U.S. Cannabis Spot Index up 1.3% to $1,446 per pound.

The simple average (non-volume weighted) price increased $13 to $1,671 per pound, with 68% of transactions (one standard deviation) in the $1001 to $2,341 per pound range. The average reported deal size decreased to 2.1 pounds. In grams, the Spot price was $3.19 and the simple average price was $3.68.

The relative frequency of trades for greenhouse flower decreased by 2% this week. The relative frequency of deals for indoor and outdoor product each increased by 1%.

Warehouse flower’s share of the total reported weight moved nationally expanded by 1% this week. The relative volume of greenhouse product contracted by the same proportion, while that for outdoor flower was unchanged.

The U.S. Spot Index rose by 1.3% this week to settle at $1,446 per pound. In the wake of the fall harvest, rates for outdoor flower remained strong, with this week’s national volume-weighted average price for such product once again representing a new annual peak for the grow type. National rates for the other product types settled just under their current year-to-date highs.

Although an uptick in the price of sun-grown flower in the wake of the harvest is not unheard of, the magnitude of the price rise observed this year is notable, especially as official data from Oregon and reports from the other West Coast states tell of a large fall crop. This week’s price for outdoor flower is up by 37.1% from two months ago, when it settled at $842 per pound in the week ending October 4. In the same span in 2018, weekly rates for outdoor product rose by 2.7%, from $706 to $725 per pound, while dipping below the $700 per pound threshold in the latter three weeks of October 2018.

The post-harvest rate increase is largely attributable to strong, and in some cases record-setting demand in the four largest legal cannabis markets. Despite the rising prices for outdoor product, however, rates for such flower are still 12.9% and 36.7% lower than those for greenhouse and indoor product, respectively. Elevated prices for warehouse and greenhouse flower are likely motivating buyers to seek out outdoor product, increasing demand for the most inexpensive grow type.

The national volume-weighted price for flower to be sold to general consumers rose this week on increases in the adult-use sectors of the markets of California and Colorado, as well as upticks in Oregon and Alaska.

The national price for medical flower also ascended this week on increases in that section of the market in California, Colorado, and Michigan, in addition to rising rates in the medical-only systems of Connecticut, Washington, D.C., and Rhode Island.

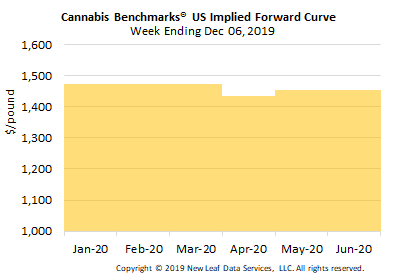

June 2020 Forward assessed at $1,455 per pound.

The average reported forward deal size was 49 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 48%, 35%, and 17% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 50 pounds, 44 pounds, and 52 pounds, respectively.

At $1,475 per pound, the January 2020 Forward represents a premium of 2.0% relative to the current U.S. Spot Price of $1,446 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

California

Overall Rise in State Spot Index in Current Quarter Driven Largely by Increasing Prices for Greenhouse and Outdoor Flower

Colorado

Licensed Cannabis Retailers Will Be Allowed to Sell Some Hemp-Derived CBD Products Come July 2020

Oregon

Monthly Average Spot Index and Prices for All Grow Types Decline from October to November, But QTD Rates for Q4 Still Up Significantly from Prior Quarter

Washington

Officials Reportedly Intend to Allow Smallest Producers to Expand Cultivation Capacity

Michigan

State Spot Index Jumps Almost $150 After Commencement of Adult-Use Sales