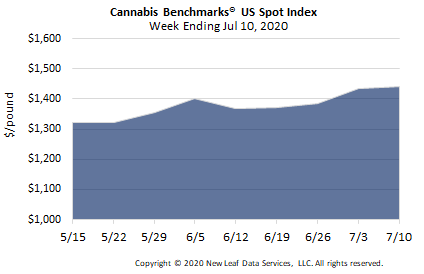

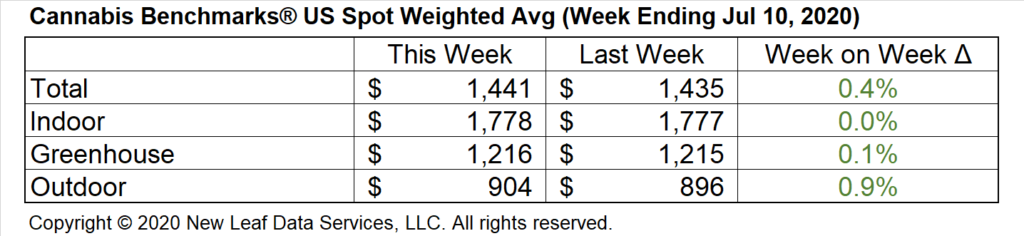

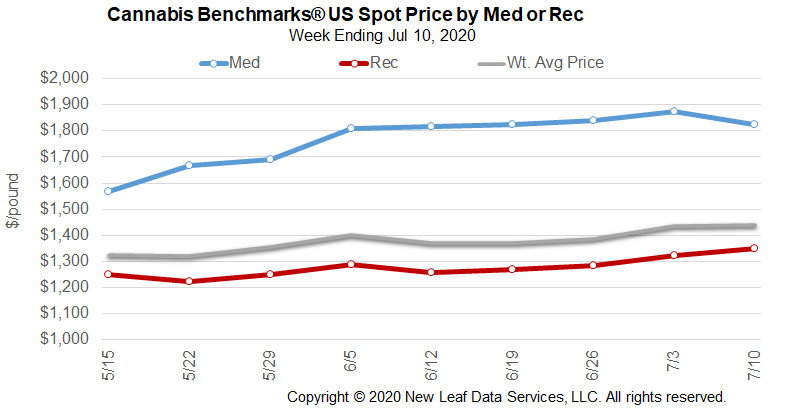

U.S. Cannabis Spot Index up 0.4% to $1,441 per pound.

The simple average (non-volume weighted) price increased $12 to $1,654 per pound, with 68% of transactions (one standard deviation) in the $897 to $2,411 per pound range. The average reported deal size was nominally unchanged at 2.1 pounds. In grams, the Spot price was $3.18 and the simple average price was $3.65.

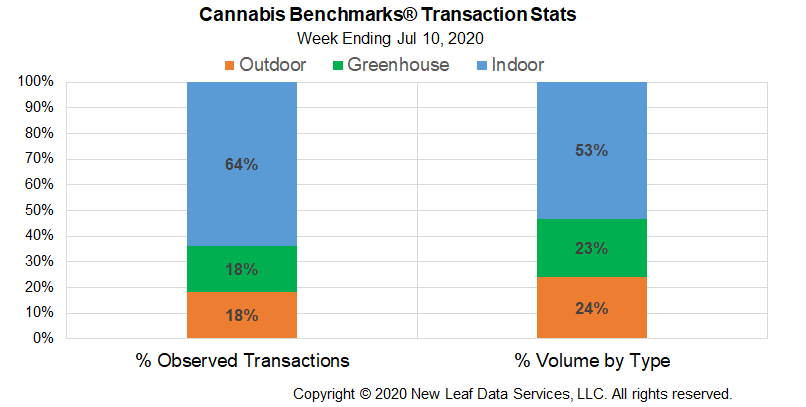

The relative frequency of trades for indoor flower increased by 2% this week. The relative frequency of transactions for greenhouse product decreased by the same proportion, while that for deals for outdoor flower was unchanged.

The relative volume of greenhouse product contracted by 2%. The relative volumes of warehouse and outdoor flower each expanded by 1%.

As the U.S. continues to lurch about aimlessly in its response to the COVID-19 pandemic, early cannabis sales figures for June out of some state markets show that the strong, unprecedented demand observed in prior months has held up and even grown in some cases. Total and adult-use sales revenue in Illinois both reached new record highs, although sales in the state’s medical market slipped somewhat from the prior month. Oklahoma’s medical cannabis sales continued to climb to new peaks, outpacing numerous adult-use markets, but the month-over-month growth rate slowed significantly compared to those observed in April and May.

Meanwhile, with the number of visitors to Las Vegas in April down 97% year-over-year, sales in Nevada saw their lowest levels since shortly after the state’s adult-use market opened. A silver lining for the Silver State is that April’s cannabis sales amounted to almost two-thirds of those recorded in January this year, which is likely the final month before the pandemic began to impact Nevada’s market, indicating strong demand from locals.

In the midst of dramatic fluctuations in total sales, an analysis of recent monthly sales data out of Oregon and Arizona shows that the proportion of total sales made up by each product type has been largely stable. In the former state, flower’s share of total sales revenue had actually grown a bit in recent months, despite warnings that smoking of any kind can worsen and complicate a COVID-19 infection.

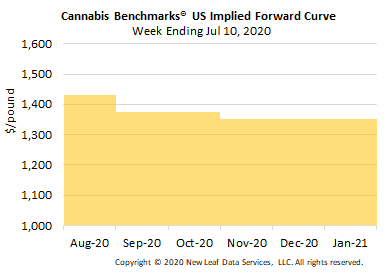

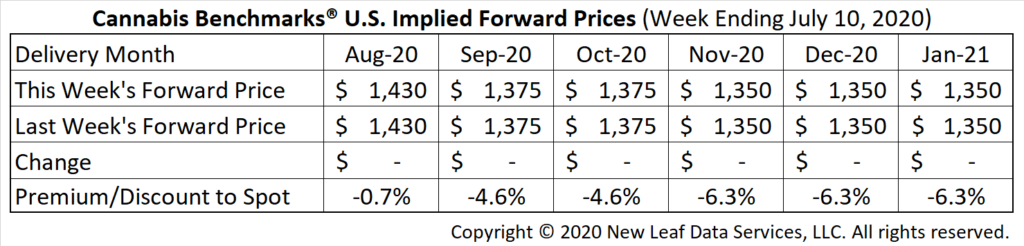

August Forward unchanged at $1,430 per pound.

The average reported forward deal size was 35 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 48%, 33%, and 19% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 39 pounds, 28 pounds, and 36 pounds, respectively.

At $1,430 per pound, the August Forward represents a discount of 0.7% relative to the current U.S. Spot Price of $1,441 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

Proportion of Total Sales Revenue Made Up by Flower Increases Slightly During Pandemic

Nevada

April Sales Slump as Tourism Dries Up, But Still Demonstrate Strong Demand from Locals

Massachusetts

Adult-Use Sales Reach $54.5 Million in June, Down Slightly from February, the Last Full Month of Sales Before COVID-Motivated Shutdown

Illinois

Combined Adult-Use and Medical Sales Top $77 Million in June, a New Record, as Medical Revenue Sees MoM Decline

Oklahoma

Medical Dispensaries Tally $80 Million in Sales in June, But Growth Rate Slows Significantly from April and May