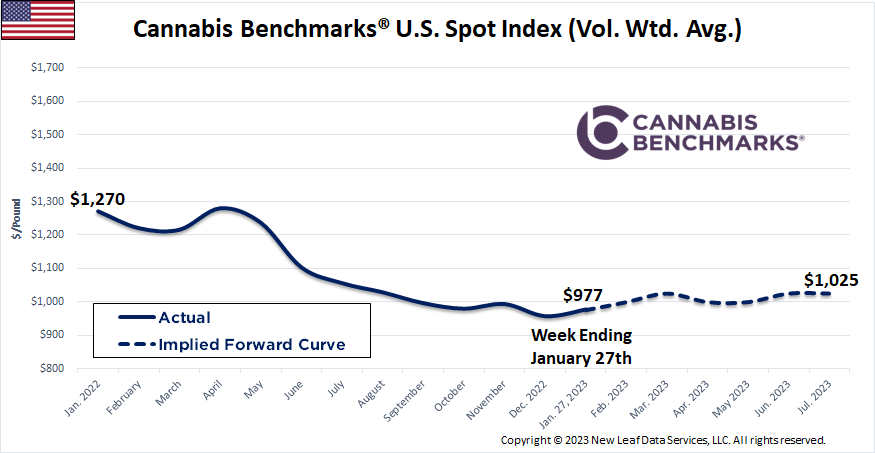

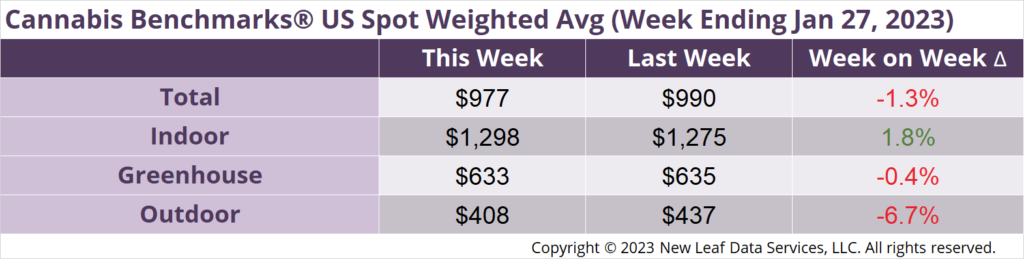

The U.S. Cannabis Spot Index decreased 1.3% to $977 per pound.

The simple average (non-volume weighted) price increased $27 to $1,221 per pound, with 68% of transactions (one standard deviation) in the $496 to $1,946 per pound range. The average reported deal size decreased to 2.6 pounds. In grams, the Spot price was $2.15 and the simple average price was $2.69.

—————————————————————————————————————————————————-

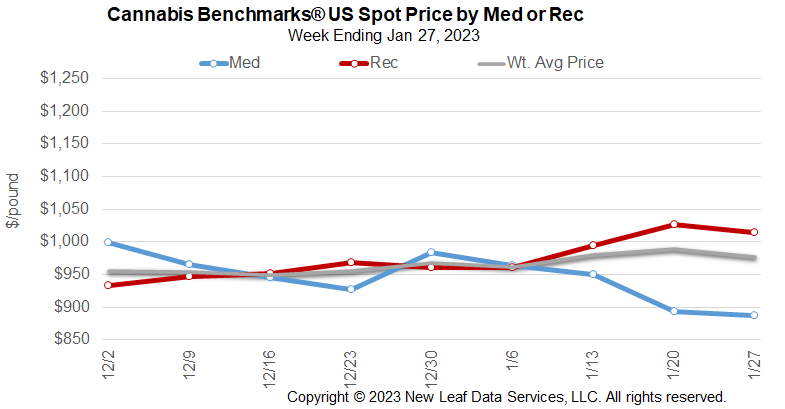

The U.S. wholesale spot cannabis price slipped $13 this week. Prices in high-population states put in a mixed performance with New England states netting + $122, while legacy western states saw a net $87 loss.

Losses in western states have narrowed of late with outdoor flower prices showing just a $66 spread across California, Oregon, Washington, and Colorado. The narrowing of this spread suggests some stability is developing in the outdoor market, that, if maintained, should slow the price erosion in the greenhouse and indoor markets. Indeed, California spot slipped just $13 this week; Colorado eked out a $2 per pound increase against a $19 loss per pound in Oregon spot and a $45 per pound loss in Washington State. The latter is the only limited license state in the legacy West and thus the only state that avoided new all-time low spot prices during the current sell-off. That said, prices for some operators in California are showing an uptick according to our interview this week.

The spread between Illinois and Michigan spot prices is still nearly $1,600 per pound despite the shellacking taking place in the Land of Lincoln. Illinois spot price has lost 26.6% since early December 2022 and has shed 37.8% since October 2021. Michigan, no slouch in the price loss game, is coming off an all-time low sub $900 per pound, made in October 2022, to somewhat higher, steadier prices since November 2022. Steady prices in Michigan are likely due, in part, to demand from Illinois consumers, while high per pound prices in Illinois are due to a lack of competition and no outdoor-grown product. Illinois will soon have to contend with Missouri’s legal market pulling some percentage of consumers on price, putting further pressure on Illinois wholesale prices.

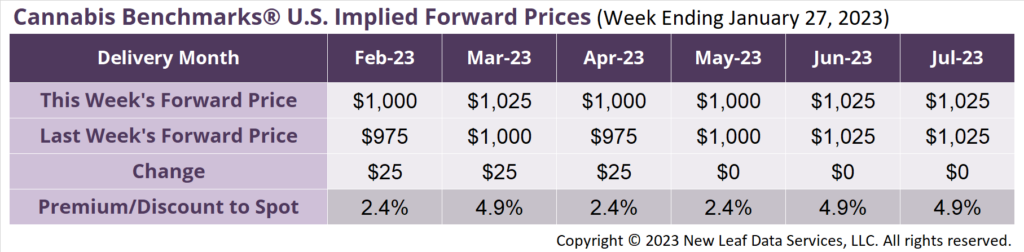

February 2023 Implied Forward assessed up $25 to close at $1,000 per pound.

The average reported forward deal size was 85 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 41%, 41%, and 18% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 100 pounds, 76 pounds, and 73 pounds, respectively.

At $1,000 per pound, the February 2023 Implied Forward represents a premium of 2.4% relative to the current U.S. Spot Price of $977 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

CALIFORNIA

Cultivation Licenses Falling and Prices Rising – Interview

NEVADA

August, September, October Sales Figures Show Big Year-on-Year Declines

OKLAHOMA

OMMA: Inspections Completed, “Administrative Actions in the Works”

MASSACHUSETTS

Curaleaf Facing Allegations in MA as it Pulls out of Western States

Content is provided “as is.” New Leaf Data Services, LLC., makes no guarantees or warranties as to the accuracy, completeness, timeliness or results to be obtained from accessing and using Cannabis Benchmarks® data.

This publication may not be duplicated, distributed, or stored in a retrieval system, in whole or in part, in any form or by any means, without prior written permission and consent of New Leaf Data Services, LLC.

1-888-502-7298 | www.CannabisBenchmarks.com | support@CannabisBenchmarks.com