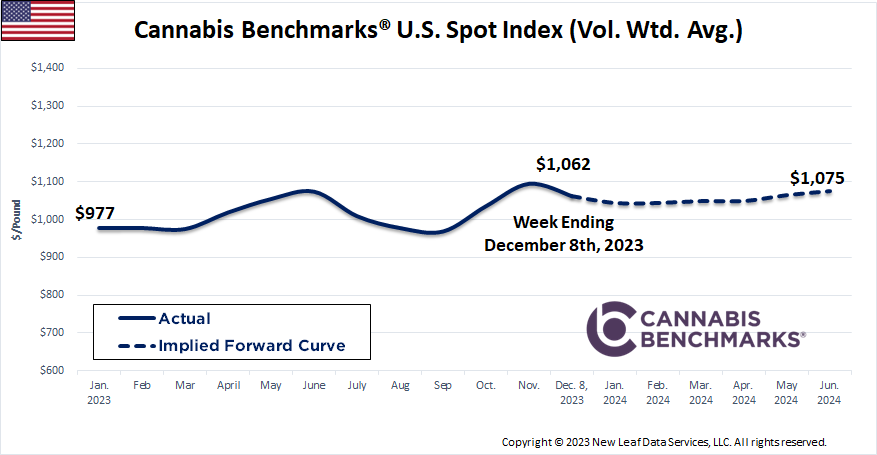

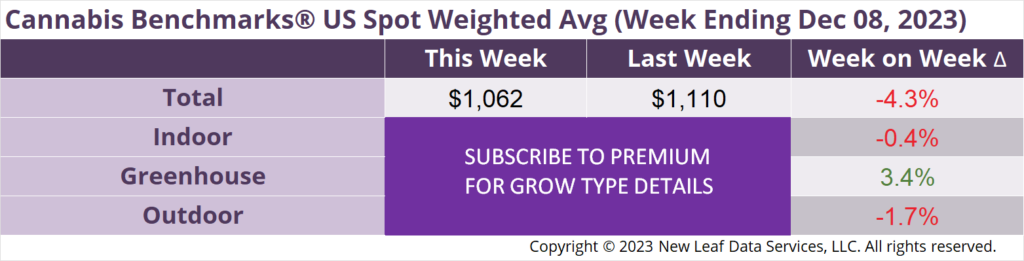

The U.S. Cannabis Spot Index decreased 4.3% to $1,062 per pound.

In grams, the Spot price was $2.34.

The U.S. Spot Index slipped for the second straight week in what may be the beginning of its seasonal decline after an atypical climb through October and much of November. Reinforcing the possibility that this month could be the beginning of a longer-term downtrend is the fact that this week’s decrease in the national average wholesale flower price broke through the support level between a recent double top formation, with peaks in the first and final week of November.

In the first and final weeks of November, the U.S. Spot wholesale flower price rose to $1,112 and $1,115 per pound, respectively. In the intervening weeks, it fell to a trough of $1,077, representing the support level. This week’s national average spot price of $1,062 per pound has dropped below the support level, signaling a reversal from the previous uptrend.

Similar price action was observed early in 2022 when the U.S. Spot saw a double top form at about $1,300 per pound, with peaks in mid-January and early April. In between, support was established at $1,177 per pound, which was the trough the U.S. Spot fell to in early March. After the April peak, spot declined and eventually fell through the support level in the first week of June, which was followed by a downtrend that lasted most of the rest of 2022.

For the moment, however, the U.S. Spot and national-level prices for indoor and outdoor flower remain up year-on-year. This week’s overall national wholesale flower price is up 11.4% from $953 per pound in the week ending December 9, 2022. This week’s indoor flower price is up 6.2% year-on-year, while the national rate for outdoor flower this week represents a 17.4% rise from a year ago.

Given the technical retracement and likelihood of declining prices in the medium to long term, market participants should consider the possibility that recent weeks may have been the peak for wholesale flower prices for the time being. Traders in other contexts frequently take double tops as a signal to sell or enter short positions. In this instance, wholesale buyers may want to wait for more favorable prices if they are in a position to, while sellers might consider offloading inventory based on conditions in their specific state market or markets.

On the state level, wholesale prices were relatively stable across much of the country. While nearly all major markets covered by Cannabis Benchmarks saw declines in their spot wholesale flower prices this week – including the West Coast states, Colorado, Michigan, Illinois, Pennsylvania, and Oklahoma – decreases were all fairly modest, with none exceeding 2% week-on-week. Similarly, of the large markets that saw increases in their spot prices this week – Massachusetts, Arizona, and Nevada – none rose by more than 2%.

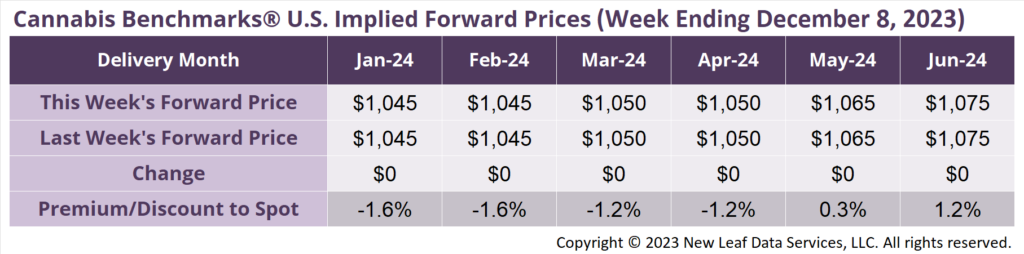

January 2024 Implied Forward unchanged at $1,045 per pound.

At $1,045 per pound, the January 2024 Implied Forward represents a discount of 1.6% relative to the current U.S. Spot Price of $1,062 per pound.

November Data Shows 2023 Seasonal Outdoor Harvest Volume Comparable to 2022

Wholesale Prices Turn Upward on Months of Record-Setting Sales Volume

Demand Holding Steady this Year; Wholesale Prices Soften After Momentary Peak

State Supreme Court Lifts Injunction, Allowing CAURD Licensing to Move Forward