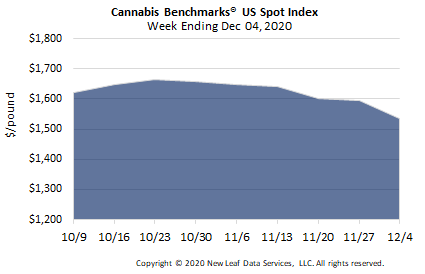

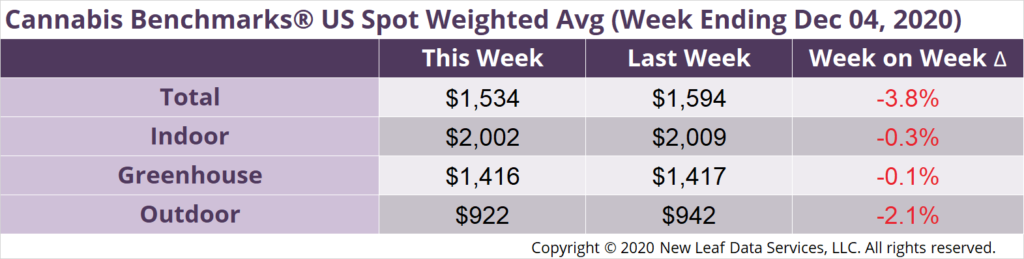

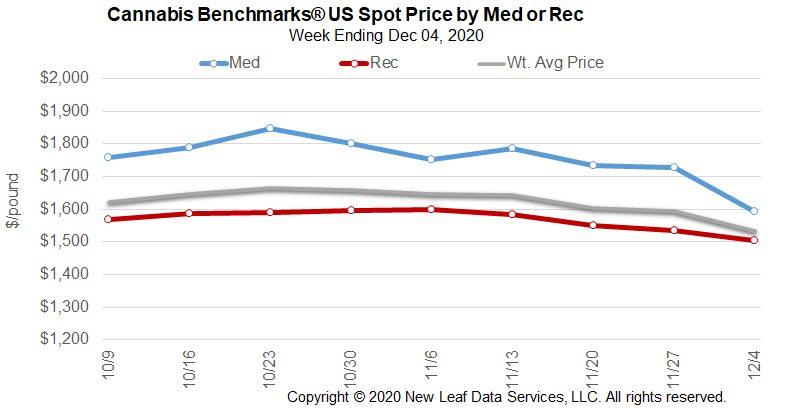

U.S. Cannabis Spot Index down 3.8% to $1,534 per pound.

The simple average (non-volume weighted) price decreased $12 to $1,834 per pound, with 68% of transactions (one standard deviation) in the $1,106 to $2,562 per pound range. The average reported deal size increased from 2.3 pounds to 2.5 pounds. In grams, the Spot price was $3.38 and the simple average price was $4.04.

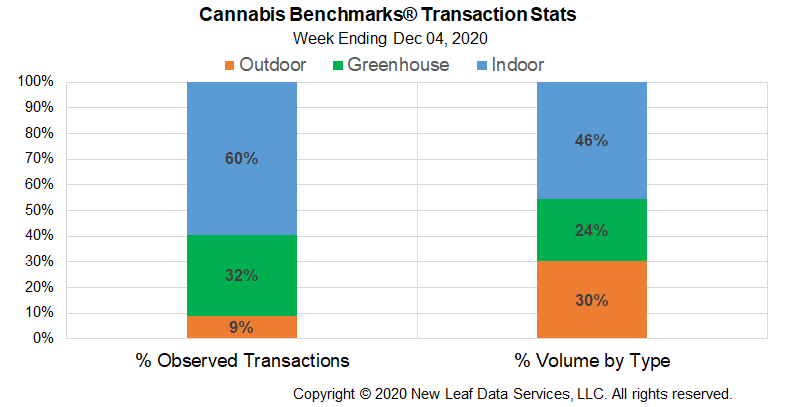

The relative frequency of trades for indoor flower decreased by almost 2%. The relative frequencies of deals for greenhouse and outdoor product increased by about 1% each.

The relative volume of outdoor flower expanded by 6% this week. The relative volumes of warehouse and greenhouse product contracted by 3% each.

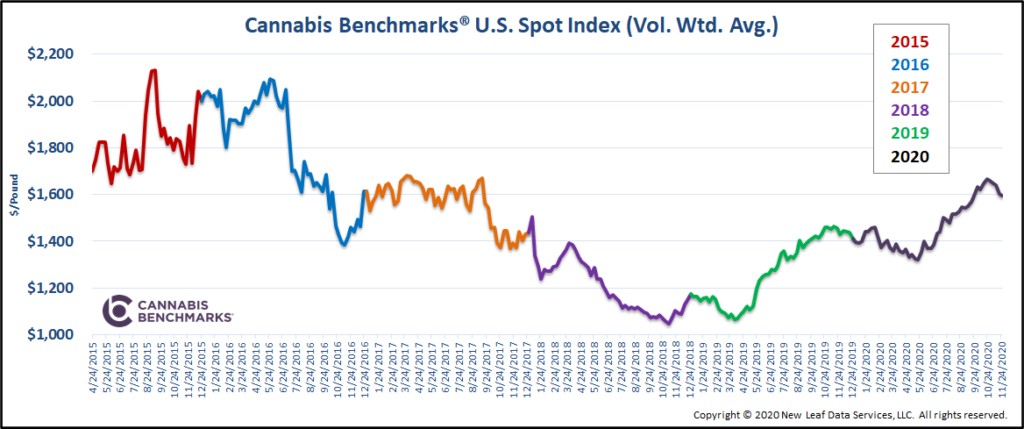

With the end of 2020 approaching, a look back on our year-to-date wholesale price assessments reveals some interesting and surprising trends. The chart below shows the course of the U.S. Spot Index since Cannabis Benchmarks first began assessing this data point in April 2015.

Perhaps most notably, the behavior of the U.S. Spot in 2020 displays strong similarities to the course charted in 2019, despite the disruption caused by the COVID-19 pandemic this year. In both 2019 and 2020, the national composite price opened the year on a downward trend due to increased supplies of outdoor flower from the prior year’s fall harvest. The U.S. Spot began to climb in the spring in both years; in 2019 this ascent started in late March, in 2020 it would not commence until late May.

Additionally, a downturn in wholesale flower prices began in November with the autumn harvest both last year and this year, but 2020’s started earlier and has so far been more dramatic. This is somewhat surprising given significantly elevated demand and sales revenues in 2020, as well as questions surrounding the fall crop due to the severe wildfires that ravaged the West Coast.

Another surprise in this year’s data is that the ascent of the U.S. Spot in 2020 has so far not matched the magnitude of the wholesale price recovery observed in 2019. Regardless, the 10% year-to-date increase from the assessed price at the start of the year represents a notable rise, especially following the U.S. Spot’s climb in 2019. Barring a large downturn in the coming weeks, it appears likely that 2020 will be the second straight time that the U.S. Spot will close the year higher than at its outset. In the first three full years that Cannabis Benchmarks assessed wholesale flower prices, the national average ended each year off from where it started, often by a large margin.

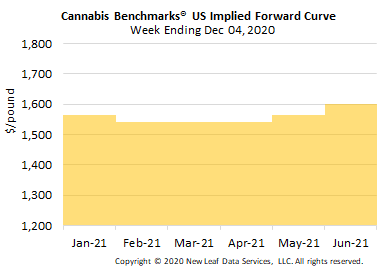

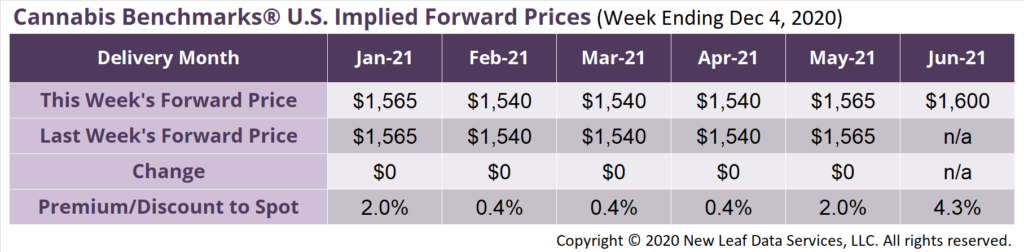

June 2021 Implied Forward initially assessed at $1,600 per pound.

The average reported forward deal size was 32 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 43%, 34%, and 23% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 45 pounds, 19 pounds, and 28 pounds, respectively.

At $1,565 per pound, the January Implied Forward represents a premium of 2.0% relative to the current U.S. Spot Price of $1,534 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Newly-Released Q3 Cannabis Tax Revenues Show Continued Growth in Retail and Wholesale Sectors of Legal Market

Los Angeles Identifies 200 Retail License Applicants Eligible for Further Processing, Temporary Approval to Operate

Oregon

Retail Revenues Through November Top $1B, but Monthly Sales in Autumn Down from Summer

Massachusetts

New Adult-Use Delivery License Types and Other Rules Approved by Regulators; Industry Group Threatens Litigation