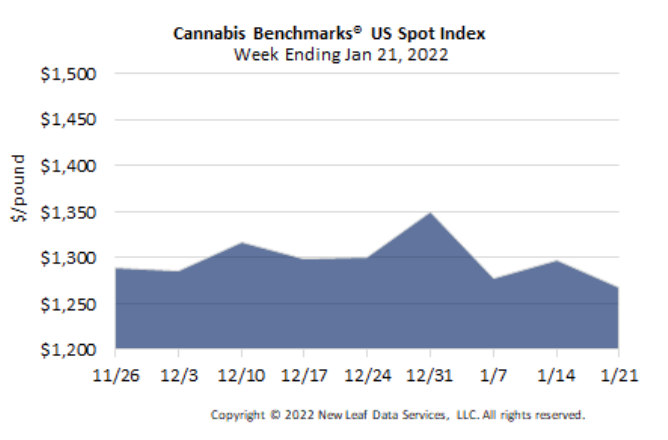

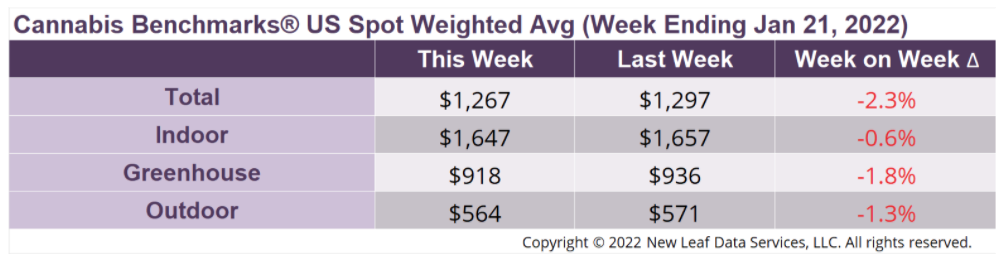

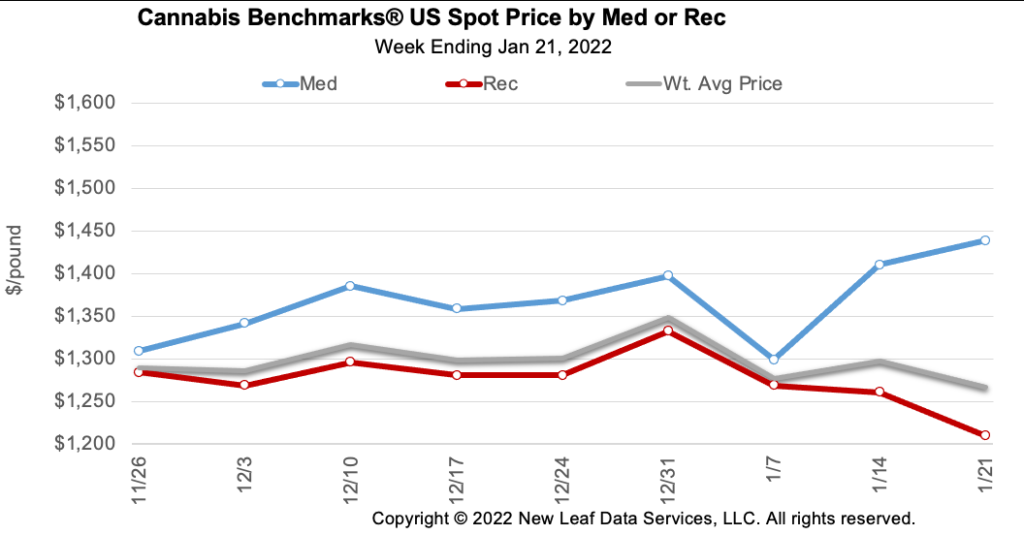

The U.S. Cannabis Spot Index decreased 2.3% to $1,267 per pound.

The simple average (non-volume weighted) price decreased $31 to $1,545 per pound, with 68% of transactions (one standard deviation) in the $743 to $2,348 per pound range. The average reported deal size increased to 2.3 pounds. In grams, the Spot price was $2.79 and the simple average price was $3.41.

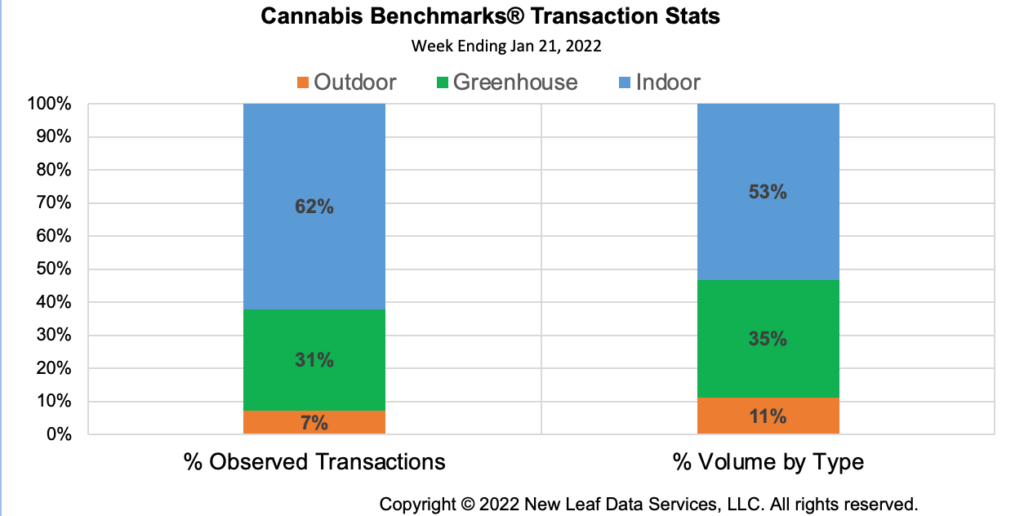

The relative frequency of transactions for indoor product fell 2%, that for deals for greenhouse product rose 1%, as did that for trades involving outdoor flower.

The relative volume of indoor flower fell about 2%, while that of greenhouse flower was unchanged and outdoor flower’s relative volume rose 1%.

Commoditized markets are those in which the product produced is deemed essentially the same no matter the producer. Commoditized agricultural products are sold in a “raw” state, unprocessed, and for immediate use by the buyer. Price differences among commoditized products tend to collapse toward the lowest price offered.

One of the conditions leading toward commodification of outdoor-grown cannabis is the development of one category of buyer. That is, one type of buyer – extractors, namely – is dominating the market for outdoor flower and other plant material, buying large quantities of product they perceive to be largely interchangeable no matter the product’s origin.

One need only observe the massive expansion of harvests in Oregon, where outdoor Spot is trading at under $400 per pound this week. Oregon growers harvested almost 55% more product in 2021 than in 2020. Much of that goes to extractors who buy thousands of pounds at a time for ever-lower prices, as growers look to offload much of their harvest ahead of what they have learned will be lower prices every year.

As extractors come to dominate high-quantity buying of outdoor product and outdoor growers continue to expand canopy, prices among states with large outdoor harvests are going to fall toward a median. This week, outdoor flower prices in legacy states – those on the West Coast and Colorado – averaged just over $500 per pound, while ranging from just under $400 to a little over $600 per pound.

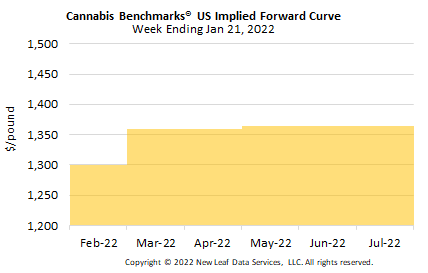

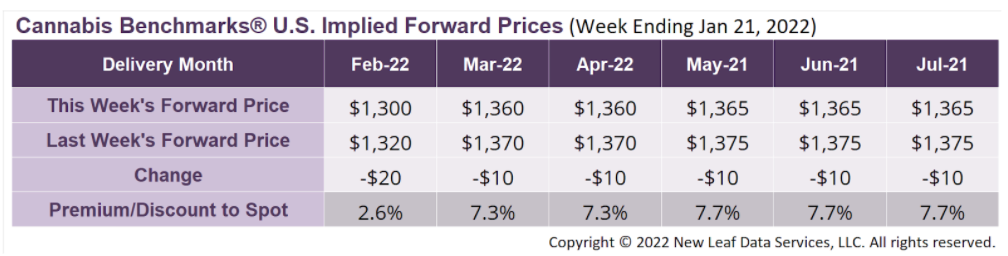

February 2022 Implied Forward assessed down $20 to $1,300 per pound.

The average reported forward deal size was nominally unchanged at 60 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 37%, 48%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 78 pounds, 52 pounds, and 42 pounds, respectively.

At $1,300 per pound, the February 2022 Implied Forward represents a premium of 2.6% relative to the current U.S. Spot Price of $1,267 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Michigan

December Sales Rise as Prices Fall; Combined Adult Use and Medical Sales Reach Almost $1.8B in 2021

Alaska

State Spot Price on a Tear

Nevada

October Sales Jump 11.2% MoM in Latest Report

New Mexico

Emergency Rule Change Doubles Number of Plants Allowed to Adult Use Growers