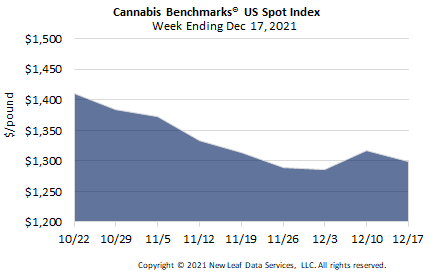

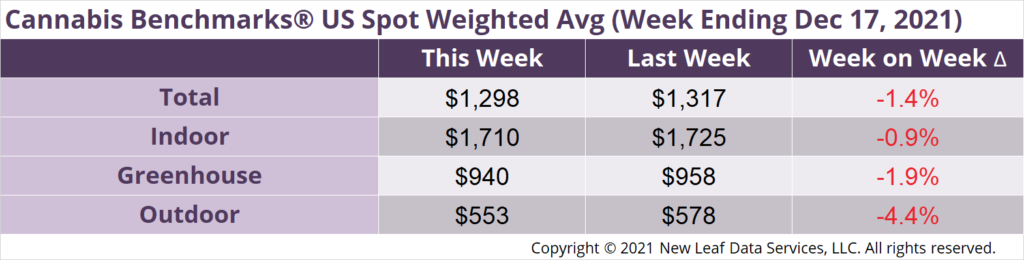

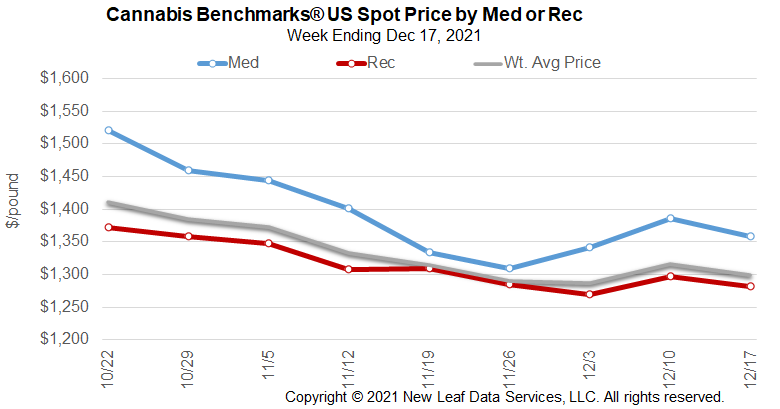

The U.S. Cannabis Spot Index decreased 1.4% to $1,298 per pound.

The simple average (non-volume weighted) price decreased $10 to $1,613 per pound, with 68% of transactions (one standard deviation) in the $830 to $2,396 per pound range. The average reported deal size decreased to 2.3 pounds. In grams, the Spot price was $2.86 and the simple average price was $3.56

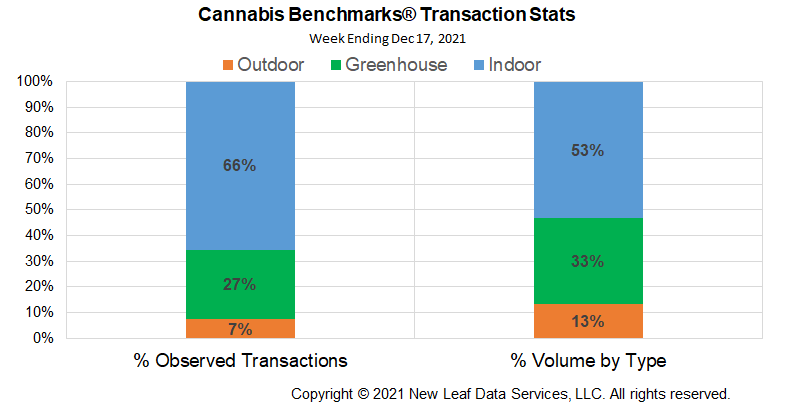

The relative frequency of transactions for indoor product rose 1%, that for deals for greenhouse product was unchanged, and that of outdoor flower fell 1%.

The relative volume of indoor flower was unchanged this week. Greenhouse relative volume fell 1% and that of outdoor flower was unchanged.

U.S. spot price has given back nearly 60% of the gains made last week on the back of accumulating losses in legacy markets. Washington indoor flower fell over $25 per pound this week, while outdoor flower fell $16. California outdoor fell nearly $40 per pound and indoor flower fell over $23 per pound. Colorado losses continue to narrow with outdoor slipping $13.70 per pound and indoor flower shedding $6.50 per pound. Oregon outdoor fell $19.53 per pound and indoor prices fell $10.75 per pound.

Oregon growers have seen steep price losses on outdoor product in the post-harvest environment, but the trajectory in this market was set early last summer when large quantities of 2020 flower started hitting the market amid a pick-up in employment that likely curbed some consumer demand. Oregon outdoor flower prices have fallen nearly 40% since June 2021. Growers are seeing myriad factors weighing on price as delineated in the interview below.

California’s Spot price is down over 34% since early summer 2021. Week-to-week losses have narrowed and that can be a sign downside momentum is fading. Fundamentally, oversupply is the biggest factor weighing on price. This situation is exacerbated by a relatively low number of retailers per capita in major population centers and a majority of municipalities continuing to ban adult use retailers altogether.

Colorado spot price losses have narrowed as well, slipping just $0.62 this week. While the downtrend is still intact, Colorado spot price behavior suggests the downtrend may be ending, which is not the same as an uptrend starting. Trading sideways within a tight range – as the market is doing currently – drains downside momentum and lays the groundwork for steadier, if not immediately higher, per pound prices.

Of all the factors weighing on legacy state outdoor prices, market commoditization, succinctly demonstrated by outdoor growers selling almost exclusively to processors for extraction, is the most inevitable and least reversible.

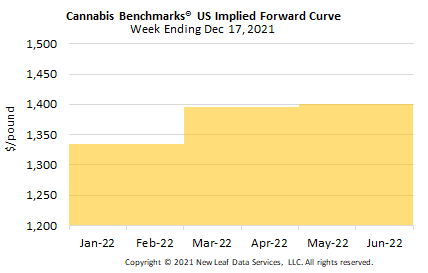

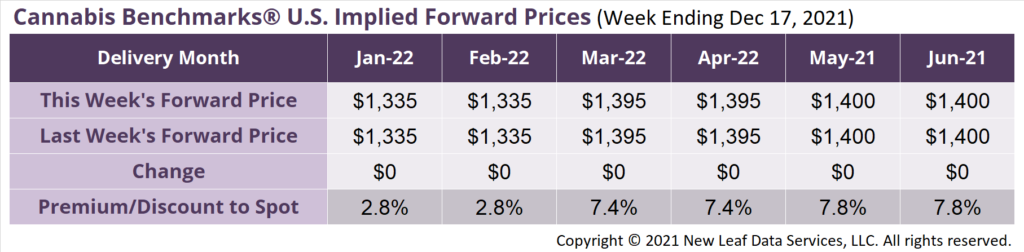

January 2022 Implied Forward unchanged at $1,335 per pound.

The average reported forward deal size was nominally unchanged at 66 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 37%, 47%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 98 pounds, 52 pounds, and 38 pounds, respectively.

At $1,335 per pound, the January 2022 Implied Forward represents a premium of 2.8% relative to the current U.S. Spot Price of $1,298 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

“The market is dead in the water;” Interview

Nevada

Retail Cannabis Sales Decline in 5 of Last 6 Months

Arizona

Steady Erosion in Medical Cannabis Sales Volume

Oklahoma

Continued Growth in Medical Cannabis Program, but October Sales Lag