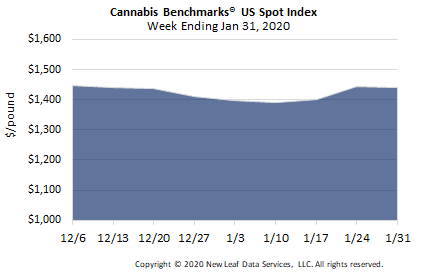

U.S. Cannabis Spot Index down 0.1% to $1,441 per pound.

The simple average (non-volume weighted) price increased $9 to $1,632 per pound, with 68% of transactions (one standard deviation) in the $895 to $2,370 per pound range. The average reported deal size increased to 2.0 pounds. In grams, the Spot price was $3.18 and the simple average price was $3.60.

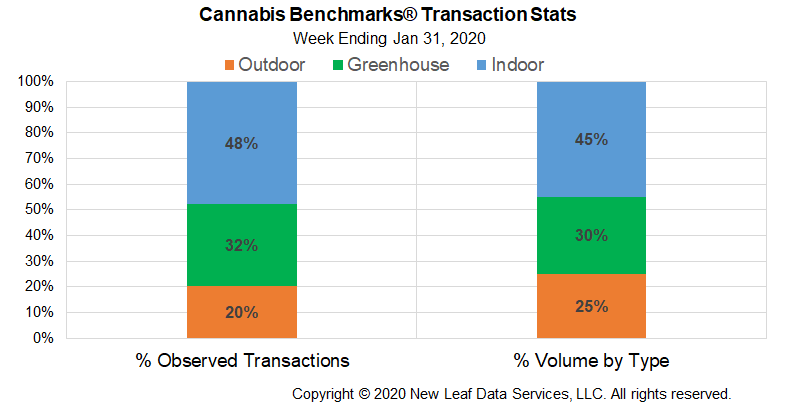

The relative frequency of trades for indoor flower decreased by 1% this week. The relative frequency of deals for outdoor product increased by the same proportion, while that for transactions involving greenhouse flower was stable.

Warehouse product’s share of the total reported weight moved nationally expanded by almost 2% this week. The relative volumes of greenhouse and outdoor flower each contracted by about 1%.

The U.S. Spot Index declined by 0.1% this week to settle at $1,442 per pound. For January as a whole, the national composite price averaged $1,415 per pound, down by 1.3% from December 2019’s mean going rate of $1,434 per pound. The transition to a new year has seen varied price movement from 2017-2018 to the current moment. From December 2017 to January 2018, the monthly average U.S. Spot price fell by 5.2%, from $1,417 to $1,343 per pound. From December 2018 to January 2019, it rose by 1.8%, from $1,136 to $1,157 per pound.

This year, the overall downturn in the national composite price has been driven by declining rates in California and Colorado. While both markets saw significant demand growth in 2019, January and February of any given year are typically periods of relatively depressed sales compared to December and March.

Meanwhile, high prices continue to be observed in the new recreational markets of Michigan and Illinois. The number of pounds of flower traded wholesale in each of those markets in 2019 amounted to about 8% and 5%, respectively, of our preliminary estimates of the amounts of product moved in either California or Colorado. Consequently, the elevated prices being reported currently out of new recreational markets are not exercising significant influence on the U.S. Spot at this time, due to the relatively small amount of trading taking place.

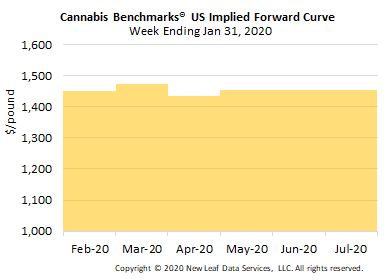

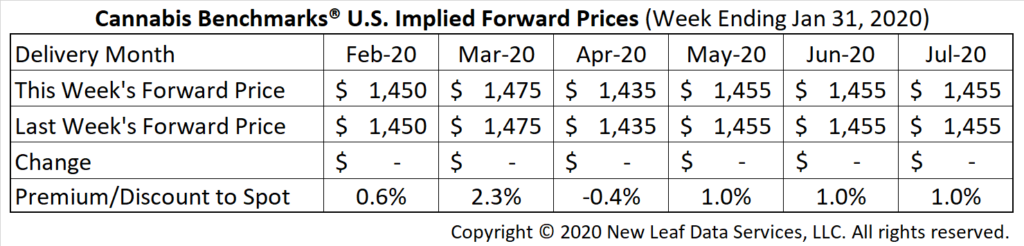

February Forward closes unchanged at $1,450 per pound.

The average reported forward deal size was 43 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 46%, 38%, and 16% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 50 pounds, 32 pounds, and 44 pounds, respectively.

At $1,450 per pound, the February Forward represents a premium of 0.6% relative to the current U.S. Spot Price of $1,441 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

California

Initial Estimate of Size of California’s Wholesale Flower Market for 2019 Indicates 25% Growth in Volume of Product Traded, Almost 30% Increase in Value

Washington

Regulators Publish Proposed Rules to Require Testing for Pesticides and Heavy Metals, Plus Estimates of Costs to Businesses

Michigan

Cannabis Benchmarks Estimates that Michigan’s Legal Cannabis Market Declined in Size and Value for Second Straight Year in 2019

Illinois

Size of Wholesale Flower Market Doubled in 2019 Compared to Previous Year, But Production Must Expand Dramatically to Meet Adult-Use Demand