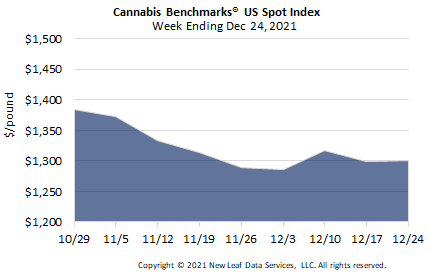

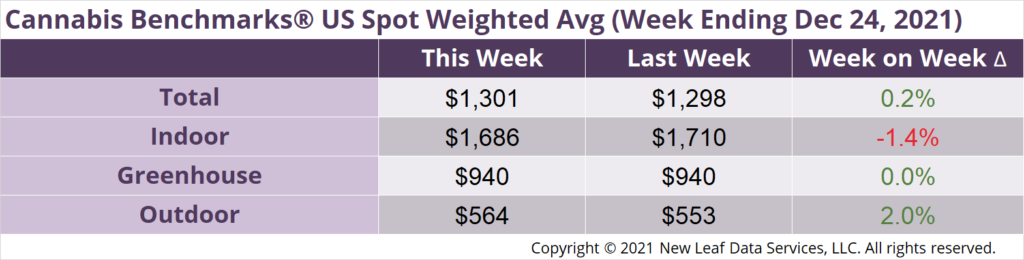

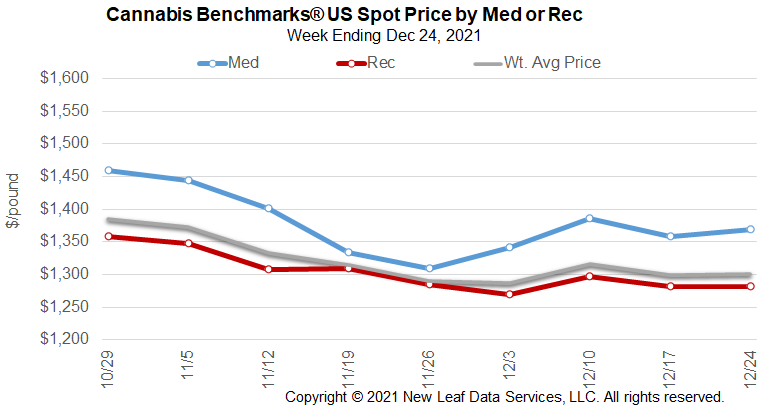

The U.S. Cannabis Spot Index increased 0.2% to $1,301 per pound.

The simple average (non-volume weighted) price decreased $3 to $1,611 per pound, with 68% of transactions (one standard deviation) in the $836 to $2,385 per pound range. The average reported deal size was nominally unchanged at 2.3 pounds. In grams, the Spot price was $2.87 and the simple average price was $3.55

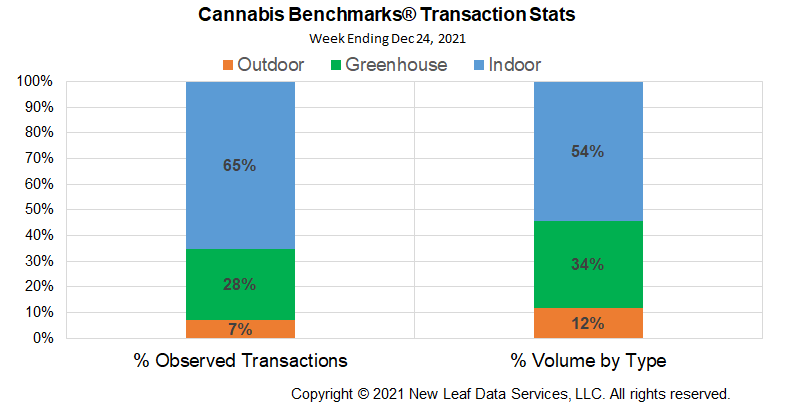

The relative frequency of transactions for indoor product decreased 1%, that for deals for greenhouse product increased by the same proportion, and that of outdoor flower was unchanged.

The relative volumes of indoor and greenhouse flower each fell by about 1%. Outdoor flower’s relative volume increased by roughly 1%.

Cannabis Benchmarks’ U.S. Spot Index has been in a steep downtrend since early August 2021, with legacy states’ overproduction of outdoor cannabis weighing on the market such that the pace of price contagion has picked up over the past several months. U.S. spot greenhouse flower price broke down through $1,000 per pound in early November and indoor flower price is trading near $1,700 per pound, down nearly 16% from its year-high level.

Legacy states are not the only ones coming under seasonal and / or fundamental price pressures. Michigan spot prices have undergone a sharp sell-off in the wake of several events, with the individual impact of each not easily discerned. Namely: A massive cannabis recall that was partially reversed in court proceedings between the Michigan Marijuana Regulatory Authority and the state’s largest testing facility, growers bringing in the state’s first significant outdoor harvest, and price competition from new cultivators entering the market. Michigan’s Spot has fallen significantly in just three weeks time.

Illinois too has undergone a nearly 8% sell-off in the state’s spot market, despite a large in-state population supplemented by multi-state demand for their adult use cannabis marketplace. Legal wranglings are delaying more licensing and there is room for many more retail outlets to create a competitive market and soak up demand.

Massachusetts’ Spot has fallen 4% since mid-October; a development that may be seasonal – harvest related, although the amount of outdoor growing in the state is not yet particularly large – or the beginning of a more competitive market.

High population states with strong demand and legal medical and adult use markets are likely to see cannabis commoditization develop at a faster clip than states with medical use only or states that grow mostly indoor and greenhouse flower. Moreover, states supplying their neighbors will see their price advantage quickly eroded when nearby states open adult use markets. The future of cannabis prices, a great reset, may already be underway.

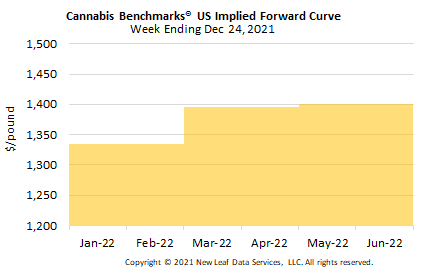

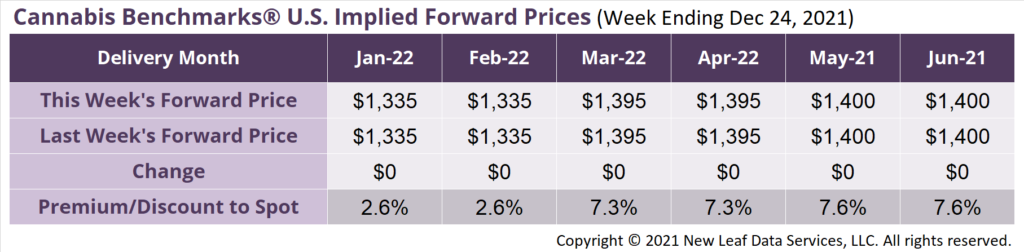

January 2022 Implied Forward unchanged at $1,335 per pound.

The average reported forward deal size was nominally unchanged at 66 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 36%, 48%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 98 pounds, 53 pounds, and 36 pounds, respectively.

At $1,335 per pound, the January 2022 Implied Forward represents a premium of 2.6% relative to the current U.S. Spot Price of $1,301 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Michigan

Spot Price Crashes as Sales Continue to Soften

Alaska

October Flower Sales, Tax Collections Fall

Illinois

Court Dates for Craft Cultivator Licensing Snarl Moved to 2022

New York

Local Opt-Outs Surge