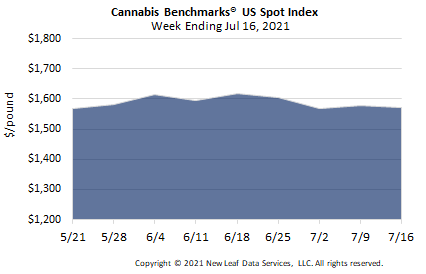

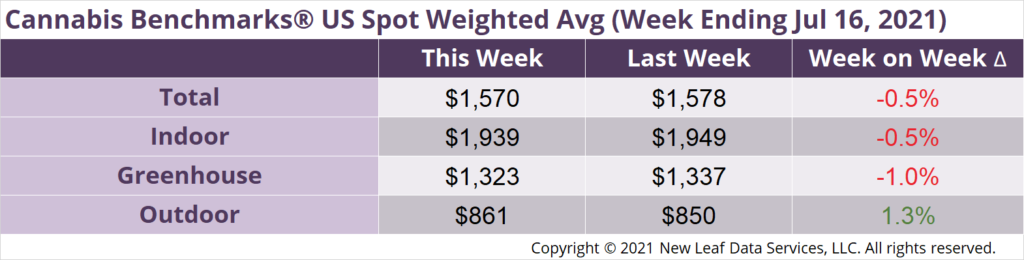

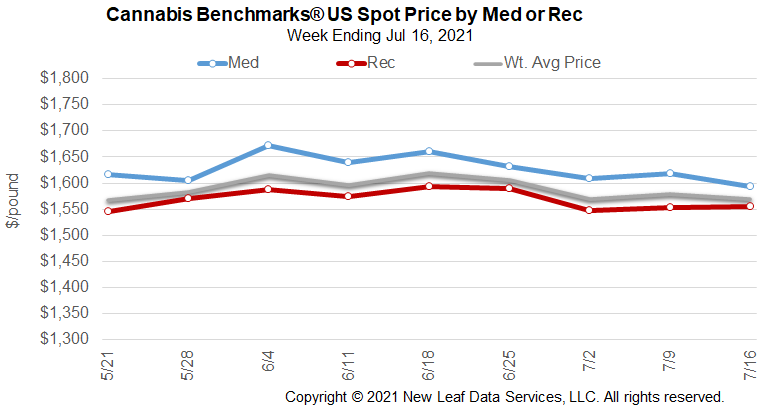

U.S. Cannabis Spot Index decreased 0.5% to $1,570 per pound.

The simple average (non-volume weighted) price decreased $16 to $1,825 per pound, with 68% of transactions (one standard deviation) in the $1,050 to $2,600 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $3.46 and the simple average price was $4.02.

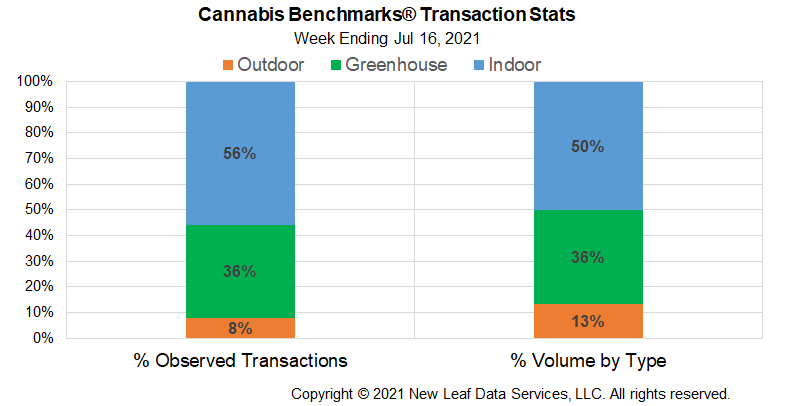

The relative frequency of transactions for indoor flower decreased by 2% this week. The relative frequencies of deals for greenhouse and outdoor product increased by 1% each.

The relative volume of greenhouse flower expanded by almost 3% this week. The relative volumes of warehouse and outdoor product contracted by about 1% and 2%, respectively.

Data released this week by officials in Colorado and Michigan tells a similar story to that examined in last week’s Premium Report: Specifically, that the late spring and early summer have seen demand in legal cannabis markets largely plateau or even decline slightly, albeit at levels elevated significantly compared to prior to the COVID-19 pandemic’s arrival in the U.S. last year.

Slowing sales in Michigan are especially notable as the regulated market is still relatively young, with adult-use sales only beginning at the end of 2019. However, if litigation regarding the city of Detroit’s adult-use licensing ordinance is resolved and the city can move forward in approving legal businesses, more significant growth should eventually resume. In Colorado, total retail sales dipped from April to May for the first time since 2018. Notably, May 2021’s combined adult-use and medical cannabis sales in Colorado were essentially flat compared to those of May 2020, the first month that the state saw a big jump in demand coincident with the coronavirus pandemic.

Stepping back to look at U.S. macroeconomic data, the Consumer Price Index rose 0.9% in June after rising 0.6% in May; this is the largest increase in CPI since June 2008. Year-over-year, CPI is up 5.4%, the largest increase since August 2008. While over a third of the rise in the overall index was due to an increase in that for used vehicles, the relatively elevated CPI may indicate that consumer spending on discretionary items such as cannabis products is being squeezed somewhat.

Also of interest to the cannabis industry is the 1.5% increase in energy prices in June, bringing the year-over-year gain to 24.5%. Energy commodities are up 44.2% year-over-year and energy services are up 6.3%, including a 3.8% gain in electricity prices and a 15.6% gain in utility gas services. Growers have likely felt the impact of higher energy prices over the past year. Furthermore, as we noted in a prior report, extreme heat in some parts of the country early this summer is likely leading to elevated HVAC costs for indoor growers.

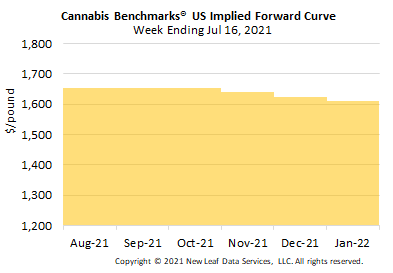

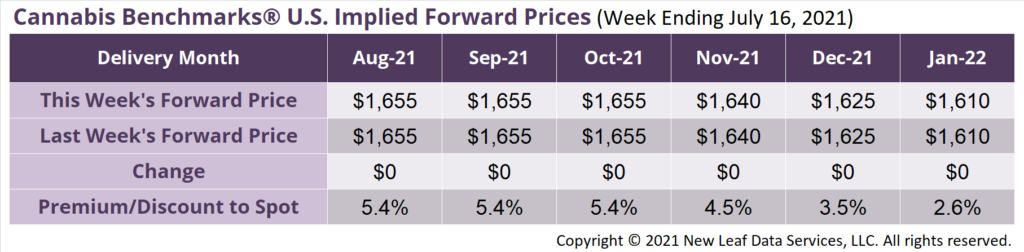

August 2021 Implied Forward unchanged at $1,655 per pound.

The average reported forward deal size was 60 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 53%, 35%, and 12% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 75 pounds, 49 pounds, and 31 pounds, respectively.

At $1,655 per pound, the August Implied Forward represents a premium of 5.4% relative to the current U.S. Spot Price of $1,570 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

May 2021 Sales Essentially Flat Year-Over-Year, Indicating Plateauing Demand After Sales Boomed by 25% 2020

Michigan

Retail Revenue Has Leveled Off in Recent Months; Prices Continued to Trend Down in June

Arizona

Contraction in Medical Cannabis Sales Persisted in June as Purchasing Shifts Increasingly to Adult-Use Market

New Mexico

Regulators More Than Double Plant Count Limit for Adult-Use Producers in New Proposed Rules