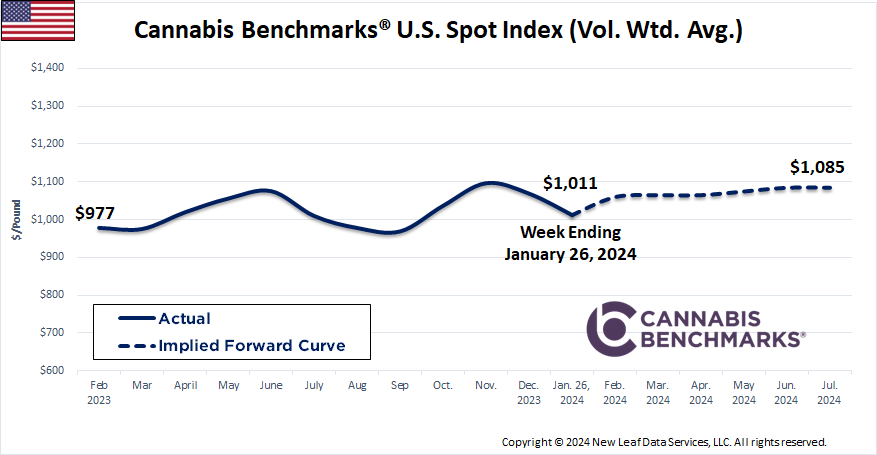

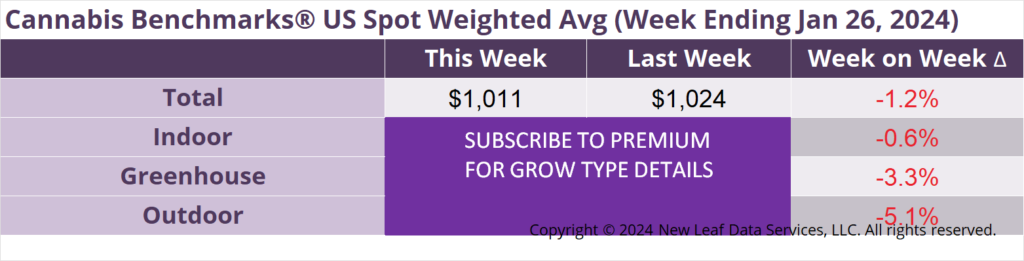

The U.S. Cannabis Spot Index decreased 1.2% to $1,011 per pound.

In grams, the Spot price was $2.23.

The U.S. Spot wholesale flower price continued its leg down this week. While the national average flower price has been up year-on-year through Q4 2023 and in the opening month of 2024, it appears as if the coming weeks could see spot break below levels seen at the same time a year ago. In Q1 2023, the U.S. spot tested the $950 pound level in early February and early March, falling close to what were historic lows at the time.

The current downturn in the overall national price for cannabis flower is being driven by declines in the rates for greenhouse and outdoor-grown product. While somewhat delayed, it appears the post-autumn harvest price slide is upon us, having begun in mid December. As of this week, greenhouse flower’s volume-weighted price has fallen 9.6% from a recent peak on December 15, 2023. Outdoor flower’s price has slipped 12.6% from a recent high in the same week.

Meanwhile, the national price for indoor flower can still be said to be in an uptrend that commenced in mid-September. Indoor flower’s price climb from September 15 was mimicked by prices for greenhouse and outdoor product, which began to trend upward from late October and late September, respectively. However, rather than turn downward in December, indoor flower’s price has risen into this year, reaching a recent peak in the week ending January 12.

Since then, however, indoor flower’s price has reversed course and headed downward, losing about $100 or 6.8% in the last two weeks. We’ve pointed out in the past that price destruction in the sun-grown product market has often presaged a decline in prices for indoor flower and by extension the U.S. spot overall, a phenomenon that appears as if it may be playing out once again.

As we discuss in this week’s Premium report in regard to Massachusetts, significant demand growth in volume terms in 2023 was not enough to lift wholesale prices, which stayed relatively steady at depressed levels in the second half of last year. Similar statements could be made regarding other large mature markets. Strong prices for indoor flower had been buoying the U.S. Spot, but if rates for warehouse-grown product continue to follow those of sun-grown flower we could see the national wholesale flower price test the $950 per pound floor again in relatively short order.

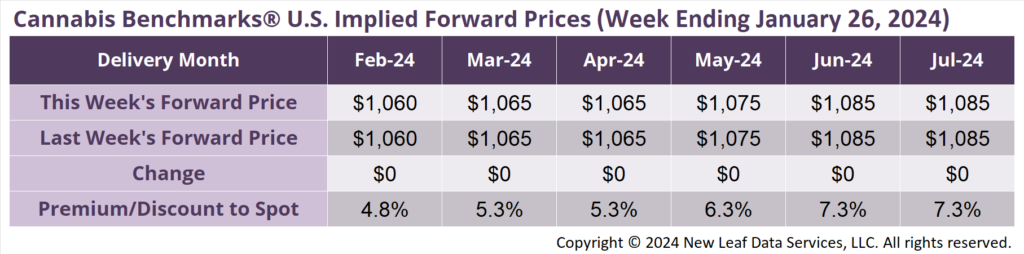

February 2024 Implied Forward unchanged to close at $1,060 per pound.

At $1,060 per pound, the February 2024 Implied Forward represents a premium of 4.8% relative to the current U.S. Spot Price of $1,011 per pound.

Retail & Wholesale Prices Stabilized at Depressed Levels in 2023, Even as Demand Expanded

Spot Wholesale Price Potentially Resetting Higher as Demand Holds Steady as of October 2023

Over $1.3 Billion in Total Cannabis Sales in First Year of Adult Use Market, But is There Room for Growth?