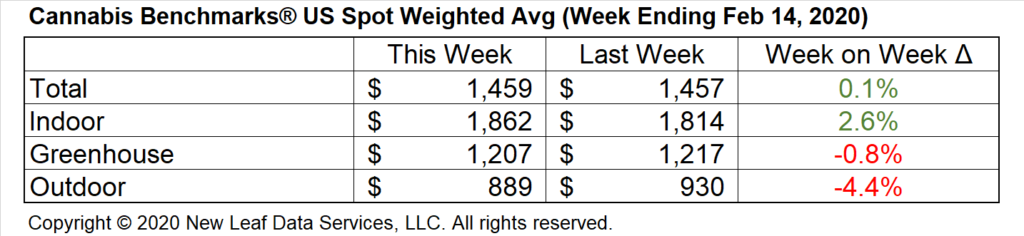

U.S. Cannabis Spot Index up 0.1% to $1,459 per pound.

The simple average (non-volume weighted) price increased $50 to $1,687 per pound, with 68% of transactions (one standard deviation) in the $929 to $2,445 per pound range. The average reported deal size increased to 2.0 pounds. In grams, the Spot price was $3.22 and the simple average price was $3.72.

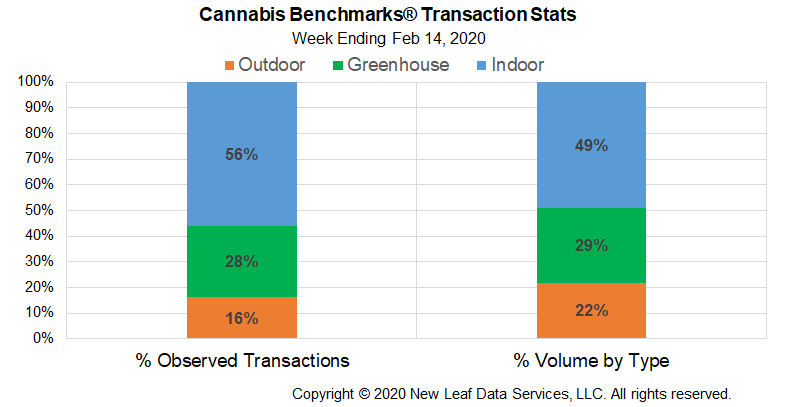

The relative frequency of trades for greenhouse flower increased by 2% this week. The relative frequency of deals for outdoor product decreased by the same proportion, while that for transactions for indoor flower was unchanged.

Warehouse product’s share of the total reported weight moved nationally contracted by 2% this week. The relative volume of greenhouse flower expanded by the same proportion, while that for outdoor product was unchanged.

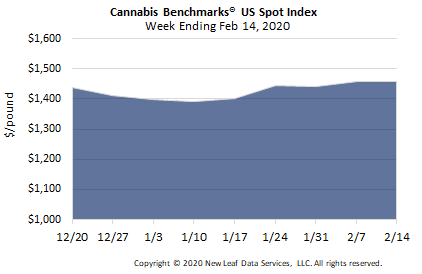

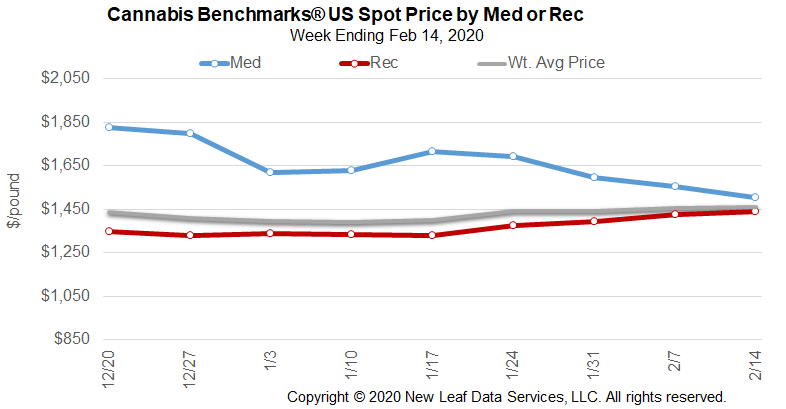

The U.S. Spot Index rose by 0.1% this week to settle at $1,459 per pound. This week’s small increase in the national composite rate is due to an uptick in the U.S. price for indoor flower. Meanwhile, prices for outdoor flower have been trending downward to open this year. A similar trend was observed through the first quarter of 2019, after which rates for outdoor product began to rise in April, along with the U.S. Spot Index. This year, strong prices for warehouse flower have buoyed the national composite rate so far in Q1; if prices for outdoor product turn upward in the spring and summer, as they did last year, then the U.S. Spot appears poised to climb into territory not observed last year, as this week’s price is already just $5 off of 2019’s peak.

New data out of Colorado and Oregon shows that sales in December 2019 did not experience the uptick that has been observed in that month in previous years. However, year-over-year sales growth in both markets was strong in 2019. Colorado saw demand – measured in terms of total retail sales revenue – increase by about 13% from 2018 to 2019, after sales stagnated somewhat in the former year. Oregon’s market saw about a 22% year-over-year rise in sales in 2019, comparable to the rate of expansion documented in 2018. Those trends helped boost wholesale prices in both markets last year, with rates in both states holding relatively steady to begin 2020. Colorado and Oregon are the second and fourth largest legal cannabis markets in the country, respectively, in terms of retail revenue.

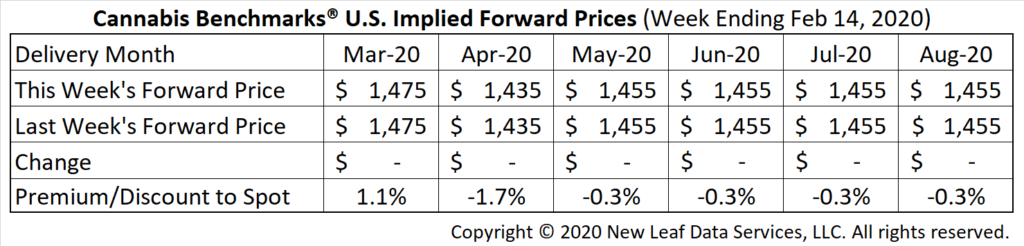

March Forward unchanged at $1,475 per pound.

The average reported forward deal size was 42 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 47%, 36%, and 17% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 46 pounds, 32 pounds, and 46 pounds, respectively.

At $1,475 per pound, the March Forward represents a premium of 1.1% relative to the current U.S. Spot Price of $1,459 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

Colorado

Total Retail Sales Reach Nearly $1.75 Billion in 2019, Up 13% YoY

Oregon

Retailers Tallied About $792 Million in Sales in 2019, Including Almost 220,000 Pounds of Flower Sold to Consumers and Patients

Washington

Bill Would Allow Producers & Processors to Provide Discounts to Retailers in Wholesale Transactions

Nevada

November 2019 Retail Sales Approach $61 Million, Down Almost 3% From October