S. Spot Price of $1,492 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

May Sees Dramatic Spike in Sales After Slowing Growth in Previous Two Months

Oregon

June Sales Down 3% from May After Three Straight Months of Meteoric Growth

Nevada

Trial Commenced Recently to Determine Fate of 61 New Retailer Licenses Held Up from Opening Since Late 2018

Michigan

Retailers Tally Over $90 Million in June as Adult-Use Sales Continue to Expand, Medical Market Demand Levels Off