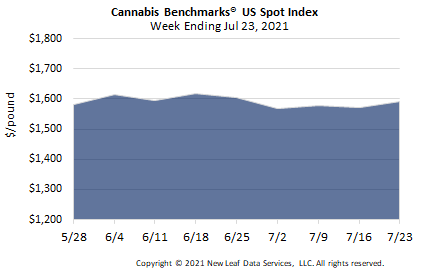

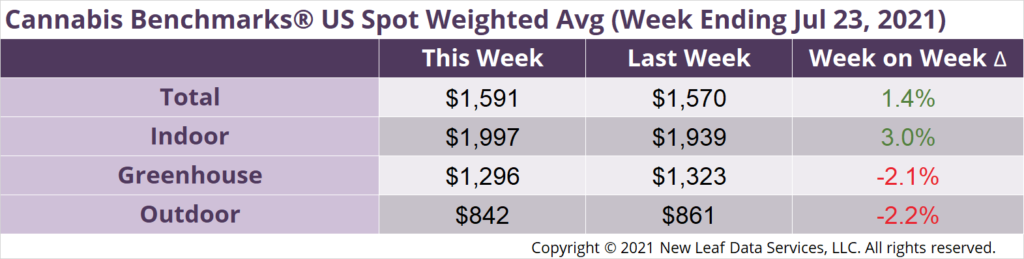

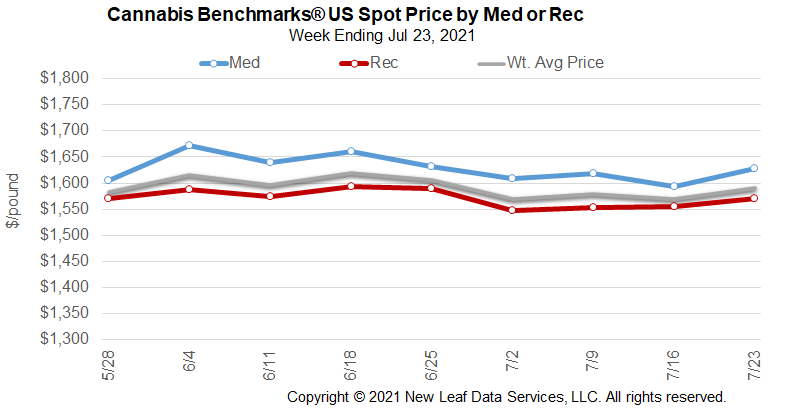

U.S. Cannabis Spot Index increased 1.4% to $1,591 per pound.

The simple average (non-volume weighted) price increased $29 to $1,854 per pound, with 68% of transactions (one standard deviation) in the $1,057 to $2,651 per pound range. The average reported deal size increased to 2.5 pounds. In grams, the Spot price was $3.51 and the simple average price was $4.09.

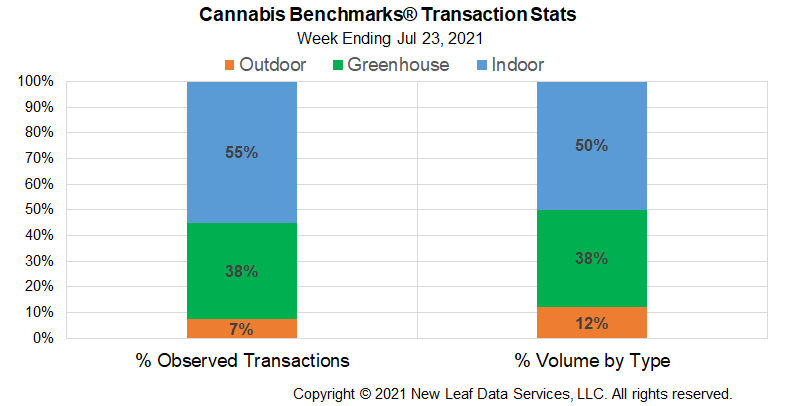

The relative frequency of transactions for greenhouse flower increased by 2% this week. The relative frequencies of deals for indoor and outdoor product decreased by 1% each.

The relative volume of greenhouse flower expanded by almost 2% this week. The relative volume of outdoor product contracted by the same proportion, while that for warehouse flower was unchanged.

While the “Dog Days” of summer have brought scorching temperatures to many parts of the country, the previous upward momentum of the U.S. Spot Index has cooled. As we have discussed in recent reports, the recent downward trend in the national wholesale flower price has coincided with reports of plateauing or slightly decreasing sales in many major markets during the May-June period. Data examined in this week’s Premium report out of Arizona, Oklahoma, and Illinois’ medical cannabis sector is in line with stagnant sales trends observed in other states, which we noted in each of the past two weeks.

The arrival of the COVID-19 pandemic last year brought with it significant uncertainty for legal cannabis markets, with many expecting to be on firmer footing this year as vaccination rates increased and restrictions on businesses and individuals were lifted. However, supply and demand dynamics for legal cannabis remain in flux and numerous factors could impact wholesale prices in the coming months. On the supply side, extreme weather in the form of excessive heat and drought – accompanied by wildfires – appear poised to again threaten outdoor cultivation on the West Coast and in Colorado. As for demand, we pointed out last week that the Consumer Price Index has been on the rise, potentially squeezing discretionary spending. Americans also currently have more options for recreational spending than they did last year due to the lifting of virus-related restrictions. Finally, the coronavirus remains in the mix as a factor to consider as U.S. vaccination rates plateau and variants spread.

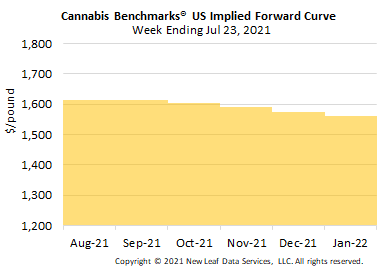

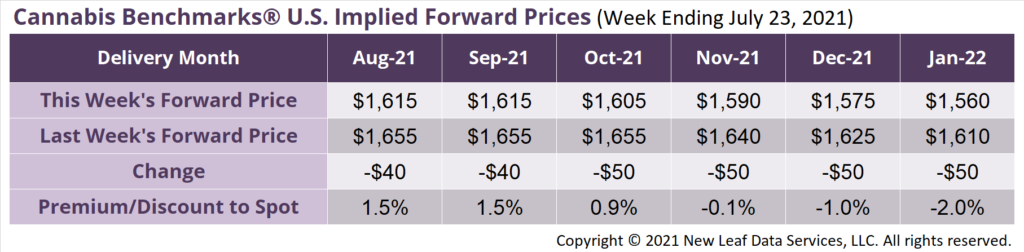

August 2021 Implied Forward assessed down $40 to $1,615 per pound.

The average reported forward deal size was 61.5 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 53%, 36%, and 11% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 76 pounds, 50 pounds, and 31 pounds, respectively.

At $1,615 per pound, the August Implied Forward represents a premium of 1.5% relative to the current U.S. Spot Price of $1,591 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Drought Prompts Humboldt County to Declare State of Emergency, Discuss Possibility of Further Water Restrictions on Cannabis Farmers

Arizona

Combined Monthly Adult-Use and Medical Sales Relatively Stagnant During March – May Period

Illinois

Medical and Adult-Use Sales Both Saw Downturns from May to June

Oklahoma

May Medical Cannabis Sales Reach Nearly $86 Million, Up Slightly from April; Wholesale Prices Stabilized in May After Declining Sharply in Prior Months