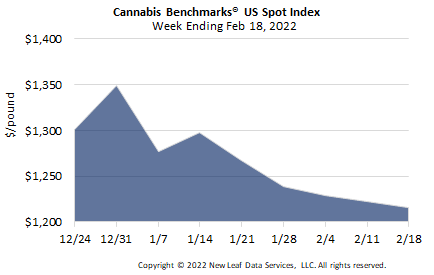

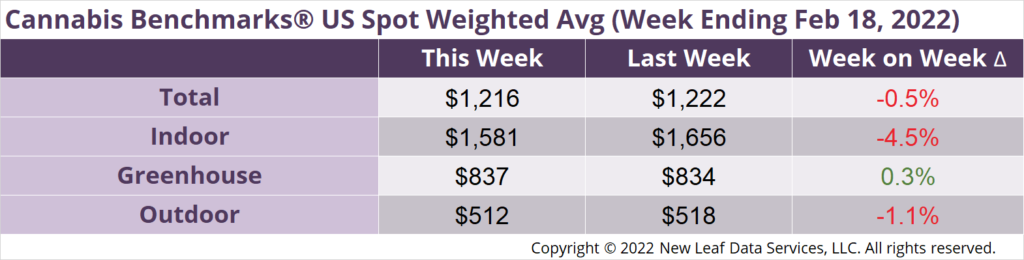

The U.S. Cannabis Spot Index decreased 0.5% to $1,216 per pound.

The simple average (non-volume weighted) price decreased $19 to $1,497 per pound, with 68% of transactions (one standard deviation) in the $668 to $2,326 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $2.68 and the simple average price was $3.30.

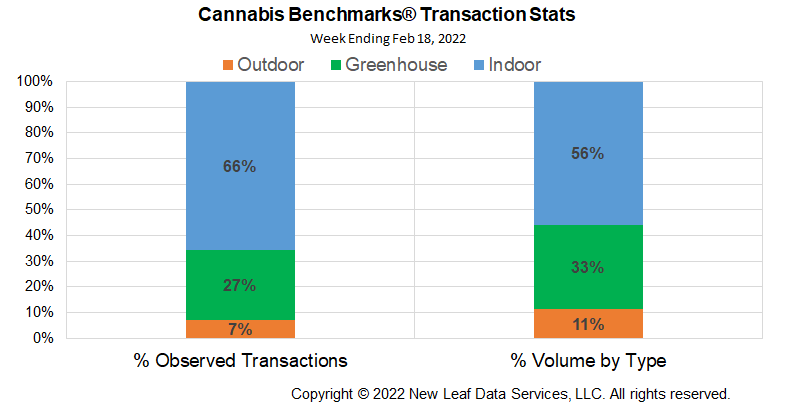

The relative frequency of transactions for indoor product rose 2%. Transaction frequency of greenhouse product fell 1%, as did that of outdoor flower.

The relative volume of indoor flower rose 4%, while that of greenhouse flower fell 2%. Outdoor flower’s relative volume also fell 2%.

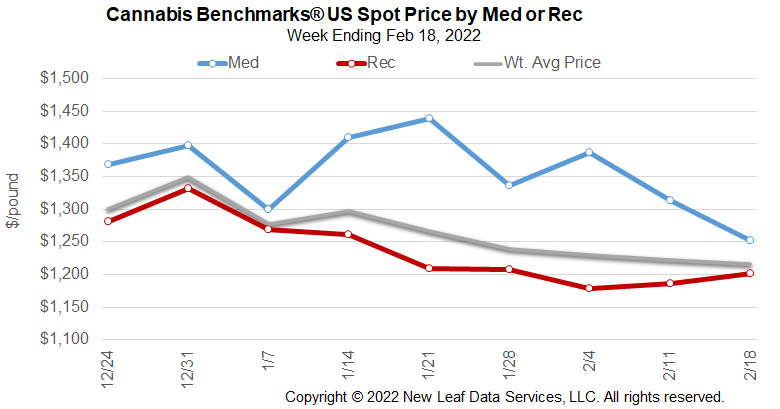

The U.S. Spot market remains in a very strong downtrend, reflecting price movements in legal markets across the country. Legacy markets – Colorado, California, Oregon, and Washington state – remain under pressure and might be considered markets capturing much of the fundamental information available about price, with well-established supply and demand fundamentals reflected in both sales and pricing. New markets – Michigan, Illinois, Massachusetts – are still establishing what demand will be in each. Still, pricing in each state reflects the same, though accelerated, movements influenced by new and expanding growers in the market, expanding licensing, and consumer demand.

While each state’s demand and supply profile is different – influenced by fundamental factors such as licensing rules, tax regimes, and population – the larger backdrop to each market is the anomaly of the COVID-19 pandemic years. Beginning in spring 2020, every state saw demand increase, to historically high levels in many cases, driving wholesale prices sharply higher while production ramped up to meet surging demand, even where supply was likely already ample. The elevated wholesale prices seen during the initial portion of the pandemic, which in most states peaked in Q4 2020, should be viewed as unsustainable, even in new markets where demand is still being determined.

The current drop in prices across the country is more than the sum of its fundamental parts. It is a reversion to mean levels in which price moves to where it was before the anomaly occurred. In such instances, price will often overshoot mean levels, in this case on the downside. Market corrections in which price overshoots the mean – the average price before the anomaly – are themselves fleeting.

That is, the current overshoot on price on the downside will itself correct higher, to a new mean, albeit one lower than pre-pandemic levels. In subsequent years, price data will clearly show the anomaly – the ongoing pandemic and the associated wholesale cannabis price rise and fall – as an isolated incident. Subsequently, we expect wholesale prices to set about reflecting supply and demand fundamentals more closely, rather than the technical pandemic correction occurring now, though when exactly this will take place remains uncertain.

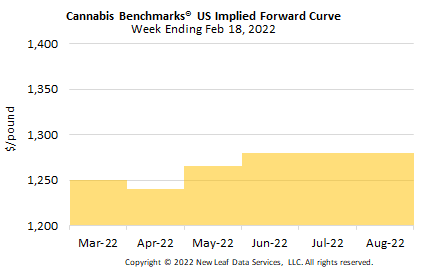

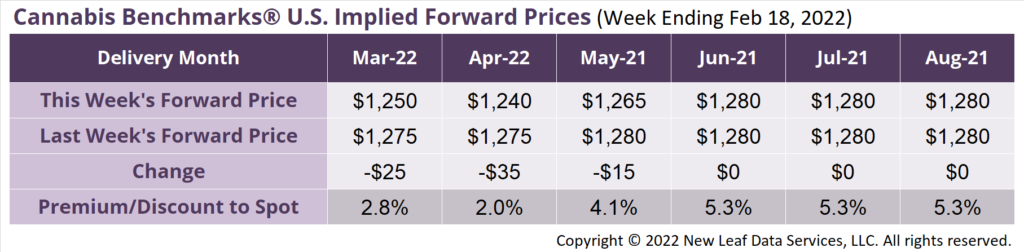

March 2022 Implied Forward assessed down $25 to $1,250 per pound.

The average reported forward deal size was 65 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 33%, 51%, and 17% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 87 pounds, 55 pounds, and 51 pounds, respectively.

At $1,250 per pound, the March 2022 Implied Forward represents a premium of 2.8% relative to the current U.S. Spot Price of $1,216 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Arizona

2021 Adult Use and Medical Sales Combine to Top $1.4 Billion

Alaska

Alaska Cannabis Flower Sales Slip in December

New Mexido

Texas Demand Will Buoy New Mexico’s Market – Interview

California

San Diego Set to Slash Cannabis Producer Taxes by 75%