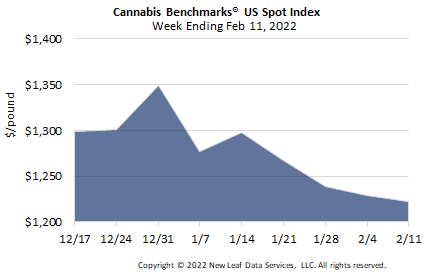

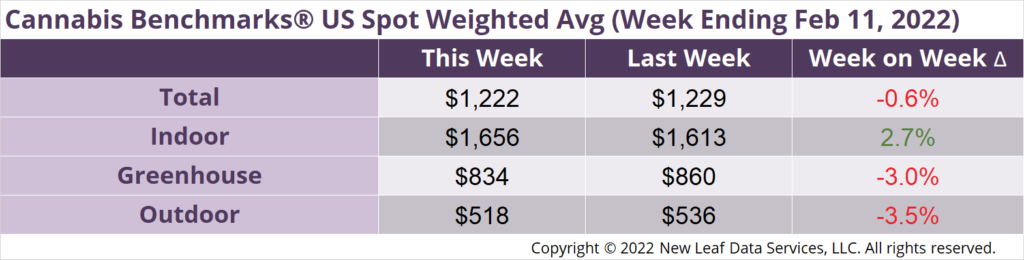

The U.S. Cannabis Spot Index decreased 0.6% to $1,222 per pound.

The simple average (non-volume weighted) price decreased $1 to $1,516 per pound, with 68% of transactions (one standard deviation) in the $676 to $2,356 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $2.69 and the simple average price was $3.34.

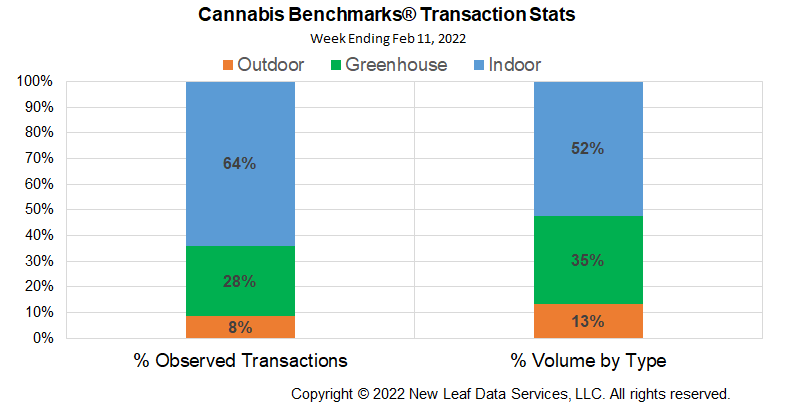

The relative frequency of transactions for indoor product rose about 1%. That of greenhouse product was virtually unchanged, as was that of outdoor flower.

The relative volume of indoor flower fell 2%, while that of greenhouse flower fell 1%. Outdoor flower’s relative volume rose about 2%.

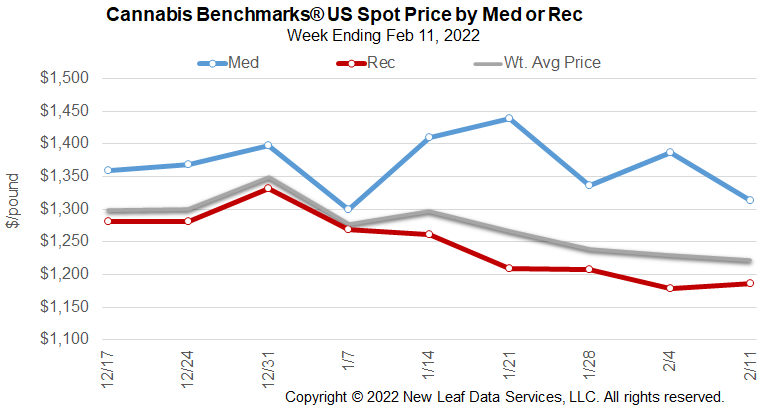

Legacy states have led the U.S. Spot price sharply lower since summer 2021. Additionally, new, high population states with growing demand are also undergoing a downdraft in price as more cultivation licenses are granted and smaller growers undercut markets to carve out room for their brands where large Multi-State Operators (MSOs) have dominated.

Operators in states with shorter growing seasons – which in these cases are states that also only began allowing legal outdoor cultivation relatively recently – are finding ways to grow outside; the first movers in outdoor cultivation, with expansive canopies and lower costs, can offer prices well below that of cannabis grown in more expensive and space-limited greenhouse or indoor environments.

Michigan brought in its first significant outdoor harvest this year, helping to pull price down over 34% since late November. Growers there say they are offering lower prices on outdoor grown product to help create demand for their brands. Buyers used to paying upwards of $2,800 per pound wholesale have eagerly snapped up product offered near $1,600 per pound.

While outdoor flower is not pervasive in Massachusetts yet, production data from state regulators shows a notable bump in the number of plants harvested in October, and buyers are clearly interested in less pricey options in one of the most expensive wholesale markets in the U.S. Massachusetts’ Spot has plummeted recently on rising production in general, with last year’s outdoor harvest contributing to increased supply, in conjunction with new and expanding indoor operations.

Illinois prices have come off their previous highs near $4,200 per pound, but have not dropped by the same magnitude as in Massachusetts or Michigan. Illinois cannabis sales remain strong due to its high population and because no adjacent states have legal adult use markets (only one, Missouri, has a full medical cannabis market; Iowa’s is very limited in terms of licenses and products). The issuance of new licenses has been delayed, as the state’s licensing process has been fraught with litigation, keeping competition at bay. However, the resolution of legal issues will eventually put independent craft growers in the picture, as well as more retail outlets. That said, with no outdoor market, the number of retailers (wholesale buyers) set to more than double, and the impact of new supply from craft cultivators likely to be fairly small compared to the existing cultivation operations, Illinois spot will remain one of the most expensive in the U.S. for the foreseeable future.

Each of these states are learning the lessons of legacy states: strong demand keeps prices high until competition starts in earnest, then prices start falling, first in the outdoor market and then in greenhouse and indoor markets. At the end of the day, cannabis prices will depend on some form of federal deregulation and interstate commerce to keep the markets growing.

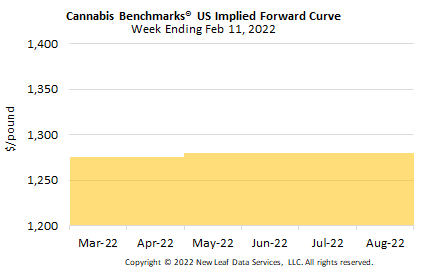

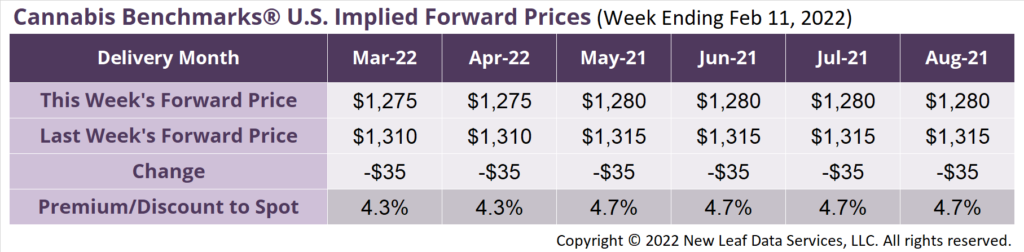

March 2022 Implied Forward assessed down $35 to $1,275 per pound.

The average reported forward deal size was 64 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 33%, 52%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 87 pounds, 55 pounds, and 43 pounds, respectively.

At $1,275 per pound, the March 2022 Implied Forward represents a premium of 4.3% relative to the current U.S. Spot Price of $1,222 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

Businesses Seek Licensing Moratorium on Cultivators, Wholesalers, Retailers

Illinois

Combined Adult Use and Medical Sales Tank 15% in January

Massachusetts

Adult Use Sales Fall 11.5% in January

Oklahoma

2021 Medical Sales Total Almost $950 Million