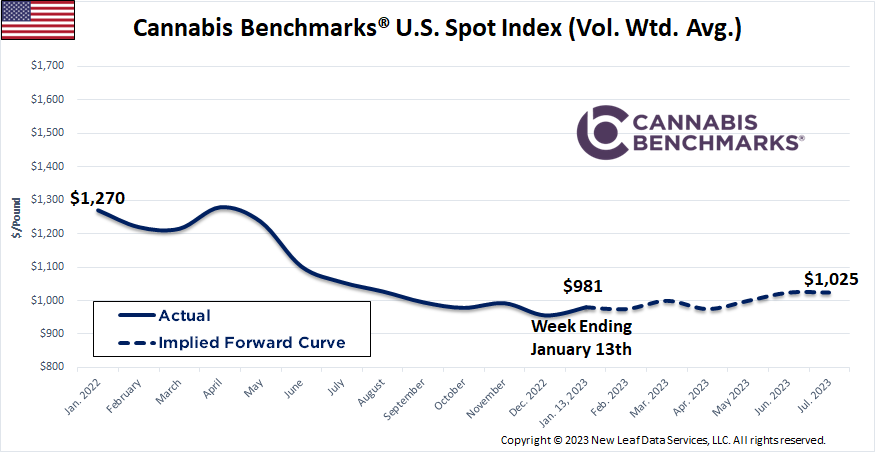

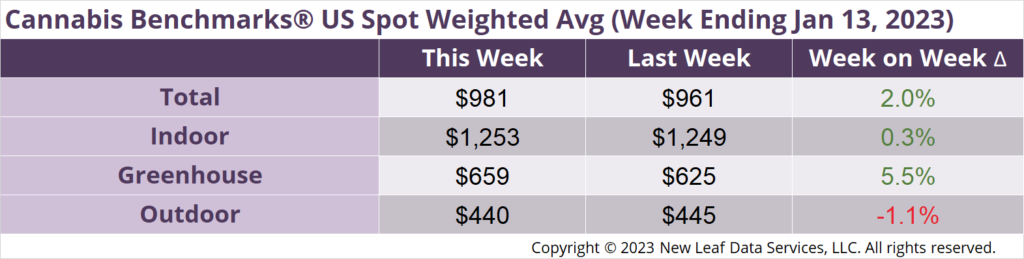

The U.S. Cannabis Spot Index increased 2.0% to $981 per pound.

The simple average (non-volume weighted) price decreased $32 to $1,232 per pound, with 68% of transactions (one standard deviation) in the $514 to $1,951 per pound range. The average reported deal size was nominally unchanged at 2.5 pounds. In grams, the Spot price was $2.16 and the simple average price was $2.72.

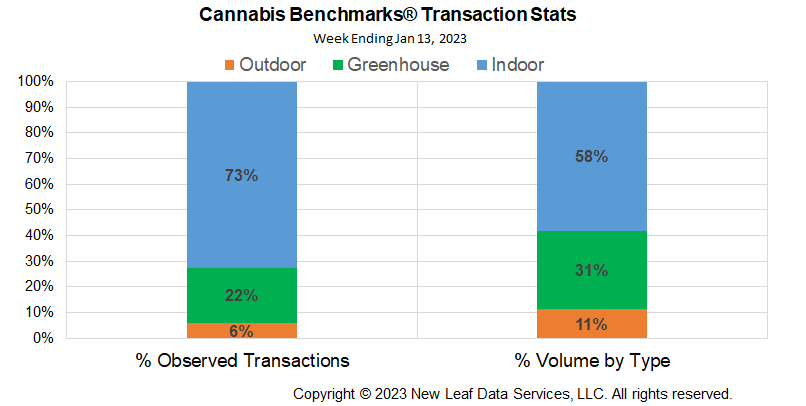

The relative frequency of transactions for indoor flower decreased 2%, while that of greenhouse flower rose 2%. Outdoor flower transaction frequency rose 1%.

The relative volume of indoor product rose 1%, while that of greenhouse flower fell 2%. Outdoor product’s relative volume increased 1%.

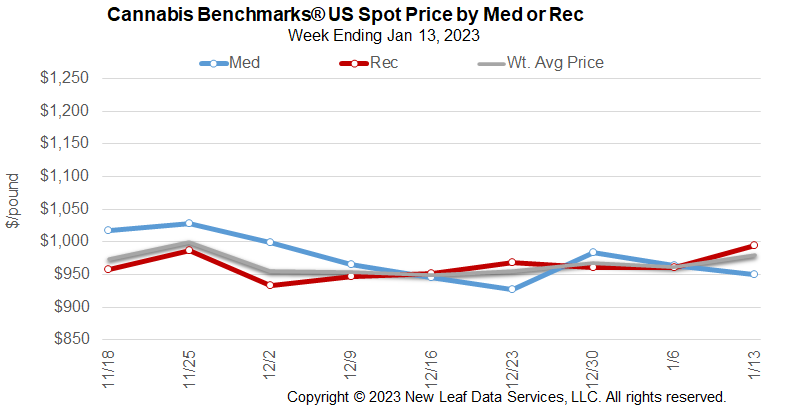

The U.S. wholesale spot cannabis price inched up $20 this week. For the past month the national spot price has hovered just over the all-time low of $950 per pound, set in mid-December 2022, as new, high population states begin legal sales and some undergo sudden price adjustments to align with neighboring legal states.

While wholesale cannabis prices in Massachusetts are being driven by fundamentals – selling product at lower and lower prices to service debt and move older inventory – it is fair to say that when Massachusetts sneezes, New England catches a cold. Witness the rapid and significant price drop in Rhode Island’s wholesale cannabis price in just one month following the state’s first legal adult use sales: wholesale spot cannabis price in Rhode Island fell 38.5%, matching Massachusetts spot deterioration week-to-week.

Pulling back from interstate dynamics, the fact that outdoor production can generate massive harvests for minimal production costs will also weigh on price, as will the inevitable price contagion that occurs when consumers buy low to get high; that is, when demand is primarily for outdoor product, forcing greenhouse and indoor growers to lower prices to compete.

There is literally no difference in soybean costs across the U.S. because the abundance of soybeans drove prices toward the cost of production. The cannabis market is likely to undergo the same price dynamics of other commodity markets: price convergence for efficiency, winnowing production methods toward the cheapest-to-produce product. Cannabis entrepreneurs might differentiate their product to get marginally higher prices, but at the end of the day, low production cost cannabis will dominate the market.

Commodity markets were developed initially in agrarian societies to allow producers to “discover” price by gathering with other producers and merchants and to smooth the movement of goods to consumers. In other words, the move to price transparency helped develop commodities markets wherein seasonal risk could be hedged and producers could get back to producing instead of worrying about selling and storing their crop. The cannabis industry needs to move quickly toward a commodity-style futures and options market where producers can hedge risk and stay in business when market dislocations of the kind noted above take place.

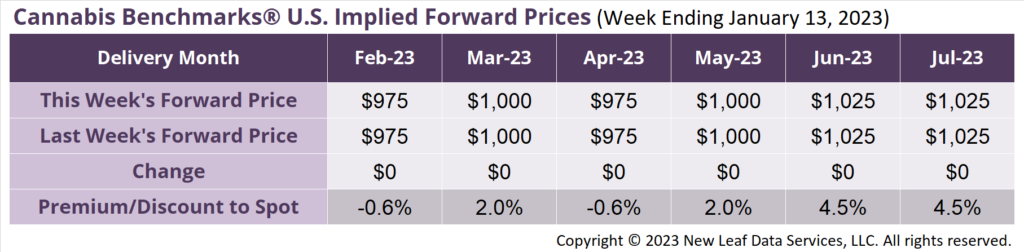

February 2023 Implied Forward unchanged at $975 per pound.

The average reported forward deal size was 80 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 42%, 40%, and 18% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 98 pounds, 67 pounds, and 67 pounds, respectively.

At $975 per pound, the February 2023 Implied Forward represents a discount of 0.6% relative to the current U.S. Spot Price of $981 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

COLORADO

Sales Continue to Soften as Prices Tank

ARIZONA

Adult Use Sales Climb as Medical Market Share Falls

ILLINOIS

Christmas in Illinois! December Sales Jump 10.3%

CALIFORNIA

Overproduction Equals Lower Prices – Interview

Content is provided “as is.” New Leaf Data Services, LLC., makes no guarantees or warranties as to the accuracy, completeness, timeliness or results to be obtained from accessing and using Cannabis Benchmarks® data.

This publication may not be duplicated, distributed, or stored in a retrieval system, in whole or in part, in any form or by any means, without prior written permission and consent of New Leaf Data Services, LLC.

1-888-502-7298 | www.CannabisBenchmarks.com | support@CannabisBenchmarks.com