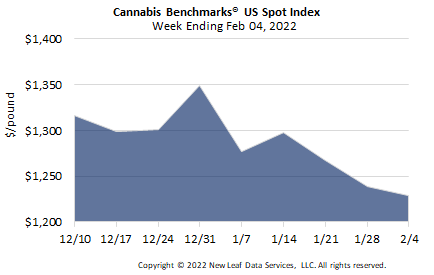

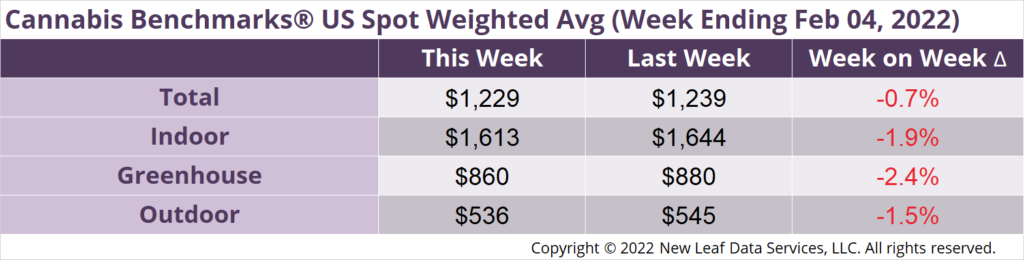

The U.S. Cannabis Spot Index decreased 0.7% to $1,229 per pound.

The simple average (non-volume weighted) price decreased $34 to $1,517 per pound, with 68% of transactions (one standard deviation) in the $682 to $2,352 per pound range. The average reported deal size decreased to 2.3 pounds. In grams, the Spot price was $2.71 and the simple average price was $3.34.

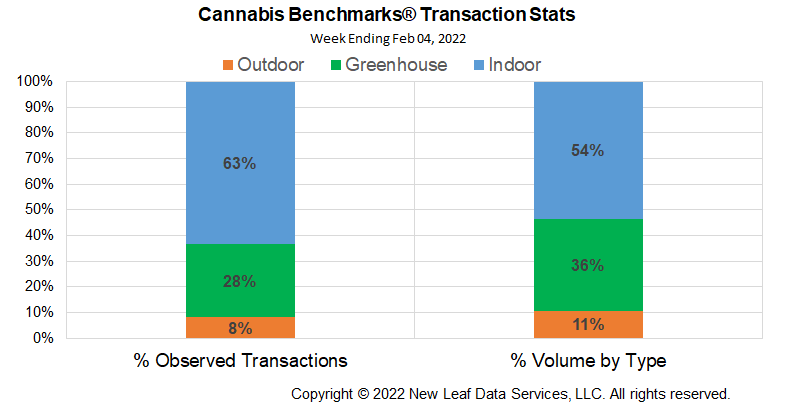

The relative frequency of transactions for indoor product fell 1%, as did that for greenhouse product. Outdoor frequency was essentially unchanged.

The relative volume of indoor flower rose 1%, while that of greenhouse flower rose 2%. Outdoor flower’s relative volume fell about 2%.

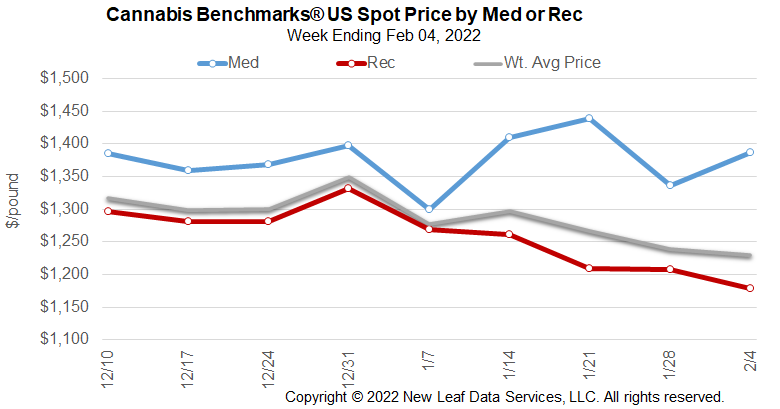

Legacy state prices remain under tremendous pressure, a condition exacerbated by massive harvests in fall 2021, falling unemployment, and the loss of the 2021 Child Tax Credit payments and supplemental unemployment benefits. Add to this the highest level of inflation since 1982 and a massive reversal in consumer spending was bound to happen, with discretionary spending impacted first. Furthermore, in an effort to stem inflation, it appears the Federal Reserve will raise interest rates several times in 2022, which will translate into higher consumer rates on credit cards, homes, and cars. Raising interest rates is intended to curtail inflation by suppressing demand and should result in lower consumer spending across the board – eventually.

For cannabis businesses, particularly in mature western markets, this may be a year of transformation, where cannabis prices adjust downward in ways previously unthinkable. Practically, this means outdoor flower prices falling even further, perhaps to $100 a pound, as predicted in our California interview below. Another result may be a pick up in price convergence across grow types. In fact, price convergence in the world’s largest cannabis market – California – has begun in earnest, with greenhouse flower prices converging toward outdoor with unprecedented speed.

The convergence of greenhouse and outdoor product prices was expected, although the pace of convergence was likely accelerated by fundamental factors – primarily oversupply. The spread between greenhouse prices and those for outdoor product fell below $100 this month from a peak of over $500 in February 2021.

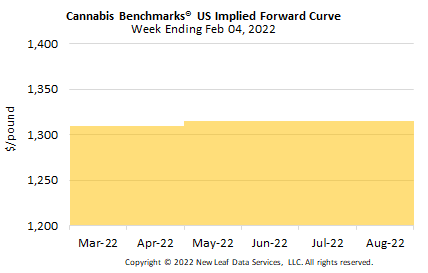

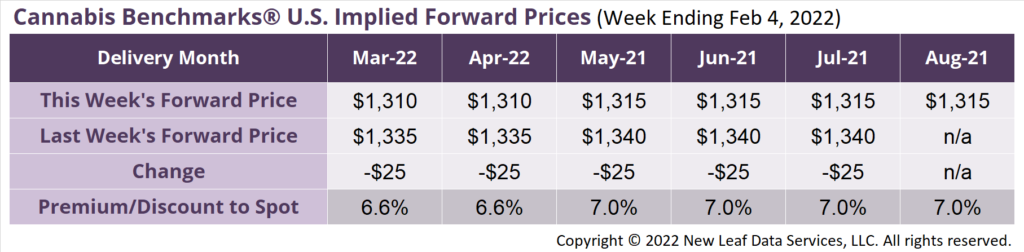

August 2022 Implied Forward initially assessed at $1,315 per pound.

The average reported forward deal size was 63 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 33%, 52%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 83 pounds, 56 pounds, and 43 pounds, respectively.

At $1,310 per pound, the March 2022 Implied Forward represents a premium of 6.6% relative to the current U.S. Spot Price of $1,229 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

California Lessons: Prices, Taxes, and the Illicit Market – Interview

Colorado

Extractors Make Good Partners – Interview

Massachusetts

Cannabis Laws: Community Host Agreements Draw Scrutiny